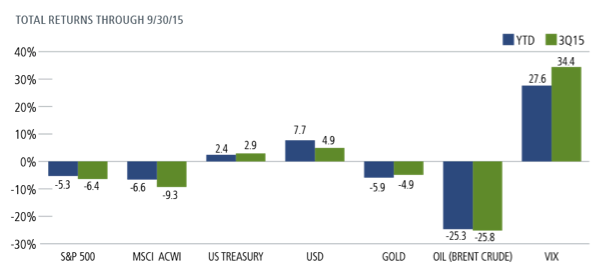

The third quarter proved difficult for investors as apprehension about slowing global growth and monetary and fiscal policies converged. As Figure 1 shows, volatility soared while equities declined sharply and commodities plummeted. Heading into the final months of the year, our positioning is cautious, but reflects our view that the markets offer many opportunities, particularly among growth-oriented equities and convertibles, along with high yield.

The third quarter proved difficult for investors as apprehension about slowing global growth and monetary and fiscal policies converged. As Figure 1 shows, volatility soared while equities declined sharply and commodities plummeted. Heading into the final months of the year, our positioning is cautious, but reflects our view that the markets offer many opportunities, particularly among growth-oriented equities and convertibles, along with high yield.

Although we remain positive, we expect elevated volatility to persist due to global growth concerns and central bank policies—including an uncertain Federal Reserve timeline and divergent courses among global central banks. Fiscal policy is likely to remain a focal point of market anxiety, with the U.S. election among the factors figuring prominently in this regard.

We believe the U.S. and global economies are likely to maintain a muted pace of expansion over the near term. The U.S. consumer remains strong, key data points in the euro zone have shown improvement, and China has many tools to avoid a hard landing. Fiscal policy remains a headwind to more robust expansion, with overregulation among the factors challenging entrepreneurship and business growth in a number of economies, including the U.S.

Whenever the Fed increases rates, it will be a sign of the overall health of the U.S. economy and an affirmation that the global economy is sufficiently stable. Also, any interest rate increases will likely follow a slow and shallow path.

FIGURE 1. 3Q 2015, VOLATILITY SOARS, EQUITIES AND COMMODITIES FALTER

Past performance is no guarantee of future results. Source: Bloomberg.

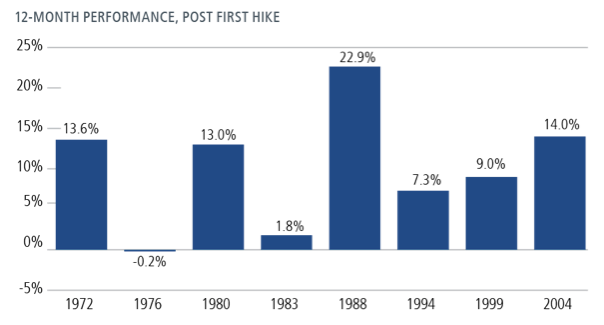

FIGURE 2. S&P 500 RETURNS AFTER RATE HIKES

Past performance is no guarantee of future results. Source: Cornerstone Macro. “Positioning For A Fed Tightening Cycle,” September 16, 2015.

Moreover, a more normal interest rate environment will ultimately benefit the economy and equity markets. While larger corporations have been able to access capital to support their growth, the low interest rate environment has not been as kind to smaller businesses. Because interest rates are lower, the margins that banks make on their loans to small businesses have been lower, too. This has contributed to banks’ reluctance to lend. If rates were higher, banks would be more likely to lend, provided that the economy was also growing. Small businesses are an important engine of job growth, so with more capital, they would be better able to hire more people, which would in turn support economic growth. Further, as illustrated in Figure 2, stocks have tended to perform well during the first year of an interest rate increase.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

John P. Calamos Sr. is chairman, CEO and global co-CIO of Calamos Investments, a firm he founded in 1977. With origins as an institutional convertible bond manager, the firm has grown into a global asset management firm with major institutional and individual clients around the world. The firm is headquartered in the Chicago metropolitan area with additional offices in London and New York.