Key Points

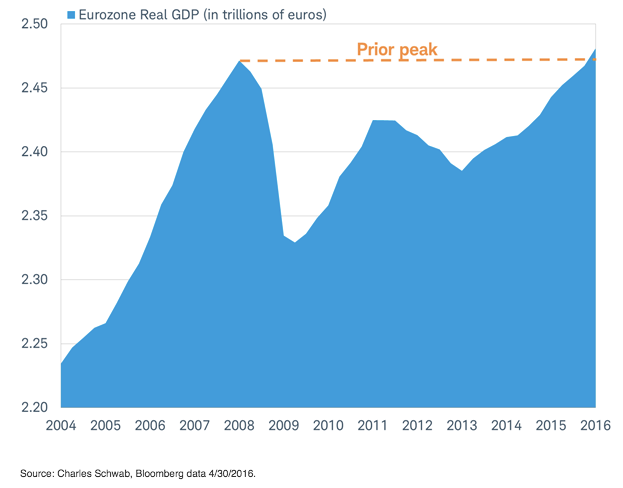

- Strong first quarter growth has pushed Eurozone GDP back above its prior peak eight years ago.

- Many companies noted solid growth in Europe during the ongoing first quarter earnings reporting season.

- Better growth has lowered market expectations for additional rate cuts by the European Central Bank and helped Europe’s stocks lead the developed markets higher in April.

Eurozone GDP growth surprised to the upside in the first quarter with a strong +0.6%, or an annualized 2.4% quarterly growth rate (for comparison to the way U.S. GDP growth is reported). This lifted the Eurozone economy to a new all-time high eight years after the Q1 2008 peak, as you can see in the chart below. This good news is supported by reports of first quarter earnings results and future quarters’ outlook provided by economically-sensitive companies. It is also welcome news for the European Central Bank (ECB) which is running out of new options to spur growth.

Eurozone GDP has finally fully recovered after more than eight years

The pace of growth in Europe in the first quarter doubled the pace in the prior quarter, but exactly where this growth came from will not be detailed until June 7. However, gathering insights from some of the individual European countries that also reported GDP last week, revealed details of broad growth across the major components. For example, GDP in France was a solid +0.5% (not annualized), a rebound from the weakness in the prior quarter, supported by strong growth in consumer spending of +1.2%. This is following the -0.1% contraction in the fourth quarter (which may have been impacted by the November Paris terror attacks). This strong growth helped lift imports by 0.5%. Additionally, fixed investment grew by +0.9%, continuing the solid growth seen in the fourth quarter.

Spain posted a strong 0.8% GDP growth rate, maintaining its rapid pace of growth. While no details were available, confirmation of Spain’s strong growth could be seen in comments from many companies this earnings season: Nestle, Heineken, Carrefour, Coca-Cola, Sodexo, Aena, and Randstad.

While Spain stood out, many companies noted solid European growth overall. Earnings reports and comments from companies from a variety of economic sectors have generally confirmed the improving pace of economic activity in Europe. For example:

- Transportation - Data from Spanish airport operator Aena show air passenger traffic grew 14% in Spain. Data provided by the Zurich airport reveals 4% growth despite a strong Swiss franc and Rome’s airport reported 4% growth in EU passenger traffic.

- Construction - Volvo raised truck order and construction equipment forecasts.

- Employment - Netherland staffing company Randstad reported solid first quarter demand.