Fast Lane

August 3, 2007

National

Financial Partners is a network of independent financial advisors as

broad as it is deep. More than 175 owned firms and more than 320 member

firms specialize in the areas that affluent clients need to protect and

growth their wealth-life insurance and wealth transfer, corporate and

executive benefits, financial planning and investment advisory

services. Jessica M. Bibliowicz, the chairman and CEO, speaks with

Hannah Shaw Grove, executive editor of PW, about her company's short

but super-charged existence and their long-term strategies to build

profitable and meaningful partnerships with the best financial

professionals in the business.

HSG: What is the philosophy of National Financial Partners?

JMB:

NFP was founded by Apollo Management in 1998, but I think the culture

and the history behind the NFP model really predated that by quite a

bit. In the '70s and '80s, distribution and manufacturing in the life

insurance industry began to separate. Life insurance advisors serving

the high-net-worth market began to leave the career insurance companies

to start their own businesses. Because they were no longer associated

with a particular life insurance company and its products, advisors

were able to evaluate and choose products from the range of carriers

that best suited their clients. Essentially, this was the first

generation of open architecture, which was a very different approach

for that time.

But as carriers began consolidation, the big

challenge these independent advisors faced was that negotiating with

the large insurance companies became tougher. Without the scale, retail

firms became focused on how they could associate with each other more

to add to their extensive knowledge of wealth planning and insurance

products.

One of the original firms to do something about this

emerging trend was The Partners Group in Texas, now known as

PartnersFinancial. It began as a producer group in 1987 with the goal

of bringing successful advisors together to create collective

purchasing power with the carriers, share intellectual capital, and

invest together in technology and marketing. In a nutshell,

PartnersFinancial helped independent advisors become a viable choice

for high-net-worth individuals by securing access to the products and

tools needed to serve such a sophisticated client.

HSG: How did that influence the genesis of NFP?

JMB:

NFP's goal was to take that idea of collective buying power and shared

intellectual capital one step further by expanding beyond the strict

scope of insurance and estate planning to support advisors in

complementary industries. Acquiring PartnersFinancial was a logical

first step for NFP because we felt it offered a permanent, strategic

structure that the other firms could plug in to for services and

support, leading to organic growth. NFP's role would be to bring scale

with the carriers and the capital infusion that would support growth

via acquisition.

Apollo Management recognized this opportunity

in the independent advisor market and in 1999 they funded NFP with $125

million of capital to start the acquisition process.

HSG: And the evolution of NFP?

JMB:

From the beginning, we knew we needed to stay focused on earnings and

keep the management teams at the firms we acquired motivated. And we

wanted to branch out quickly and make sure that we diversified our

revenue. We looked for firms to complement our strong life insurance

practices, particularly corporate and executive benefits practices in

the small and mid-size markets.

There is quite a bit of solid

cross-over between the high-net-worth market and the entrepreneurial

business owner, which allowed us to become involved in broader-based

wealth transfer, estate planning and business succession solutions. We

also wanted a stake in a third area that is important to affluent

clients-the management of their assets-so we began to acquire

investment advisors serving that space.

HSG: So, coming out of the gate NFP was broadly diversified?

JMB:

NFP was not originally conceived as a diversified story, but we quickly

adopted it as a strategy. With so much happening in the high-net-worth

space that needed attention, it was a logical next step for us. We also

wanted to take NFP public and we needed to think about growth and

revenue stability. Life insurance is a profitable business, but it can

be volatile. The benefits business and the asset management business

have more recurring revenue. We have diversification and non

correlation of our firms' earnings. It's a mix that is incredibly

appealing to clients and investors.

HSG: So what value does NFP provide for a firm and its clients?

JMB:

NFP is designed to support our firms from every angle, which creates

better service for their clients. For instance, a firm talking to a

business client about health and welfare, 401(k) and their voluntary

business can tie in to our corporate benefits resources for servicing

and administration, get competitive pricing for health care offerings,

deliver education on HSAs and so forth. But as part of NFP, they can

also bring our annual report to the table, showing that they are part

of a public company with a strong reputation, backed by a balance

sheet, with an established strategy and longevity. Our firms not only

have access to the products and tools they need, they also have a

national organization behind them.

HSG: What makes an NFP firm or firms the right choice for an ultra-affluent client?

