Are 3.5% yields on floating-rate senior loans exposing clients to too much credit risk?

Apparently, investors don't think so. In the first quarter of 2011, more than $10 billion flowed into mutual funds that invest in floating-rate senior loans, according to Lipper, New York.

Senior floating-rate loans are short-term collateralized loans made by financial companies to corporations with below-investment-grade credit ratings. These debt instruments also go by the rubrics of "bank loans" or "syndicated floating-rate bank loans." The loan's interest rate typically resets every 30 to 90 days, based on changes in the London Interbank Offered Rate (LIBOR). The interest rate is based on the LIBOR rate plus a spread to compensate lenders for the credit risk.

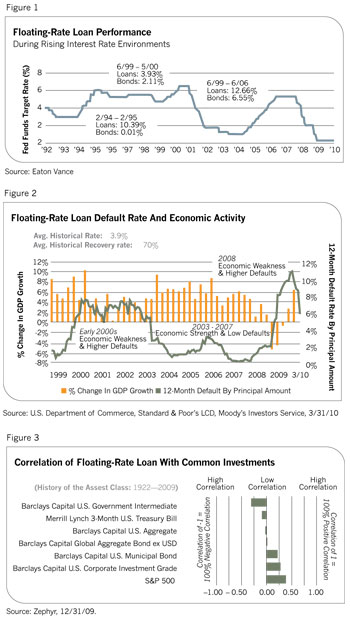

Although there is a risk the creditor may default, there is little market interest rate risk because the loan interest rates are reset periodically. The average duration of a portfolio of the holdings in senior loan mutual funds is less than one year, and their average maturity is about four years, according to Morningstar Inc., Chicago.

In addition, the loans are collateralized by the borrower's assets. Investors get paid before holders of subordinated bank loans, bondholders and stockholders if the company defaults.

Over normal business cycles-unlike the one in 2008 that triggered a financial market collapse and frozen credit markets-senior loans have performed well.

But financial advisors, despite the growing popularity of these investments, need to scrutinize the risk-return trade-off of including these floating-rate loans in client portfolios.

"The trade-off for that attractive interest rate profile and generous income potential is a healthy dose of credit risk," says Morningstar fixed-income director Eric Jacobson. "That's because the portfolios in this category almost exclusively invest in yield-rich debt of highly leveraged loans." The leverage, he says, refers to the debt on the issuer's balance sheet rather than margin loans by the mutual funds that hold them.

Robert H. Dial, manager of the Mainstay Floating Rate fund, recommends that financial advisors view senior floating-rate loans as a separate asset class because of their low correlations to stock, high-grade corporate bonds and U.S. Treasury bonds. "Floating-rate loans should not be considered an alternative to money market securities, money market funds or certificates of deposit," he stresses. "They are a short duration alternative to high-yield bonds."