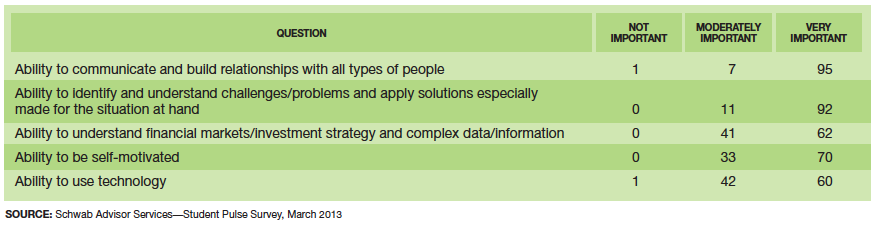

In a recent poll of more than 100 students in the personal financial planning program at Texas Tech University, the respondents overwhelmingly said that the so-called “soft” skills of financial services—building relationships and problem solving—were “very important” to them, while a much smaller majority felt the same about “hard” skills such as understanding financial markets and technology.

The questions and replies in the accompanying chart speak to the changing nature of the advisory business. Back in the day, most advisors cut their teeth in a commission-based world. These days, aspirants to the financial planning profession generally abhor the commission model and are attracted to the relationship side of the business. That’s fine, but shouldn’t they have a keener interest in the markets and in the technology needed to run a successful financial services company?

Laurie Belew, a senior financial advisor at Fox, Joss & Yankee LLC in Reston, Va., says the poll findings are in line with her firm’s expectations for new hires. The firm actively promotes new talent by using internship programs and hiring graduates of college financial planning programs (including Texas Tech’s). She says the graduates of those programs receive a sufficient foundation in financial markets, asset allocation and planning software.

“Where we differentiate students when looking to hire them is on their ability to develop relationships with clients and to think outside the box and to think analytically,” Belew says. “We look for those softer skills.”

The survey was conducted by Schwab Advisor Services.

Financial Planning Students Favor "Soft" Skills

April 4, 2013

« Previous Article

| Next Article »

Login in order to post a comment