The financials sector is the second-largest in the S&P 500® Index and a key part of the American economy. It has also been under attack by politicians and unloved by investors since the financial crisis, resulting in some very volatile performance. We have been both criticized and praised for our outperform view, depending on when investors were looking. So, following the dismal May jobs report and a sharp decline in Federal Reserve rate-hike expectations, the question is: Does the financials sector represent source of danger or opportunity for investors?

Both.

As always, investments have both risks and potential benefits, but while the danger signs are blinking slightly brighter for the financials sector, we continue to see more potential opportunities and are sticking with our outperform rating—for now.

The financials sector tumbled around the start of the year because of recession concerns. It then rebounded nicely and outperformed from mid-February through May as those concerns faded and expectations of a rate hike rose. Then came the disappointing May jobs report.

The Department of Labor said the U.S. economy added just 38,000 jobs that month, leading the market to slash its expectations for a Fed hike. That hit the financials sector in turn. However, we believe the retreat is overdone at this point. As we’ve said before, investors should avoid putting too much importance on any single piece of economic data, especially one that is typically a lagging indicator like the jobs report.

Broadening the scope to include other sources of data reveals a slightly different story, one of a tightening job market, increasing wages, strengthening housing and solid retail sales. To us, this doesn’t look like an imminent recession, and the possibility of a Fed hike in the near future remains on the table. That bodes well for the financials sector.

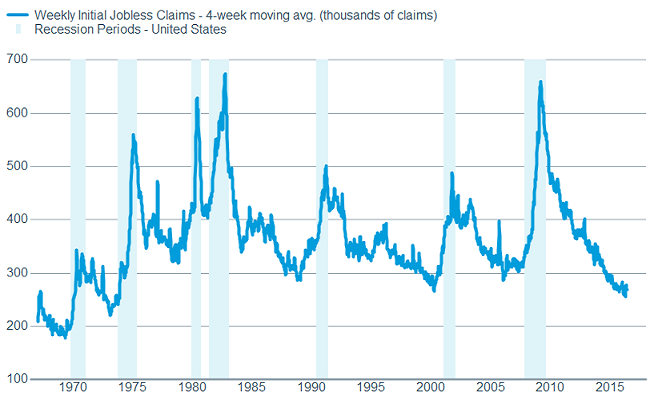

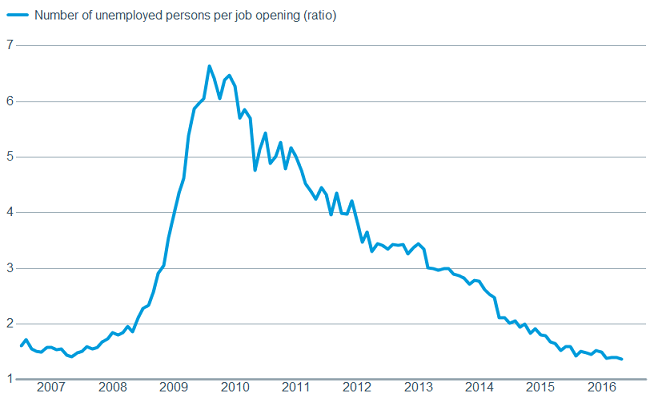

And the jobs number didn’t tell the whole story. Jobless claims, a leading indicator, continue to run near historically low levels and show no signs of a softening job market. Meanwhile, the recent JOLTS (Job Openings and Labor Turnover Survey) showed the number of job openings matched the record high seen in July of last year, and the number of unemployed per job opening dropped to its lowest level since May 2001. And briefly, there’s been much talk of the U-6 unemployment number being a more accurate measure of the labor force because it includes such things as part-time workers who would like to be working full time and marginally attached workers—meaning those who aren’t actively looking, but could be enticed to take a job. The number of U-6 unemployed per job opening is at its lowest since March 2007.

The forward-looking job report indicates strength

Source: FactSet, U.S. Dept. of Labor. As of June 22, 2016.

As does the JOLTS report

Source: FactSet, U.S. Bureau of Labor Statistics. As of June 22, 2016.

The strong jobs market, combined with another solid retail sales number for May, leads us to believe the U.S. economy is improving and will allow the Fed, which has indicated its desire to get to a more “normal” level of interest rates, to hike rates sooner than the market expects.

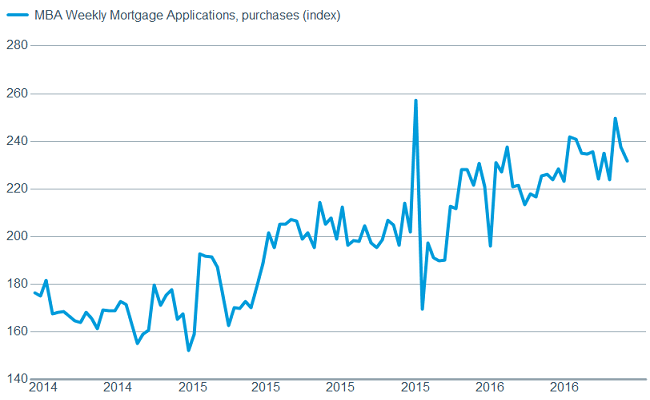

Additionally, the housing market has improved and mortgage demand has been strong, which should help banks to increase their revenue.

A solid housing market should help financials

Source: FactSet, Mortgage Bankers Association. As of June 22, 2016.

Also, banks appear to have plenty of dry powder should demand for loans start to increase. The Federal Reserve and Ned Davis Research found excess reserves stood at a whopping $2.3 trillion as of June 3, up from about $900 billion in 2010 and virtually zero before the financial crisis. And while having a cushion of excess capital can be desirable at times, it can also restrict potential economy-enhancing investments.

It also hints at the heavy regulatory burden placed on the financials sector over the past several years. But there are some glimmers of hope here as well. Despite the heated political rhetoric being leveled against the financials sector, there does seem to be an increasing realization that the regulations may have gone too far and had unintended consequences. While there is virtually no chance of regulations being rolled back in this election year, it seems the flow of new rules may at least slow. And though it will go nowhere this year, the financials sector got a boost when the Chairman of the House Financial Services Committee announced a proposal to overturn much of the massive and onerous Dodd-Frank law.

There are certainly dangers to the financials sector that shouldn’t be ignored. Negative interest rates in much of the world are pushing money into the U.S. Treasury market and appear to be flattening the yield curve, which could pressure margins in the financials sector and make it more difficult for the Fed to raise interest rates. Additionally, depending on how the upcoming U.S. election turns out, the regulatory environment could get worse next year for the financials sector. But for now, in an environment where it’s difficult to find investments that seem like a good value, we think the potential opportunities outweigh the dangers. We also acknowledge that the May jobs report, reduction in rate-hike expectations and flatter yield curve have raised the level of concern and threaten our outperform rating.