JMB:

We have all the benefits of a large corporation, but it's really

boutique providers that deal with clients. Our firms have deep

knowledge in their respective areas of specialty and there's been a

long-term focus on the super-rich. There's real operating knowledge and

experience dealing with the complex issues of wealth-whether they are

regulatory, structural, or personal issues. And the boutique mentality

means they are used to partnering with other professionals to design

and deliver a customized solution. It's the type of service model the

truly wealthy have been relying on for years that can't be delivered by

a single provider at the same level of quality.

HSG: What makes for a great partnership between NFP and a firm?

JMB:

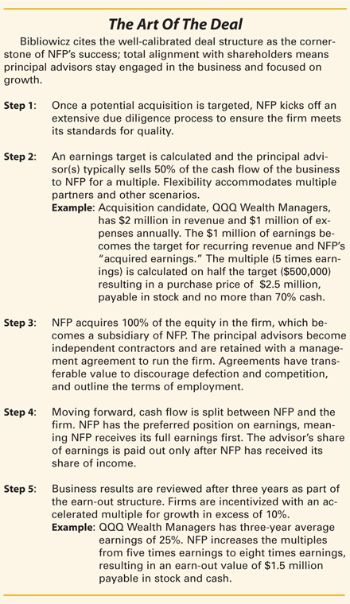

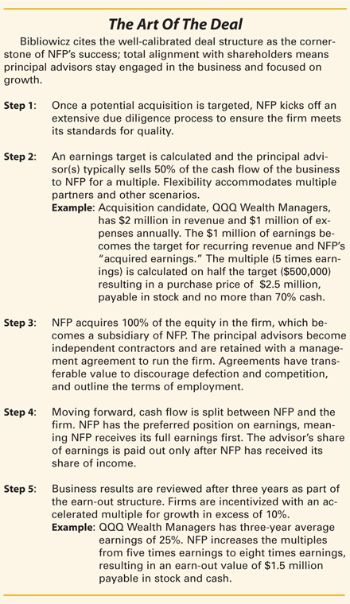

As we built NFP through acquisitions, we really learned how to do due

diligence on acquisition targets and understand, not only what we want

in a firm, but what a firm wants from NFP. There's no doubt the NFP

transaction offers a wonderful alignment from the advisor's perspective

given that they become shareholders as a result, but when an advisor

asks why the acquisition will be good for clients, I know we've

targeted the right firm. Each firm is a subsidiary of a public company,

and as part of that are required to adhere to our strict compliance and

ethics and Sarbanes-Oxley regulations, but they are also still in

control of running their individual businesses because they have proven

they can do that better than a corporate entity. The NFP structure

offers a great balance in that way.

HSG: The performance of your stock has been strong. How did the market respond to the IPO?

JMB:

We'd always planned to go public and had been working toward that goal

from the beginning, but the climate in the early 2000s wasn't great for

that type of activity. We were ready, but the markets definitely

weren't so we were delayed a few times. When we finally hit the road in

September of 2003, the timing was good. Mutual funds, which are natural

IPO investors, were seeing positive cash flows. Investors were very

engaged with the NFP story, the separation of manufacturing from

distribution, the open architecture, and the client service focus. It

wasn't a common business model and there was no comparable company in

existence, so we faced a steep education curve but, overall, NFP was

very well received.

HSG: What changed when you went public?

JMB:

Because there was more information about NFP in the marketplace for

firms to access, it became an easier story for advisors to tell their

clients.

HSG: Why has it been so successful?

JMB:

Our client orientation. We made structural decisions about the business

based on what was right for the end client from the very beginning. We

watched the big financial services businesses split themselves up into

different companies to eliminate conflicts of interest. We never had

the conflicts to begin with.

The other choice we made from the

very beginning was designing a structure that kept the advisors engaged

in running their business. The advisors ARE their business, and are

responsible for the ultimate success of their business. We never lost

the entrepreneur-to-entrepreneur connection, we just gave the firms

more to work with when serving their clients.

HSG:

What does the corporate infrastructure look like? Do you have

centralized functions like strategy, product development, marketing

that the firms can use?

JMB: The New York

office is our corporate headquarters and is where the acquisition, firm

management and corporate activities are housed, including finance,

legal, compliance and marketing. Our distribution facility is in

Austin, Texas. The tools and services that support revenue generation

and growth are based there, along with NFP Securities, Inc., which is

our wholly owned broker-dealer, the registered investment advisor, NFP

Insurance Services, Inc., which is our insurance carrier management

company, and NFP Benefits Partners, our benefits-focused membership

organization. Overall, our Austin facility is focused on helping our

firms deliver solutions to clients. We have invested in the technology

that firms can use to help streamline or grow their businesses as well.

