It ain't working. Eight years after the outbreak of the financial crisis, central bank chiefs suggest they have saved the world, but have they? We argue central banks have become part of the problem, not the solution. At its core, their indoctrinated focus on inflation may well do more harm than good, with potentially perilous implications for investors.

Justification of Monetary Policy

Most central banks have a mandate to promote price stability; the Fed is said to have a dual mandate to also maximize employment. Over the decades, we believe most economists have come to believe pursuing an inflation target is the holy grail of modern central banking. As such, it's not a surprise that by arguing inflation is too low, central bankers have justified the pursuit of their various policies since the onset of the financial crisis. Some prominent central bankers, including European Central Bank (ECB) head Draghi, have argued the law requires them to pursue an inflation target, thus pursue potentially ever greater monetary easing; and that if there are unintended consequences, 'macro-prudential' measures ought to be employed by policy makers to address those (as an example, the argument is central to this speech by Draghi last February). Our interpretation: Draghi sees his role as doing whatever it takes, and don't blame him if there are unintended consequences. While Draghi may be more radical in some of the tools he employs, we consider his "leadership" as a symptom of the environment we are in.

Inflation Targeting Ain't Working

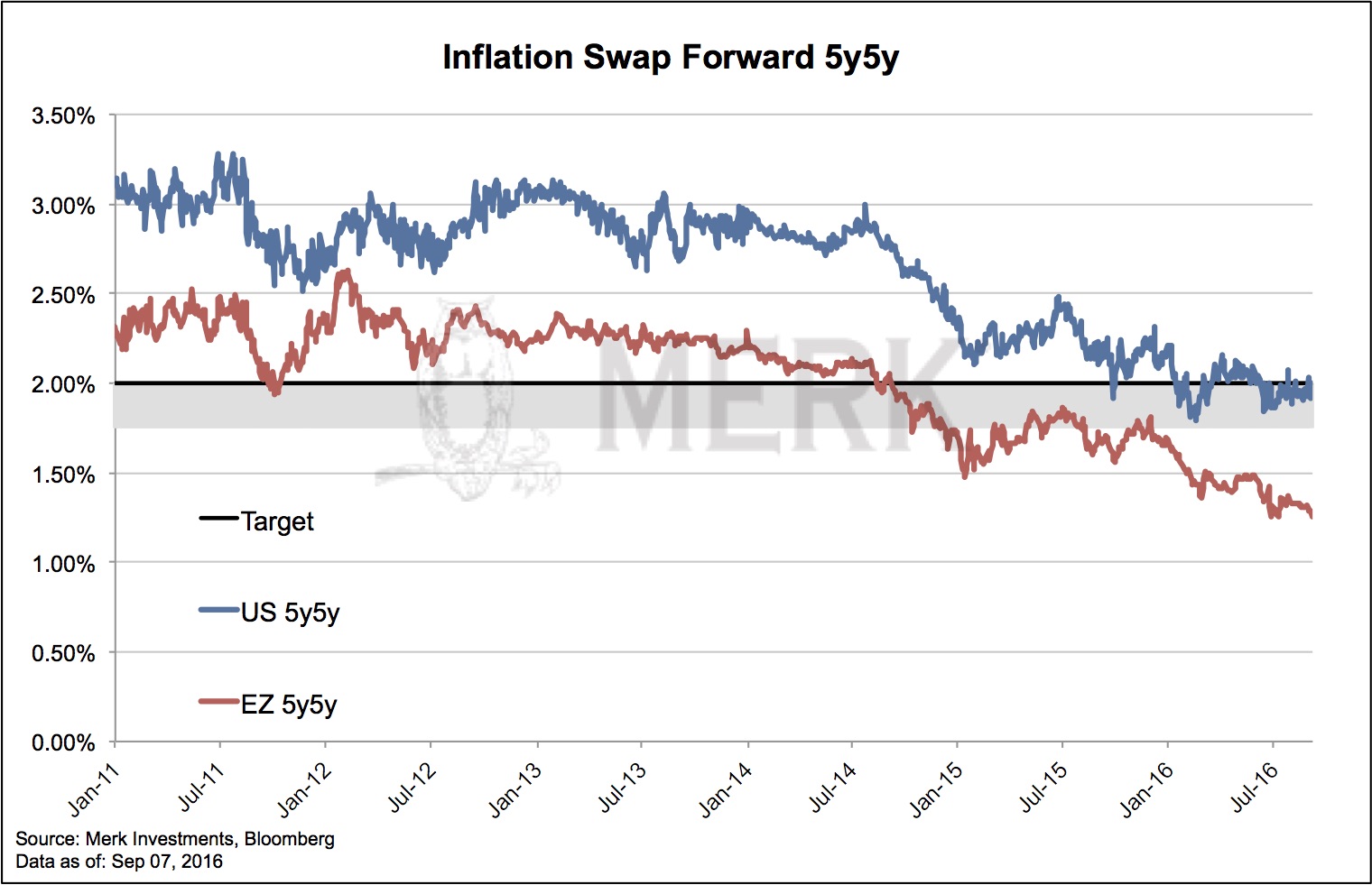

Inflation targeting isn't working. Below is a chart of market-based long-term inflation expectations for the U.S. and Eurozone (EZ). If we are not mistaken, Draghi shutters when he sees long term inflation expectations sagging; we believe former Fed Chair Bernanke would have long been tempted to resume quantitative easing (QE) looking at this chart. Fed Chair Yellen is a labor economist, so she may not be quite as glued on this particular chart. The Fed, in general, also likes to point out that there are other (survey based) measures of inflation that don't paint that bleak a picture.

Why is it bad that inflation expectations are ticking downward? Isn’t your purchasing power improving when inflation is low, even negative? You might say that as a saver, but if you have debt, you might prefer inflation. Economists have figured out that workers have a greater incentive to work if inflation chips away at the purchasing power of your hard earned cash ever so slightly every year. A credit (read: debt) driven economy might go into reverse (a deflationary spiral) if inflation is too low. It’s why we sometimes state that incentives of a government in debt may be very different from those of investors.

