KEY TAKEAWAYS

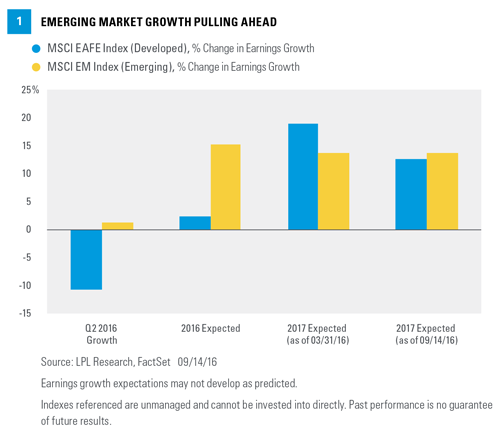

· Earnings growth across emerging market (EM) equities has been positive in contrast to the decline in earnings and earnings expectations in developed international markets.

· Valuations in EM have not increased at the same pace as developed international or U.S. markets, creating a more attractive entry point for the asset class.

· Technical weakness in developed foreign markets is coinciding with reductions in earnings expectations.

By nature, emerging markets (EM) have greater risks, but they also have attractive attributes relative to developed foreign markets. For most markets, earnings have been stagnant while valuations—what investors are willing to pay for those earnings—have increased. In contrast, emerging markets are beginning to see earnings actually increase, albeit modestly. Initially, EM earnings growth was driven by commodity related sectors, but has broadened out, most importantly to include financial stocks. Furthermore, valuations in EM have not experienced the same expansion as other markets. As the earnings picture is souring for developed foreign markets, represented by the MSCI EAFE Index, overall, these developments increase the relative attractiveness of EM stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

IMPROVEMENT FOR EM EARNINGS

Given that the global financial markets have been in an earnings recession, emerging markets have experienced both earnings growth and improved expectations for future earnings growth. Admittedly, this growth is modest in both respects, but it is in stark contrast to prolonged earnings weakness in Europe [Figure 1]. EM earnings rose 1.3% year over year in the second quarter of 2016, a gain made more significant because at the beginning of the quarter, expectations were for a 6% earnings decline. More importantly, whereas 2017 earnings forecasts for the EAFE Index have declined over the past five months, expectations for EM are essentially unchanged. The fact that EM earnings have grown, and have exceeded expectations, has created greater confidence in forecasts. The poor performance in developed overseas markets has forced the market to lower expectations for the future.

The source of earnings growth is also telling, and shows the contrasts between developed and emerging economies. Earlier in the year, we saw EM earnings growth largely in commodity-related companies, as prices of not only energy, but also copper, iron ore, gold, and other commodities rallied after the sharp decline in late 2015 and early 2016. However, commodities no longer dominate the EM stock universe. In March 2011, commodity stocks represented nearly 40% of the index; today, energy and materials together only comprise 13.4% of the index. However, commodity-related stocks still “punch above their weight” by affecting stocks in other sectors, and entire national economies for countries like Brazil and Russia are heavily tied to commodity prices.

Today, financial stocks are the largest sector in both the MSCI EM and EAFE Indexes, at 26.5% and 19.2%, respectively. As has been well documented, the negative interest rate environment across the developed world has affected earnings and the performance of financial stocks. However, negative rates are a developed market phenomenon only; emerging countries tend to have much higher interest rates. In fact, the farther a country is removed from the global economic mainstream, the higher its interest rates tend to be. For example, export-dependent countries like South Korea and Taiwan have very low, though still positive, rates at 1.25% and 1.375%, respectively; while countries like China and India are at 4.35% and 6.5%. Rates are even higher in less politically stable countries, like Russia, where the central bank just cut rates to 10%, and Brazil, where short-term rates are 14.5%.