One of the most frustrating statements we hear is that bull markets are impossible without price/earnings ratios expanding. History shows that this simply is not true. There have been interest rate-driven bull markets during which interest rates fall and PE multiples expand, but there have also been earnings-driven bull markets during which interest rates rise and PE multiples contract.

At RBA, our portfolios are positioned for an earnings-driven bull market and this positioning increasingly seems quite out of consensus on many levels. Whether it is our view on the overall equity market, our sector preferences, or our fixed-income strategy, a broad range of data currently seem to show we are swimming upstream.

What Is An Earnings-Driven Market?

There are historically two types of bull markets: interest rate-driven and earnings-driven. Interest rate-driven markets are those characterized by falling interest rates and expanding PE multiples. Investors have become very familiar with this type of bull market because of the secular fall in interest rates since 1980. That familiarity has led investors to believe that falling interest rates and expanding multiples are the sole construction of a bull market.

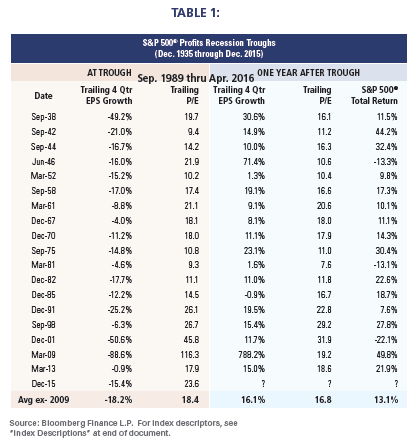

However, there have been many periods of significant returns during rising interest rate environments. Bull markets during periods of rising interest rates are dependent on earnings growth to offset the PE multiple contraction associated with rising rates.

It is virtually a mathematical tautology that valuation multiples increase when longer-term interest rates fall because of present value theory. As interest rates fall, investors are more willing to expand the time horizon of their investments (i.e., PE multiples expand) because there are fewer shorter-duration investments that offer competitive returns. Portfolio construction during periods of falling interest rates typically focuses on making sure that PE multiples expand by “P” going up rather than by “E” going down. Stable growth companies tend to outperform cyclical companies during interest rate-driven markets because falling interest rates imply slower nominal growth, which hurts cyclical earnings. During interest rate-driven markets, “P” rises for stable growth, whereas “E” deteriorates for cyclicals.

Conversely, portfolio construction during an earnings driven-market needs to focus on PE contraction, ensuring that multiples contract by “E” going up rather than by “P” going down. Cyclicals tend to outperform stable growth during earnings driven-markets because cyclical companies’ incremental earnings growth more than offsets the negative effect of rising rates. Stable growth companies, by definition, are stable and have little or no incremental growth. Stable companies’ PEs usually contract by “P” going down because “E” is stable.

RBA Thinks The Next Year Or So Will Be An Earnings-Driven Bull Market