The Fed’s Mandate Ain’t Inflation Targeting

The biggest bully tends to grab everyone’s attention. Be that Mr. Bernanke, under whose leadership a formal inflation target was established at the Fed; or be that Mr. Draghi, who has suggested he’ll pursue the ECB’s inflation target no matter what. In their defense, they firmly believe that a big part of achieving an inflation target is to shape expectations that such a target may be achieved, and putting up a good show (it’s called communication) may well be part of it. As such, we don’t mean to personally offend them in implying they may be bullies; it’s part of their institutional role that they tend to bully the market.

But let’s take a step back and look at what the Fed’s mandate actually is; the Federal Reserve Reform Act of 1977 introduced three mandates, although we commonly refer to it as the dual mandate:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates. [emphasis added]

Unlike the U.S., other major central banks around the world do not have an explicit employment target; the argument against an employment target is that the best way to achieve maximum employment is indeed by providing price stability. If, however, employment were the focus, the central bank might be at risk of becoming politicized (which would be bad for the effectiveness of the central bank and ultimately inflation).

The short of it is, central bankers the world all over have learned to love the inflation target; so much so, that is has become a formal target in many countries; while it isn’t the law in the U.S., the Fed adopted a formal target under Bernanke’s leadership.

So why am I arguing the Fed's mandate isn't inflation targeting? Because the law clearly puts a litmus test on monetary policy, namely that they must be "commensurate with the economy's long run potential to increase production"

Economy’s Long Run Potential

We believe many economists would agree that an economy’s long run potential is reflected in its long-term interest rates; more specifically, it is reflected in long-term interest rates net of inflation (long-term real interest rates). The rarely mentioned third mandate, namely, “moderate long-term interest rates” refers to just that: higher longer-term rates are desirable if they reflect a potential to increase production rather than inflation.