Corporate Debt Binge

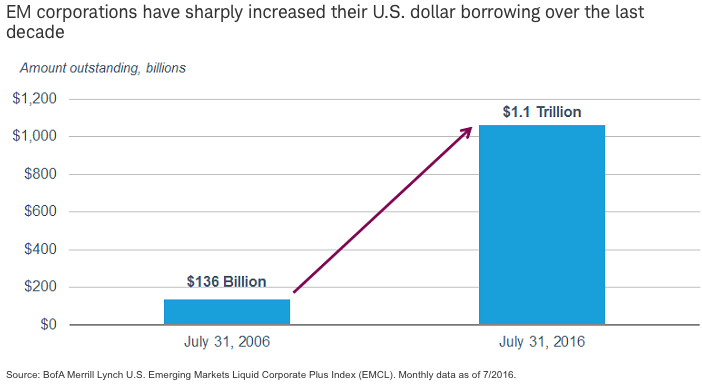

Meanwhile, corporate borrowers in emerging markets have loaded up on U.S. dollar debt in recent years, as low interest rates have given them access to cheap funding. About 46% of the nonbank corporate borrowing in EM countries is denominated in U.S. dollars, according to data from the Bank for International Settlements (BIS). 2 That kind of borrowing can make sense if a borrower’s revenues are denominated in dollars because it is a natural hedge. However, if most of a borrower’s revenue is some other currency, then a stronger dollar could make it harder to repay debt.

According to the BIS, between now and 2018 repayments will rise by 40% compared to the previous three years. And if the U.S. Federal Reserve raises interest rates later this year, which we think is a possibility, some companies that borrowed in U.S. dollars may have difficulty refinancing their debts if the dollar rallies on higher interest rates. That is especially worrisome given the very sluggish pace of global growth.

Higher interest rates in the U.S. could also pose a problem for U.S. dollar-denominated EM bonds, as higher rates could entice some bond investors back to the U.S.

Highly Valued

Valuations are also a consideration. EM bonds can provide diversification benefits to a fixed income portfolio. However, the higher risks involved (compared to developed market or domestic bonds) should mean investors in such bonds should receive more compensation in the form of higher yields.