Second quarter earnings season has been okay, but we were hoping for more. S&P 500 earnings are tracking to a 2.6% year-over-year decline in the second quarter of 2016, which means the earnings recession is poised to continue. The quarterly decline would make four in a row according to Thomson Reuters data (by FactSet’s count, the streak is five). Although the numbers for the quarter were not great, there have been some encouraging signs. The technology sector has produced solid results, and forward estimates have been resilient overall. This week we provide an overview of earnings season and discuss prospects for a second half earnings rebound. Later this month we will update our Corporate Beige Book barometer, an analysis of the topics covered in companies’ earnings conference calls.

SECOND QUARTER EARNINGS BY THE NUMBERS

With 428 S&P 500 constituents having reported second quarter results, S&P 500 earnings are tracking toward a 2.6% year-over-year decline, just 1.2% better than expectations as of quarter end (June 30, 2016). The second quarter of 2016 will also mark the fourth straight quarterly decline in one of the longest earnings recessions outside of an economic recession ever (read more on the earnings recession in this Thought Leadership publication).

But among those dreary headlines, there is some good news:

· The second quarter results help to solidify the first quarter of 2016 as a trough in earnings growth.

· S&P 500 profit margins are near record highs, excluding energy.

· The technology sector produced significant upside to prior second quarter forecasts, with positive revisions to third and fourth quarter estimates.

· S&P 500 revenue came within 0.5% of a year-over-year gain and is up 3% year-over-year, excluding energy.

· Pre-announcements have been less negative than the historical average. The ratio of negative-to-positive pre-announcements for the third quarter, at 2.4, is better than the long-term historical average (2.7).

· Forward four quarters earnings estimates have fallen by a below-average 0.8% since earnings season began.

At the same time, there have been some disappointments:

· Backing out headwinds from oil prices and the dollar still get us to only about 2% year-over-year earnings growth, a weak pace for this stage of the business cycle; moreover, the U.S. dollar comparison versus the year ago quarter suggests less currency drag than we have seen.

· Despite easing drags from oil and the dollar, the S&P 500 may not be able to generate the average earnings upside to prior forecasts of about 3%.

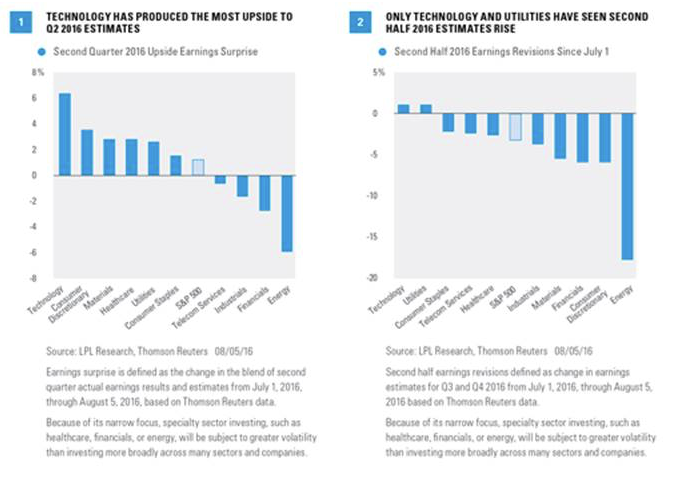

· The bars for the energy and industrials sectors were not low enough. Energy has missed second quarter estimates by more than 6%, while the industrials sector has fallen 1.6% short thus far.

TECHNOLOGY WAS A STANDOUT PERFORMER

The clear highlight of this earnings season has been the technology sector, which has produced the biggest upside surprise in the quarter of any sector, at more than 6% [Figure 1], and a positive revision to estimates for the second half of the year—the only sector besides utilities that can make that claim [Figure 2]. The sector has benefited from powerful shifts toward mobile and cloud computing, as well as the continued strong trends in ecommerce. With each passing day, these growth areas become a bigger share of sector revenue and, with their better profit margins, improve the profitability and growth profile of the technology sector.

Technology remains one of our favorite sectors for the second half of the year based on the potential pickup in growth and attractive valuations.

WHAT BREXIT?

In our earnings preview commentary, we wrote that the United Kingdom’s (U.K.) decision to leave the European Union (EU) would have a limited impact on S&P 500 earnings and that is indeed what we have seen. Most companies that have cited Brexit as a potential business risk have noted that it is too early for them to predict what the impact might eventually be. For those who have been affected, it has been through the currency (the British pound has fallen 13% versus the U.S. dollar since the late June vote). But just because the impact has been minimal thus far does not mean the topic has not been popular on earnings calls. According to Bespoke, 49% of companies’ earnings calls for the one month ending July 28, 2016, included at least one Brexit mention. We will have more on Brexit in our Corporate Beige Book commentary coming up in the next couple of weeks (for reference, you may view the first quarter’s Corporate Beige Book here).

PROSPECTS FOR SECOND HALF REBOUND

We continue to expect earnings to rebound in the second half of the year. The U.S. economy should help. The latest data have gross domestic product (GDP) for the third quarter tracking between 2.5% and 3.5%, and the fourth quarter could reach similar levels as the recent drawdown in inventories reverses. Recent readings on the Institute for Supply Management’s (ISM) Manufacturing Index, one of our favorite earnings indicators, have been solidly in expansion territory (five straight months over 50), with particular strength in new orders and production.