“Wow, an absolutely breathtaking panoramic view!”

This was my reaction each time I summitted one of the 54 fourteeners (mountains with an altitude exceeding 14,000 feet) in my home state of Colorado. Once on top, I could see for miles in every direction: other fourteeners to the west and the front range cities of Denver, Boulder and Colorado Springs, and the Great Plains stretching to the east. My exhilaration was further heightened by the tremendous effort I had exerted in order to partake of this spectacular scene. And it never got old!

But the stay on the mountaintop was brief, and in short order I was heading back down, bathed in the glow of the accomplishment. I knew that within a few weeks I would be trekking towards the top of another mountain, again experiencing the enjoyment of another successful ascent.

Market Peaks

In a similar fashion, I enjoy and celebrate each new stock market peak, that is, a new all-time high. A peak means my stock market investment has generated a positive return regardless of when I invested. Like the many obstacles that must be overcome in order to reach the top of a mountain, such as boulder fields, narrow ledges, step scrambles and fickle weather, the market must navigate a gantlet of business, economic, political and international challenges in order to reach a new peak, making the accomplishment all the more impressive.

When a trading day ends with a new all-time high, we are left wondering what will happen next. Too often the feeling among investors, and the press for that matter, is one of dread. After all, what goes up must come down and doesn’t a peak mean the market is very likely overvalued? These thoughts play into the general unease investors have regarding the stock market. Whether the market has recently been heading up or going down, the abiding fear is that the next move is down.

What Has Actually Transpired After A Peak?

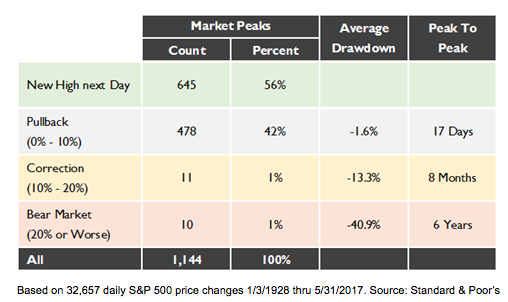

What is the most likely market movement the day after it hits a peak? I have posed this question to many investors and, to a person, they say the market will most likely go down. But as shown in the table nearby, the most likely event is just the opposite: a new market peak (56 percent of the subsequent days experience a new peak). In fact, a strategy of investing more in stocks the day after a peak is a winner.

After 98 percent of peaks, the market either hits a new high or pulls back less than 10 percent. In the case of a pullback, the next peak is reached in an average of 17 trading days. A 10 percent to 20 percent pullback (correction) is experienced 1 percent of the time, while a greater than 20 percent pullback (bear market) is experienced 1 percent of the time. So it is rare that a serious market decline follows a peak and, in fact, the vast majority of time a peak signals good returns to come.

What Has Transpired After Market Peaks: 1928-2017

Over this 90 year period, there were 1,144 market peaks, an average of one a month. So you do not have to wait long for the next peak to be enjoyed. One a month is roughly the pace at which I climbed mountains during Colorado summers when I was younger. Climbing mountains and achieving new market highs produced roughly the same pattern of enjoyment for me.

Market The Beautiful

The lyrics for America the Beautiful were written by Katharine Lee Bates in 1895, a year before the launch of the Dow Jones Industrial Average, after she stood gazing east from the top of Pikes Peak, a mountain I have climbed many times. As I revel in each new market peak as an indication of success in my equity portfolio and the market overcoming potentially debilitating obstacles, I wonder if there is a song somewhere in here.

To celebrate the over 1,000 new peaks since 1928, could a song be written with the title Market the Beautiful? Maybe this would begin altering investor perception of market peaks as something to enjoy rather than as something to fear.

C. Thomas Howard, Ph.D., is an emeritus professor of finance at the University of Denver and chief investment officer at AthenaInvest of Greenwood Village. He is the author of Behavioral Portfolio Management. Please feel free to contact me if you compose the song Market the Beautiful, as much to my chagrin I have no talent for such an endeavor.