We believe there is room for further improvement in emerging market debt (EMD) valuations.

We believe there is room for further improvement in emerging market debt (EMD) valuations.

The Federal Reserve’s and the Bank of Japan’s recent stimulus actions may help support EMD performance.

Slower growth may pose a challenge for EMD issuers, but cheaper valuations mean that investors may be compensated for potential risks.

The first quarter of 2013 witnessed the worst quarterly performance for emerging market debt (EMD) investors since 2008 and the peak of the financial crisis, as measured by the JP Morgan Global Emerging Market Bond Index. A moderation in EMD performance was to be expected after strong performance in 2012, but recent weakness appears to have run too far, given that many of the favorable longer-term trends underlying the asset class, such as stronger economic growth and lower debt burdens compared to developed country counterparts, remain in place.

After a disappointing first quarter of 2013, EMD is enjoying a rebound at the start of the current quarter. Many of the challenges facing EMD that led to a weak first quarter still persist. These include:

- Slower growth. Emerging market economies continue to expand, and in some cases notably faster than those of developed countries, but the rate of growth has slowed. This is particularly true for India and Russia, two of the larger emerging countries. Although not prolific debt issuers, slower growth in both countries has fostered broader emerging market (EM) growth concerns. According to Bloomberg, forecasts for EM economic growth have been revised down in recent weeks and months. Such growth concerns contrasted to U.S. economic data that frequently exceeded forecasts over the first quarter of 2013, and U.S. economic growth is tracking to over 3 percent, according to a Bloomberg consensus forecast. As a result, investors focused investment dollars more on domestic markets rather than emerging markets.

- Less friendly central banks. Central bank interest rate cuts were a favorable theme underlying EMD over recent years but appears to be stalling. While not raising interest rates, many central banks paused, removing a key tailwind behind emerging market bond performance. A few central banks lowered interest rates, but such actions were isolated. In some countries, higher inflation is restraining central banks from lowering rates despite slower growth. Central banks may seek to cut rates in an attempt to spur economic growth, but widespread interest rate cuts are not likely, in our view, at this point.

- Greater interest rate risk. The JP Morgan Global Emerging Market Bond Index, a closely followed index for emerging market bond investments, holds slightly greater interest rate sensitivity compared to the domestic Barclays Aggregate Bond Index. Although greater interest rate sensitivity was only a secondary factor to EMD weakness, the rise in Treasury yields contributed to price declines during the first quarter. The possibility of higher future interest rates may be a headwind.

Following The Stimulus

All of the factors above contributed to EMD weakness and caused investors to focus on countries where stimulus is greatest, namely, in the United States and Japan. Both the Federal Reserve (Fed) and, most recently, the Bank of Japan (BoJ), impressed investors with aggressive monetary stimulus programs. The European Central Bank (ECB) has not increased stimulus, but a lingering recession is limiting investment opportunities.

The Valuation Argument

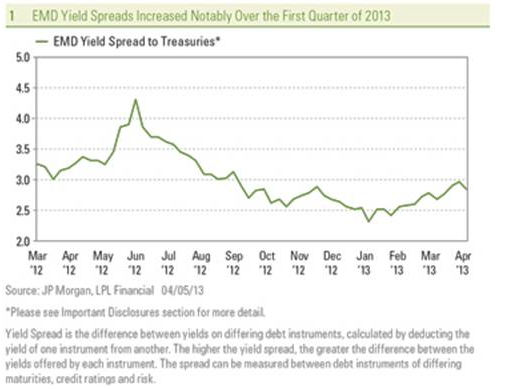

One compelling reason for EMD investment comes from a notable change in valuations. As is often the case in investing, attractive valuations can offset potential challenges, such as the ones outlined above. We believe EMD currently represents such a case. The average yield advantage, or spread, to comparable maturities Treasuries increased substantially over the first quarter of 2013 [Figure 1]. The average yield spread increased from a low of 2.3 percent in January 2013 to 3.0 percent before closing at 2.8 percent on Monday, April 8, 2013. Although valuations have richened over the first few days of the second quarter, we believe they remain attractive and have retraced only a portion of first quarter weakness.

More importantly, relative valuations have improved. Bond valuations remain elevated across the entire bond market, and bouts of weakness can provide opportunity in the current low-yield bond market environment. EMD weakness coincided with continued strength of high-yield bonds. In addition, valuations for investment-grade corporate bonds also showed improvement over the first quarter. In sum, the strength of high-yield bonds and the resilience of investment-grade corporate bonds stood in sharp contrast to EMD weakness during the first quarter of 2013.

We believe some of the fears are misplaced, and valuations have improved to better compensate investors for the risks. Investors appear to have taken notice at the start of the second quarter, given the snapback in emerging market bond prices. It is important to note that on a longer-term basis EMD yield spreads are relatively low, but in the context of a low-yield bond market and narrow yield spreads across all non-government bond sectors, we believe there is room for further improvement in EMD valuations. The existing challenges noted earlier will likely persist and may prevent EMD valuations from retaining their prior peak, but with an average yield of 5.0 percent, according to the JP Morgan Global Emerging Market Bond Index (as of April 5, 2013) investors can reap an attractive yield.

While emerging market central banks may not all turn accommodative, EMD may receive help from recent actions by the BoJ and the Fed. The BoJ’s surprising stimulus announcement led to lower Japanese government bond yields and may help keep yields low, motivating investors to consider higher-yielding alternatives such as EMD. In our view, Chinese economic growth has stabilized and may accelerate, providing a boost to broader Asian emerging market debt issuers. The Fed’s actions also motivate investors to consider higher-yielding sectors backed by more good fundamentals. Slower growth may pose a challenge for EMD issuers, but cheaper valuations mean that investors may be compensated for potential risks.

Anthony Valeri has been with LPL Financial since June 1993. As Senior Vice President and Market Strategist, Valeri is a member of the Research department’s tactical asset allocation committee and is responsible for developing and articulating fixed income and general market strategy.