"Happiness is contagious, spreading among friends, neighbors, siblings, and spouses like the flu, according to a large study that for the first time shows how emotions can ripple through clusters of people who might not even know each other. The study of more than 4,700 people, who were followed over 20 years, found that people who are happy, or become happy, boost the chances that someone they know will be happy. The power of happiness, moreover, can span another degree of separation, elevating the mood of that person's husband, wife, brother, sister, friend or next-door neighbor. Your emotional state also depends on the choices and actions and experiences of other people, including people to whom you are not directly connected. Happiness is contagious. One person's happiness can affect another's for up to a year, the researchers found, and while unhappiness can also spread from person to person, the 'infectiousness' of that emotion appears to be far weaker. Laughter can trigger guffaws in others; seeing someone smile can momentarily lift one's sprits.But the new study is the first to find that happiness can spread across groups for an extended period of time. The findings provide striking new evidence of the power of social networks, which should have implications for public policy. Happy people tend to be better off in myriad of ways, being more creative, productive and healthier. Some experts praised the study as a landmark in the growing body of evidence documenting the influence of personal connections and the importance of positive emotions. 'It's a pathfinding article,' said Martin E. P. Seligman, a University of Pennsylvania psychologist. 'It's totally original and the findings are striking.'"

. . . James Dines, The Dine's Letter

"Happiness" . . . what a novel concept! As the brilliant strategist James Montier writes:

"If you are after specific investment advice, stop reading now." He goes on to note:

"Don't equate happiness with money. People adapt to income shifts relatively quickly; the long lasting

benefits are essentially zero."

"Exercise regularly. Taking regular exercise generates further energy, and stimulates the mind and body."

"Have sex (preferably with someone you love). Sex is consistently rated as amongst the highest generator of happiness."

"Devote time and effort to close relationships. Close relationships require work and effort, but pay vast rewards in terms of happiness."

"Pause for reflection, meditate on the good things in life. Simple reflection on the good aspects of life helps

prevent hedonic adaptation."

"Give your body the sleep it needs."

"Don't pursue happiness for its own sake, enjoy the moment. Faulty perceptions of what makes you happy, may lead to the wrong pursuits. Additionally, activities may become a means to an end, rather than something to be enjoyed, defeating the purpose in the first place."

"Take control of your life, set yourself achievable goals."

"Remember to follow ALL of the (above) rules!"

Clearly the equity markets were "happy" last month, for after losing 8.2% in May, and 5.4% in June, the S&P 500 (SPX/1101.60) gained nearly 7.0% in the month of July. Despite the often mentioned parade of negative indictors "tripped" during the June and May mauling, I was bullish at the beginning of July, for as stated, "The equity markets are the most oversold they have been since the capitulation alert of October 2008." Indeed, during the first week of July less than 5% of the stocks in the SPX were above their Raymond James Investment Strategy respective 50-day moving averages (DMAs), which is a VERY oversold reading. Moreover, my sense was that second quarter earnings reports were going to surprise on the upside. And sure enough, half way through earnings season ~78% of the S&P 500's companies have bettered their earnings estimates, while two out of three companies are beating revenue estimates. My hunch is the balance of the earnings reports will do the same.

The July Jump has had another endearing feature in that the three consecutive 100-point "up days" in the D-J Industrial Average (DJIA/10465.94) catapulted the Dow above its June closing high of 10450.64 last Monday. Simultaneously, the D-J Transportation Average (DJTA/4422.94) closed above its June high of 4433.60, thus registering a Dow Theory "buy signal," at least as I interpret Dow Theory. Ladies and gentlemen, a same day confirmation from both averages is a rare event and suggests a fairly powerful "up move" is underway. That said, Dow Theory signals often come after a significant rally (or decline) has already taken place and hence has expended a lot of energy. Also worth noting is that a number of other Dow Theorists opine an upside signal has not yet been registered. They need a close above the Dow's April 23rd price of 11204.28, with a confirmation by the Transports above its May 3rd closing high of 4806.01, for a Dow Theory "buy signal" to be rendered. Alas, "listening" to the market is an art, not a science, and Dow Theory is interpreted differently by many practitioners. Nevertheless, by my pencil a "buy signal" has been registered and I am a buyer on weakness with fairly close stop-loss points to manage the risk.

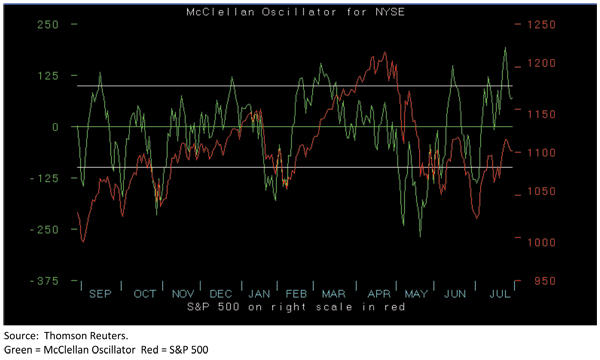

Accordingly, that begs the question of what to buy. In past missives I have mentioned a number of stocks and mutual funds that are recommended either by Raymond James' analysts or by our research correspondents for your consideration. On the more value vent I have used: Microsoft (MSFT/$25.81); Intel (INTC/$20.60/Outperform); Wal-Mart Stores (WMT/$51.19/Strong Buy); Allstate (ALL/$28.24/Strong Buy); and Johnson & Johnson (JNJ/$58.09/Outperform), to name but a few. On the more "growthy" side I have mentioned: Iridium (IRDM/$10.31/Strong Buy); NII Holdings (NIHD/$37.46/Strong Buy); Nuance (NUAN/$16.51/Strong Buy); and PAREXEL (PRXL/$20.53/Strong Buy). And, this morning I am offering McAfee (MFE/$33.10/Outperform) for your consideration. I think McAfee's new CFO (Jonathan Chadwick) is a decided plus for the company. As for mutual funds I have been using: MFS International Diversification Fund (MDIDX/$11.83); Putnam Diversified Income Fund (PDINX/$8.01); and OCM Gold Fund (OCMGX/$23.97). Last week, however, in my verbal comments I offered the caveat that on a very short-term basis the McClellan Oscillator was the most overbought it has been in years and therefore a pullback might be in order (see the attendant chart). Still, as seen in the nearby chart, the McClellan Oscillator corrected some of its overbought condition last week, leaving the equity markets in a position to trade higher.

The call for this week: Since the SPX's rally began in early July I have suggested the first upside challenges would come at the 50-DMA (currently at 1081.54) and then the 200-DMA (currently at 1114.37). The 50-DMA indeed took some time to surmount. Last week the 200-DMA also proved difficult to surpass. Nonetheless, I think it will eventually be breached to the upside, bringing into view the June reaction high of 1131. As the Lowry's organization opines, "In summary, as the major price indexes have moved sideways since the May 25th low, market conditions have showed clear signs of strengthening, not weakening. While overbought readings on short-term indicators suggest the potential for a near-term pullback, any decline should act only as a temporary setback in the rally from the July 2nd low and is unlikely to represent the next leg of a more prolonged move lower." Plainly I agree . . .