It Isn’t About Calamity

Some market observers have cautioned that overvaluation always leads to poor returns because multiples contract. There is indeed history to support such concerns. However, the key word is “always”. As we have shown, there have been many periods in stock market history during which earnings growth improves, interest rates increase, PE multiples contract, and a bull market continues. They are called earnings-driven bull markets.

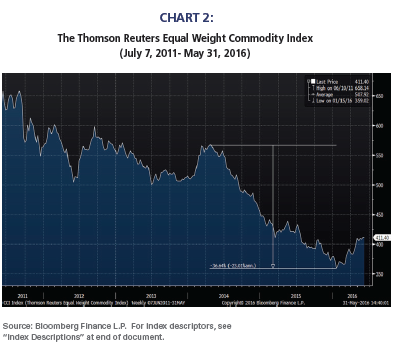

It is always headline-grabbing to predict a calamitous end to a bull market, and a broad range of sentiment data strongly suggests investors are quite scared. At RBA, however, we continue to swim against that fearful tide, and our portfolios are positioned for a cyclical rebound in earnings and an earnings-driven bull market.

Richard Bernstein is chief executive and chief investment officer at Richard Bernstein Advisors.

Earnings-Driven Bull Markets

June 10, 2016

« Previous Article

| Next Article »

Login in order to post a comment