HSG: Do firms avail themselves of the infrastructure support differently?

JMB:

Sure, much depends on the scope of a firm's internal capabilities and

how mature they are as an organization. Generally, the longer a firm is

with NFP, the more likely they are to know what services are available

to them and how to best access them.

HSG: What do you do to ease the integration process and help firms understand the scope of what's available to them?

JMB:

Understanding the resources and support available through NFP is an

important part of the acquisition process and obviously one of the most

attractive components of the NFP deal. We also have a Firm Relations

team that is involved with each firm from the very beginning. They are

there offering support and guidance during the acquisition process with

a goal of making it an easy transition, and then they stay on with the

firm to provide counsel and act as its voice internally at NFP. For the

most part, we are acquiring firms with whom we have a strong

philosophical link so the early days as part of NFP are usually more

about introducing them to other firms, starting their business plans,

and getting engaged with the resources. At the end of the day, the

firms and NFP are incented the same way, which creates an alignment

that makes the transition pretty easy.

HSG: What are the most likely hiccups a firm will encounter during the integration process?

JMB:

Well, this has changed a lot as our business has evolved over the past

nine years. In the beginning, when we acquired a firm everything stayed

the same, which made the transition to NFP very easy. Once we went

public and had to comply with Sarbanes Oxley, we implemented systems

for the accounting and financial controls for all our firms. These

requirements were much more onerous than many firms expected. But

again, it was helpful that the advisors were shareholders because they

understood that it had to get done. Now this infrastructure is firmly

in place and the ramp up into our system is addressed at the time of

acquisition.

HSG: And these days?

JMB:

Our broker-dealer, NFP Securities, has an unbelievable reputation and

has become a real advantage in the recruiting process. As part of the

acquisition process, we require firms to switch to our broker-dealer,

which can be difficult. The good news is that we do more acquisitions

than anyone so we've learned how to make the transition as smooth and

speedy as possible. And because we had to be able to handle the more

sophisticated business of our high-net-worth clients, we learned early

on that if the central processing point is good, it can ease things

considerably. We made some big investments of capital, time and talent

to get where we are today.

HSG: Approximately how long is your due diligence process?

JMB:

On our end, the whole process takes about 60 to 90 days. We verify

revenues and expenses, visit the office, perform an investigative

search on the firm, it's a very intense process. If an advisor is

nervous or skeptical, or just not ready to make the decision, it can

run much longer, sometimes years. But we stay in touch with the firms

we like and when the owner is ready, it's amazing how fast we can move.

HSG: You did 23 acquisitions in 2006?

JMB:

NFP has a full-time M&A and due diligence team, which allows us to

do as much internally as we can. Our firms are also a big source of

leads for us. They tell us who is good in the marketplace, it's great

insight for us.

HSG: How do you forecast for the street?

JMB:

We budget the amount of acquired base earnings rather than the number

of firms. And we help analysts understand how much of our revenue

growth we expect to be from acquisitions versus organic. We've been

fortunate to exceed our acquisition targets in past years.

HSG: And how do you remain opportunistic?

JMB:

We run NFP with such a clean balance sheet that we are not restricted

from acting when we encounter a great firm with acquisition potential.

It's a wonderful position to be in. It's a power that comes from years

of operating very conservatively. We also have the luxury to wait

patiently until the right opportunity comes along.

HSG: So if I talked to some of the principals, would they echo your sentiments about the benefits of be coming part of NFP?

JMB:

Yes, but you have to remember that their businesses were successful to

begin with, and continue to be successful because of what they put in

place prior to joining NFP. NFP brings its firms more products, more

services, more capital and the ability to grow faster. But at the end

of the day, the advisors themselves are the people who really

understand their marketplace, understand their clients, and are getting

the job done.

HSG: So you are acquiring successful firms, ones that want to grow?

JMB:

Yes. NFP is a public company with a commitment to its shareholders. We

must have a long-term plan that makes sense so we can continue to

deliver results. NFP is not a training ground and we don't do lift outs

from the bigger investment firms. We want to acquire firms that are in

great shape, have a good history and a good future ahead of them. Our

advisors are experienced, ambitious professionals who want access to

NFP to grow.

HSG: What's the biggest selling point to a practitioner?

JMB:

That we respect the track records of our firms and want the advisors to

stay involved, running their business they way they did right up to the

point of acquisition.

