Income tax rates could drop in 2017. President-elect Donald Trump campaigned on lower rates, and a Republican-controlled Congress awaits him on Capitol Hill.

It’s too soon to know whether any new legislation might resemble Trump’s September 2016 tax plan, the House Republicans’ tax-reform blueprint, a happy marriage of the two, or something else again.

Nevertheless, “there are strategies clients can implement by year-end that, in most cases, have little downside and significant potential upside,” says Boston CPA Michael Antonelli, a partner at Edelstein & Company LLP.

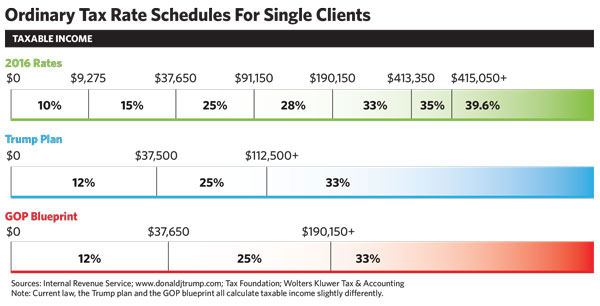

With today’s 39.6% top ordinary rate possibly dwindling to 33% under both Trump’s plan and the GOP blueprint, deductions may be more valuable this year to the biggest earners. For them, accelerating write-offs into 2016—ever mindful of alternative minimum tax consequences, of course—could yield substantial savings.

Moreover, Trump has proposed capping itemized deductions at $200,000 for a couple filing jointly and $100,000 for single filers. “A client who could be affected and who was planning to make charitable contributions over the next two or three years may want to accelerate them into 2016,” Antonelli says.

Deferring income to 2017, when tax rates may be lower, could also benefit top-bracket clients.

“If a client is selling an S corporation or a partnership, they may be better off closing the deal in 2017 if a significant portion of the gain will be taxed as ordinary income due to the existence of inventory or receivables,” Antonelli says, “or if there are passive investors in the business who will get hit with the 3.8% net investment income tax.” Both the Trump and GOP plans nix the 3.8% Obamacare surtax.

Higher Rates Ahead For Some

Deferring income to 2017 could be dicey for single clients making between $112,000 and $190,000. They would pay a lower rate next year if the Republican blueprint is enacted, but a higher one in Donald Trump’s America.

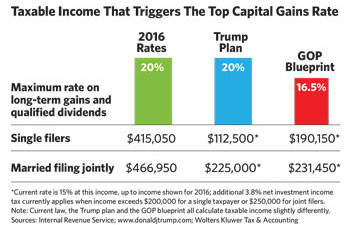

Investors seeking to take gains confront a similarly murky tax-rate picture. “Trump’s capital gains rates aren’t going to be an improvement necessarily. You could be in a higher bracket,” warns Tom Wheelwright, a CPA and the CEO of ProVision Wealth Strategists in Tempe, Ariz.

The Republican plan would likewise push many clients into a higher cap-gains bracket, although most would ultimately pay a lower rate than they do today after accounting for repeal of the Obamacare surtax.

Thus, a couple filing jointly with income of, say, $400,000, would see their gains and qualified dividends taxed this year—assuming there were no AMT consequences—at 18.8% (a 15% capital gains tax plus a 3.8% surtax), where it would be 20% next year if Trump gets his way or 16.5% if House Republicans get theirs.

“We would recommend taking steps to minimize 2016 taxes versus hedging in hopes of change,” says George Marron, a senior wealth management consultant with Manning & Napier in Fairport, N.Y.

Strategies For Business Clients

The future availability of business tax credits and deductions is in question. “Most corporate tax expenditures except for the research and development credit” would be eliminated, according to www.donaldjtrump.com. Whether “tax expenditures” refers to credits, deductions or both befuddles Washington-watchers. Whatever its meaning, it does suggest that December 31 could be the last call for a variety of business tax breaks.

So before the year is out, owners should consider writing down inventory that isn’t moving and charging off debts, whether accounts receivable or notes, that they probably won’t collect, says CPA Blake Christian, a tax partner at accounting firm HCVT LLP, in Park City, Utah.

He’s also advising cash-basis businesses to pay employee bonuses before the new year. Accrual-basis employers should accrue bonuses when closing their 2016 books to get the deduction this year; payment need not occur until March 15, 2017, which would benefit employees whose tax rate falls next year. But this shift won’t work for bonuses to partners or controlling shareholders, says Christian. “They are effectively put on a cash basis for deductibility.”