The S&P 500 Index advanced 1.5% last week, marking the third straight week in which U.S. stocks advanced more than 1%.1 We attribute the recent rally to three factors: 1) A growing realization that equities are more attractive than bonds, given low Treasury yields; 2) An improving corporate earnings outlook for the next 12 months; and 3) A sense that Brexit risks should be relatively well contained thanks in part to stability in the banking system.1

Weekly Top Themes

1. Second quarter growth should improve, but the economy may slow in the third quarter. First quarter real gross domestic product growth was 1.1%,2 and we believe the second quarter should come in at around 2.5%. Looking ahead, that pace may slow due to deteriorating U.S. trade conditions, declining business confidence and a possible cooling off in consumer spending.

2. Bond yields are likely to trend higher. In our view, low Treasury yields are due more to overseas forces than domestic factors. In particular, the rising trend of negative government bond yields throughout the world is causing a significant drag on U.S. rates. Given positive (if slow) economic growth and modestly rising inflation in the United States, we expect U.S. yields should rise. As long as the increase is moderate and due to firmer growth levels, we think such an advance should support equities.

3. We think fiscal policy stimulus is likely in 2017. U.S. monetary policy remains accommodative, but will likely tighten slowly over the next 18 months. The prevailing political backdrop suggests we will see a fresh push for infrastructure spending and increases in other government programs after a new government is sworn in next year. To help pay for such spending, we think it is likely that we will see taxation on repatriated foreign earnings.

4. Geopolitical risks are rising, but so far have had limited economic and financial impact. The sheer number of horrific events that have occurred over the past few weeks is staggering. Terrorist attacks, political instability, growing violence in the United States directed at police and the attempted military coup in Turkey have all dominated the headlines. The investment implications have been modest, but these risks bear close attention for their broader political implications.

5. Historical trends suggest recent highs are bullish for equities. Last week’s new high for the S&P 500 Index was the first such new high since May 2015.3 Since 1950, this marks the 15th time that it took the index 12 months or more to mark a new high from the previous one.3 In the 14 previous occasions, the index was higher a year after the new high every time.3 The average 12-month gain was 18% and the smallest gain was 3.1%.3 In addition, the next major peak for the stock market occurred a minimum of 15 month after the new high.3

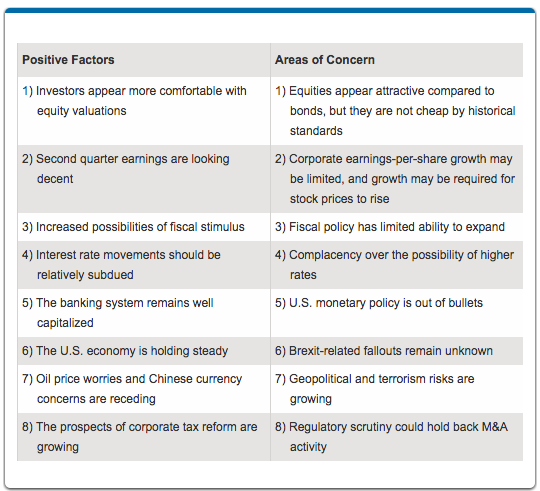

There Are More Reasons to Be Positive than Negative

Despite the recent highs in stock prices, investors remain uneasy about a number of issues, including uncertainty over global economic growth, monetary policy and financial market valuations. On balance, we remain cautiously optimistic, and close with a list of reasons to be positive, and to be cautious, adapted from J.P. Morgan:4

1 Source: Morningstar Direct, as of 7/15/16

2 Source: Commerce Department

3 Source: Strategas, Wampum

4 Source: Adapted from J.P. Morgan, U.S. bull/bear debate week of 7/18/16

Bob Doll is chief equity strategist at Nuveen Asset Management.