Key Points

- Analysts’ improving outlook for corporate earnings has tracked the trend of better-than-expected economic data, helping to support stocks in the face of negative geopolitical events.

- The upturn in earnings forecasts that began in March is taking place across a broad number of countries and sectors.

- Without stronger global economic growth, earnings may stabilize but are unlikely to post a powerful rebound.

In the past month, headlines have been full of geopolitical risks including Brexit, a terror attack in France, and an attempted coup in Turkey. Yet global stocks are rallying—a different reaction than might have taken place earlier this year or last year. One reason for the change in stock market reaction: earnings expectations are back on the rise.

Earnings estimates are rebounding

Source: Charles Schwab, Factset data as of 7/21/2016.

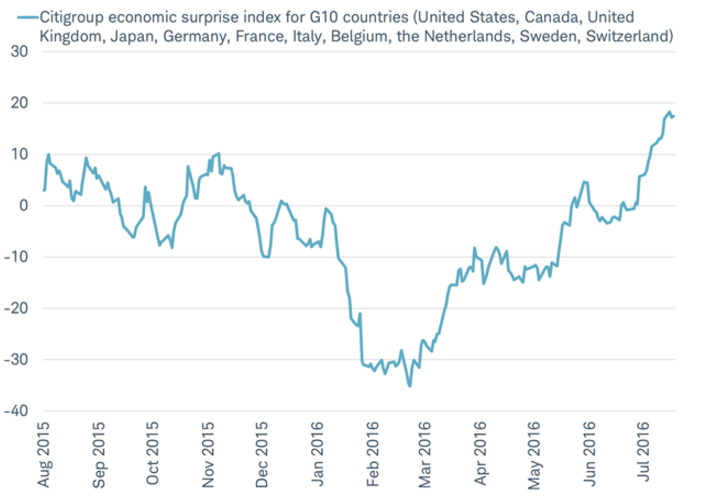

Analysts seem to be catching up with surprisingly solid global economic data. The reversal in the trend of analysts’ earnings estimates has tracked the reversal of global economic data relative to economist expectations. Economic data for the Group of 10 (G10) countries (United States, Canada, Japan, United Kingdom, Germany, France, Italy, Belgium, the Netherlands, Sweden and Switzerland) has rebounded and is now exceeding economists’ expectations, as you can see in the chart below. In response, stock analysts’ have been forced to raise their earnings estimates.

Economic data surprises have turned positive

Source: Charles Schwab, Bloomberg data as of 7/21/2016.

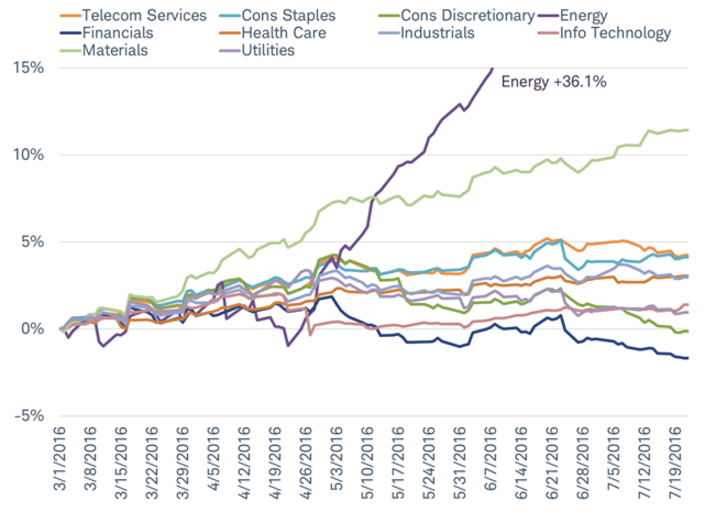

Even in Europe where the gains have remained even after the Brexit vote, the revival in the earnings outlook is taking place. It is worth noting that the upturn in earnings forecasts that began in March isn’t just taking place across a broad number of countries; it can also be seen across most sectors. Earnings expectations for stocks in the industrials, energy, materials, consumer staples and information technology sectors have joined the healthcare, utilities, and telecom sectors of the MSCI World Index with an improving outlook since February. The earnings outlook for the consumer discretionary sector has not seen any net change and the only sector to see an ongoing decline is the financials sector. Perhaps if interest rates halted their decline it may help to reverse the EPS revision trends in the financials sector.

Nine of ten global sectors have seen rising earnings estimates in recent months

Percent change in next twelve months earnings per share estimate since 3/1/2016.

Energy sector line truncated on chart due to scale.

Source: Charles Schwab, Factset data as of 7/22/2016.

The IMF updated their forecast last week post-Brexit by shaving 0.1% off of global growth for both 2016 and 2017. Global growth this year is now expected to be 3.1%, the same as in 2015, followed by a modest acceleration to 3.4% in 2017. While the global growth outlook is relatively stable, it remains below-average and vulnerable to shocks. Without stronger global economic growth, earnings may stabilize but are unlikely to post a powerful rebound.

The end of the downtrend in earnings estimates over the past year and a half has helped to support stocks in recent months, even in the face of negative geopolitical developments. The so-called “fear gauges”, or stock market volatility indexes, for the United States (VIX) and Europe (VSTOXX) are in line with some of the lowest levels of the past year and a half. However, if earnings estimates should roll back over due to a shock or deterioration in the global economic data, stocks are unlikely to be as resilient to geopolitical developments.