Key Points

- Municipal bonds issued by school districts can be part of the stable foundation of a municipal bond portfolio, in our view.

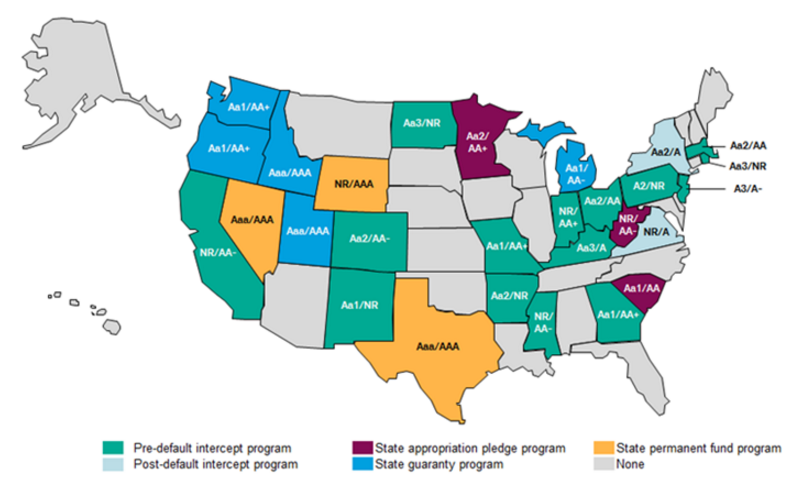

- School district bonds in some states come with extra protection from state enhancement programs that can make missed interest and principal payments.

- The strength of the different enhancement programs varies by program.

Source: Moody’s and S&P. Data as of 8/18/2016. Note: For illustration only. May not include all enhancement programs. Some states may have multiple enhancement programs with different ratings. Consult the bond’s offering statement prior to investing.

It's that time of year when students wind down their summer breaks and start to turn their thoughts to school. Municipal bond investors may want to follow their lead.

Bonds issued by school districts—along with other highly rated general obligation bonds from cities and states and revenue bonds backed by essential services—can serve as the stable foundation of a municipal bond portfolio. School districts in most states tend to have high credit ratings, boasting A-level ratings or better. Why? One reason is that school district bonds in most states are backed by property taxes, which can be a stable and reliable revenue source. A strong property tax pledge can help support the credit quality of school district bonds, in our view.

And bonds issued by some school districts may come with an extra layer of protection: backing from a state credit-enhancement program. In short, this just means that if a school district runs into financial trouble, the state government can step in and make principal and interest payments on the district’s behalf.

Such programs make it easier for even small districts to access bond markets to help fund construction or renovations of public schools. But not every district has this kind of backing. Generally speaking, a school district has to apply to be part of an enhancement program and then receive approval from a state oversight board. School districts can participate only in their home-state programs, and each state’s programs may differ in terms of the strength of their backing.

Below we discuss some of the risks and benefits of different state enhancement programs.

State programs can enhance the credit quality of school district bonds

Just over half the states have credit-enhancement programs for school district bonds. The financial strength of many programs is linked to the financial strength of the state sponsor, and the credit ratings of individual enhancement programs tend to be based on the rating of the state’s general obligation bond.

Enhancement programs vary by state

Ratings are the Moody’s and S&P program ratings.

However, that’s not always the case. Some enhancement programs are stronger than others and may not be closely tied, or tied at all, to the state’s GO bond rating. And for some programs a change in the state’s GO rating can also result in a change in the enhancement program’s rating, which can then affect the ratings of issuers that participate in that program. In a few states, enhancement programs are backed by large endowment funds and so don’t depend on the state’s credit quality.

Bonds backed by an enhancement program will often have two ratings: the rating of the state enhancement program, which tends to be higher, and the underlying rating of the school district, which is based on its financial health. And two sources of credit protection are better than one when it comes to state enhancement programs.