Charting a New Course When Rajiv Jain left Vontobel Asset Management in May 2016 to set up his own shop, it’s a good bet his former employer wasn’t very happy. A 22-year veteran of the Switzerland-based firm, who started as an analyst and left as its chief investment officer, Jain was a marquee name with a loyal following and nearly $50 billion in international and emerging market assets under his supervision. When he left, Vontobel’s stock dropped and billions of dollars in assets under management left the firm.

When Rajiv Jain left Vontobel Asset Management in May 2016 to set up his own shop, it’s a good bet his former employer wasn’t very happy. A 22-year veteran of the Switzerland-based firm, who started as an analyst and left as its chief investment officer, Jain was a marquee name with a loyal following and nearly $50 billion in international and emerging market assets under his supervision. When he left, Vontobel’s stock dropped and billions of dollars in assets under management left the firm.

It’s not easy these days for one person to earn such clout—when index-based and quantitative investment strategies are grabbing market share from star active managers. Jain was able to turn heads in the U.S., however, because of his track record at the Virtus Vontobel Emerging Markets Opportunities Fund (HIEMX).

It’s not easy these days for one person to earn such clout—when index-based and quantitative investment strategies are grabbing market share from star active managers. Jain was able to turn heads in the U.S., however, because of his track record at the Virtus Vontobel Emerging Markets Opportunities Fund (HIEMX).

He ran it from 2006 until March 2016. The website Mutual Fund Observer compared the fund during his tenure with 67 other funds in the emerging markets space. The results, the report noted, were “startling.” Over a 10-year period, he’d posted the highest returns among diversified EM equity funds. His fund had the group’s smallest maximum drawdown, the second lowest volatility and the second highest Sharpe ratio.

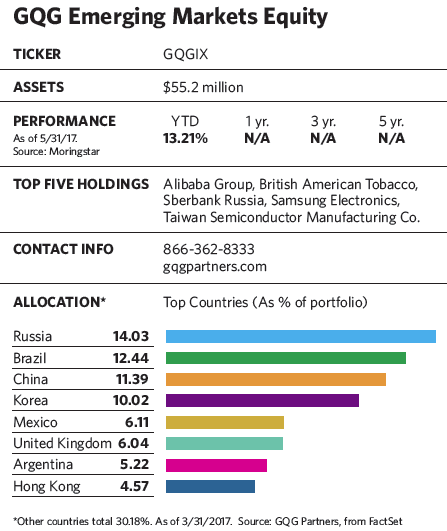

The 50-year-old manager is aiming for another success story with his new vehicle, the GQG Partners Emerging Markets Equity Fund (GQGIX). It’s one of two U.S. mutual funds offered by Fort Lauderdale-based GQG Partners, a firm established by Jain a year ago that has already accumulated some $5 billion in assets and 29 employees. The emerging markets equity fund, launched in December 2016, invests for the long term in high-quality companies that have sustainable earnings growth and are available at a reasonable price. The fund typically holds between 50 and 80 stocks, and has no market cap restrictions.

Jain emphasizes that he’s a benchmark-agnostic, active manager willing to shift positions should conditions warrant. “Emerging markets tend to swing from one extreme to another, so buy-and-hold does not work well here,” he says.

Jain set out on his own after a change in management at Vontobel “created differences of opinion about where the business should be heading.” He also wanted to create a corporate culture that aligns firm and client incentives.

Since GQG is an employee-owned firm, a meaningful portion of its employees’ incentive compensation, and much of Jain’s personal net worth, is invested alongside the clients’ money. The investment team includes traditional and non-traditional analysts, with backgrounds in things such as investigative reporting and forensic accounting. As a private company, GQG avoids shareholder pressure to grow assets under management and to focus purely on investment results. The fees for the emerging market fund and the firm’s international fund are well below their peer medians, and Jain plans to keep it that way.

“I wanted to have a truly institutional-grade shop from day one,” he says. “Managing someone else’s money is a privilege, and I am always mindful that retirement funds and college accounts are going to be impacted by my decisions.”

Whenever a star manager leaves a mutual fund, the fund companies often try to reassure investors that the heart of a fund’s strategy and success lies in a time-tested investment process, not one person. But a look at the differences between Virtus Vontobel’s and GQG’s emerging market offerings suggests that managers, even those who follow similar investment philosophies and strategies, can follow very different investment paths.

Emerging Markets Star Sets Up Shop

July 2017

« Previous Article

| Next Article »

Login in order to post a comment