HSG:

You've mentioned some consistencies across your firms-they are

successful, seasoned, oriented toward affluent clients. Are there other

qualities they share?

JMB: Drive, all our firms

are driven to succeed. Most of our advisors work with successful

entrepreneurial businesses or in the high-net-worth space for clients

with $10 million or more in assets. Some have even higher thresholds;

say $25 to $50 million. You must have strong drive to succeed in this

space given the expectations of the more sophisticated client.

HSG: What's notable about your core business of life insurance?

JMB:

I think the DNA of somebody who sells high-end life insurance is

unique. First, it's one of the most complex financial products. You

then have to understand the client's circumstances and their charitable

inclinations. An advisor has to know the best carrier for every

situation and how to achieve the best possible pricing. An advisor also

has to be able to bring the network of attorneys and other

professionals together to make it all work. It's a comprehensive

planning process. It's a truly unique skill and unbelievably

complicated. That's why I love it and believe we have some of the best

practitioners in the field.

HSG: What about the benefits business? How does NFP present itself in that market?

JMB:

On the benefits side, NFP's primary focus is on the small- and

mid-sized markets. The larger benefits firms tend to under serve those

markets, so we are trying to reach out to them. We find that the

cross-marketing opportunities within a client company are valuable.

There is usually a small group of decision makers and retention is very

important to them, and there is often a much stronger connection

between management and the employees. These clients want expert advice,

which is great because it allows an advisor to make a real difference

for the client.

HSG: Do you offer anything for the large market?

JMB:

Many of our client companies have grown dramatically while they've been

with us and we continually evolve our offerings. We have a strong

concentration in executive benefits, and some specific niche

capabilities like nonqualified deferred compensation plans and bank

owned life insurance.

HSG: The move into asset management was more recent for you. Can you describe your capabilities?

JMB:

Most of our asset management firms are fee-based planners. They operate

as asset allocators, using outside money managers, and work across

asset classes for their clients, including alternative investments and

other strategies that meet specific wealth needs. NFP's investment

advisors and financial planners are a sophisticated group and I'd like

to acquire more of them because they are a perfect fit for our company.

Many fee-based planners are not engaged in the insurance business, but

their clients need the asset protection a good life insurance plan

offers. If an advisor can turn to another NFP firm for a life insurance

solution, it's a great outcome for everyone-especially the client.

HSG:

You place an emphasis on collaboration. Do most NFP firms maintain

their existing network of professionals? Do you require your firms to

work together?

JMB: Our advisors will always

maintain their relationships with lawyers and accountants. They're

usually long-standing and are a valuable referral source for our firms.

We don't force internal collaboration. It doesn't make sense from a

compliance standpoint and most professionals don't respond well to that

type of directive. But, assuming the capabilities are there, most of

our firms will try to keep business inside NFP. I'm more interested in

helping our advisors think about expanding their business instead of

fine-tuning what they already do well. Moving beyond life insurance

into long term care, is an example. Being additive to their business is

NFP's ultimate goal.

HSG: How do you help firms with professional development? Does NFP sponsor any forums that allow firms to interact?

JMB:

Our advisors interact on the NFP intranet, through e-mail, online

training, etc. It really is an engaged community. But at the end of

day, this is a people business and we host quite a few big educational

meetings for our advisors each year. Each of our business lines-life,

benefits, investment advisory-have their own dedicated forums, as well

as regional meetings focused on local trends and issues.

The

best ideas surface when our advisors get together. They are so clear,

so smart, ahead of the curve. They understand their businesses so well

that when they start to bounce ideas off each other, it's pretty

amazing how quickly new opportunities are uncovered. That's why I use

words like collaboration and describe NFP as 'one dynamic company'-when

getting the best for the client is the focus of everyone's efforts,

it's ideal.

HSG: Can a firm work with NFP even if they aren't ready for an acquisition scenario?

JMB:

Yes, those advisors can join NFP through our membership

organizations-PartnersFinancial, NFP Benefits Partners and The HighCap

Group. For a membership fee, these advisors have access to some of the

benefits of NFP, like competitive pricing, and access to products and

support. These organizations help us achieve our national scale and

allow us to "greenhouse" firms that are potential acquisitions.

HSG: What does the membership entail?

JMB:

One of the real attractions is the number of carriers and products we

make available, which is usually much larger and more extensive than

what an advisor can access on their own. An advisor can join our

meetings and use our educational resources. They pay for an operational

infrastructure that includes the broker-dealer and RIA platform, and

technology support. For one reason or another, these firms are too

small, too young, simply not interested in the NFP transaction, or not

ready to do the full acquisition. In any case, it's a great

introduction to what NFP offers its owned firms.

