Currency Question

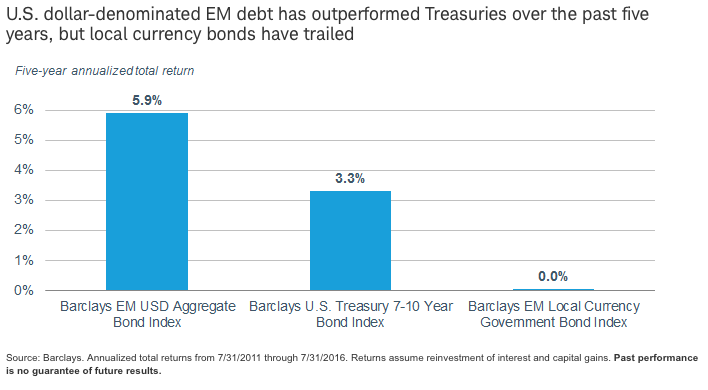

EM bonds denominated in U.S. dollars have done well over the past five years when compared to U.S. Treasuries of comparable maturities, as you can see in the chart below. Dollar-denominated EM government debt, in particular, has performed well as low global interest rates have helped push yield-seekers into new markets.

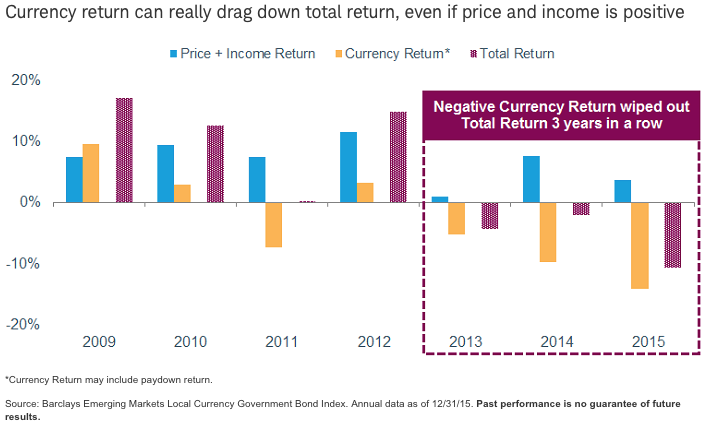

The same can’t be said for local currency EM bonds. Average returns from such debt have actually been flat over the past five years, largely because currency losses have offset price increases. As you can see in the chart below, currency weakness actually wiped out any returns from local currency EM bonds in the last three years.