Key Points

Jeffrey Kleintop is senior vice president and chief global investment strategist at Charles Schwab & Co.

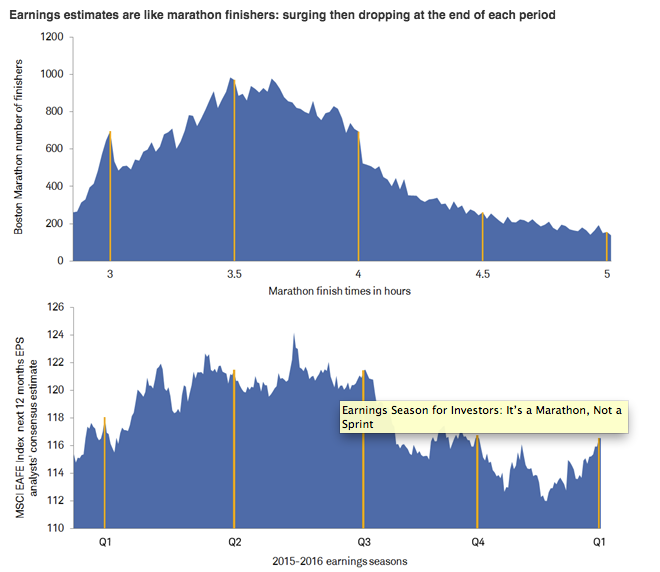

• Just as the number of marathon finishers surges then drops off as each half-hour mark passes, the surge in the level of earnings estimates often drops off after each quarter ends.

• The return of earnings growth is a key factor in getting global stocks to move materially higher.

• Successful long-term investing is like a marathon since investors must be prepared, disciplined, able to overcome setbacks, and focused on their goal in order to be successful.

The 120th Boston Marathon takes place today, as the first quarter earnings season starts in earnest with 7% of companies in the MSCI All Country World Index scheduled to report this week.

After falling for most of the first quarter, expectations for earnings per share over the next twelve months’ earnings have been revised higher in recent weeks for the stocks in the MSCI EAFE Index (which measures developed economies excluding the United States). While that is welcome news, it might not last. The earnings season can be like finishing a marathon. Just as the number of marathon finishers surges then drops off as each half hour mark passes, the surge in earnings estimates often drops off after each quarter ends. The charts below illustrate the pattern in marathon finishes mirrored in the earnings expectations for the MSCI EAFE Index over the past year.

Source: Charles Schwab, MarathonGuide.com and Factset data as of 4/14/2016.

The psychology of runners’ targeting a certain time and wanting to finish before the start of the next half hour increment passes suggests that missing the target carries a sense of failure. Perhaps the same motivation leads corporate leaders to lower expectations for earnings during the reporting season to avoid the risk of failing to meet the target.

As we’ve seen in the past, as this earnings season gets underway, many companies will beat expectations for the first quarter just as they lower earnings estimates for future quarters. But investors shouldn’t be too discouraged by these downward revisions since they are part of the regular quarterly pattern. On average, stocks have tended to post gains during the seven weeks of the quarterly earnings reporting seasons of the past five years.

The current analysts’ consensus expectation of around $117 in earnings per share for the companies in the MSCI EAFE Index suggests 22% growth for 2016 from the $96 in earnings per share reported over the past 12 months—an unlikely surge given our outlook for below-average global economic growth. But material cuts of as much as 10-15% in the outlook for earnings per share could still lift stocks, if those expectations for single-digit earnings growth were deemed by investors to be highly likely.

We believe the return of earnings growth is a key factor in getting global stocks to move materially higher. Historically, the manufacturing purchasing managers index has been a useful indicator of future profit growth. The broad uptick in this index across most countries during March is encouraging. If these and other recent improvements in indicators of global economic growth are sustained, and the stabilization in commodity prices continues, investor confidence may rise in the eventual return of earnings growth.

Looking beyond the quarterly earnings season, today’s runners competing in the Boston Marathon are setting an example for investors. Successful long-term investing is like running a marathon. Investors must be prepared, disciplined, able to overcome setbacks, and focused on their goal in order to be successful. Coaching can be a big help, too. But, sprinting during a long race is like short-term investing toward a long-term goal leading to exhaustion and emotional highs and lows that contribute to poor decision making, undermining investors’ progress toward their goals.

Earnings Season For Investors: It’s A Marathon, Not A Sprint

April 19, 2016

« Previous Article

| Next Article »

Login in order to post a comment