HSG: Is NFP transparent to the end client or positioned as the "solutions platform?"

JMB:

Clients are associated with firms, so the firm and its advisors are

always front and center. Their names are on the door, on the business

cards, on client proposals and presentations. They have the option to

sub-brand as an NFP Company-some do, some don't. We are seeing more

firms choosing to use the NFP sub-brand, but whatever an advisor

chooses to do, the relationship with NFP appears cohesive to the client

and suggests a broad platform of capabilities that can be harnessed

just for them.

HSG: At the end of 2006 you had over 175 firms. How does that change your roles and responsibilities as a holding company?

JMB:

At the current pace of growth we have to make sure we manage it in the

best possible way, create scalable solutions, and find the right

balance. But the biggest difference is that we can't just keep our

heads down and work quietly anymore. In the early days, we could focus

on the M&A activity. Now, NFP has such a large presence in the life

insurance space that we are obligated to get involved in the issues

that will shape the future of the business. There are more public

aspects of the business that need attention. We have to be engaged for

our clients.

HSG: Any downside to the growth?

JMB:

Well, there are the obvious challenges of dealing with all the

different personalities and perspectives. And you want to make sure

that big doesn't mean slow. We need to stay innovative, keep the great

ideas and the creative juices flowing. Most of our firms haven't been

part of a big company for a very long time, and in some cases never

have been. We have to maintain the environment that made NFP the right

fit for them in the first place, even as we grow. We have to make sure

that they are part of a big company under the best possible

circumstances, so to speak, and plan for the succession of our

advisors' businesses when the time comes.

HSG:

Your success seems to have spawned a group of people with plans to

create a similar firm of advisory firms, but no one seems to have any

real traction. Any thoughts on why?

JMB: We had

unbelievable capital from the start and were able to make some big,

smart acquisitions, so we got important scale early. Some of these

circumstances can't be replicated. But I think the profile of our firms

has a lot more to do with our success. We attract established

professionals that want to be part of something bigger. They've got a

long-term outlook and an incredible work ethic, which leads to our

results. Another key factor for NFP is our management team. We have the

best-of-the-best working across all our departments. I count myself

lucky to have attracted such talent.

HSG: So this isn't a roll-up strategy? Or an exit alternative for a maturing advisory practice?

JMB:

It's difficult to attract our caliber of talent when the short-term

goal is to acquire a handful of firms and flip the company. There's a

belief that amassing assets is enough, but assets walk. Clients buy

professionals, and you need professionals that take pride in their

discipline, pride in the name on the door and the business they built.

Look, the idea of building the next NFP is incredibly attractive

because of our success, but, having gone through it personally,

successful execution is incredibly difficult.

HSG: Can you share some of your thoughts on future growth and how you'll be positioning NFP moving forward?

JMB:

We still like the integration opportunity, so on the M&A side we're

looking for benefits firms and wholesale-type organizations. We see

those companies as growth engines for our other firms. And we'll

continue to help our firms diversify by branching out into

complementary areas that help them better meet their clients' needs.

HSG: What's the best approach to the diversification Opportunity?

JMB:

We'll pursue it from both sides simultaneously-work with the life

producers to support expansion into areas like benefits and

investments, and help the investment advisors take their business

beyond the strict scope of money management.

HSG: What do you view as one of your biggest future opportunities?

JMB:

I think the insurance business is very exciting now. There are more

financing options available, there are more exits available, wealthy

clients are looking at the risk components of their portfolios

differently and looking for ways to manage volatility. The idea of a

guarantee can be very alluring. Our advisors are true specialists, they

can add tremendous value operating in a discrete capacity and making

the pieces work together. Plus, they have the billion-dollar buying

power of NFP behind them. So, if there's a $150 million life case that

has to go out to 15 to 20 carriers-we have those relationships and that

negotiating leverage.

I also believe our willingness to

conduct "shared" business will give us a real advantage. It's not an

approach favored by a lot of financial professionals, but our firms

collaborate with each other quite a bit in order to deliver a total

solution to clients.

HSG: What will allow you and your firms to grow?

JMB:

Doing what we can to make it easier for our firms to operate and, more

importantly, grow. Our advisors have a true understanding of what their

wealthy clients need and it's our job at NFP to create the right mix of

product and support to ensure that, in the end, the client receives the

best service available in the marketplace.