In three years of managing investments for North Dakota farmer Richard Haus, Long Island stock broker Mike McMahon and his colleagues charged their client $267,567 in fees and interest - while losing him $261,441 on the trades, Haus said.

McMahon and others at National Securities Corporation, for instance, bought or sold between 200 and 900 shares of Apple stock for Haus nine times in about a year - racking up $27,000 in fees, according to a 2015 complaint Haus filed with the Financial Industry Regulatory Authority (FINRA).

Haus alerted the regulator to what he called improper “churning” of his account to harvest excessive fees. But the allegation could hardly have come as a surprise to FINRA, the industry’s self-regulating body, which is charged by Congress with protecting investors from unscrupulous brokers.

FINRA has fined National at least 25 times since 2000. As of earlier this year, 35 percent of National’s 714 brokers had a history of regulatory run-ins, legal disputes or personal financial difficulties that FINRA requires brokers to disclose to investors, according to a Reuters analysis of FINRA data.

McMahon did not respond to requests for comment. National declined to comment.

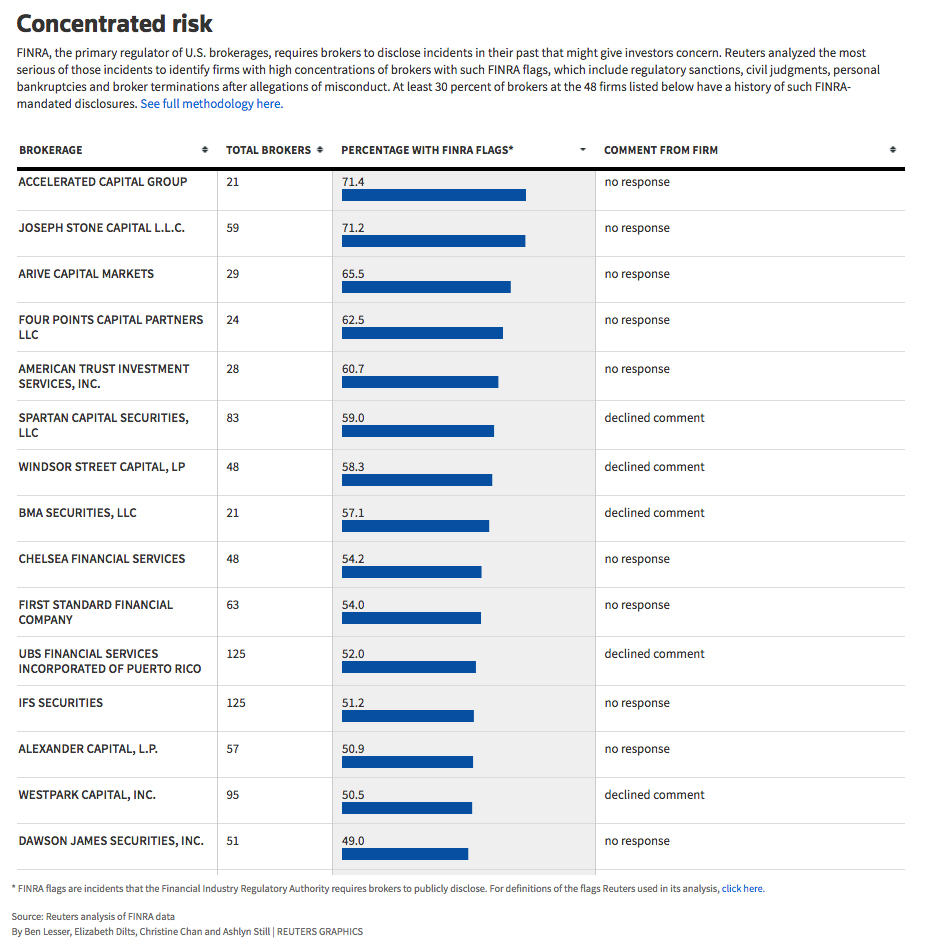

National is among 48 firms where at least 30 percent of brokers have such FINRA flags on their records, according to the Reuters analysis, which examined only the 12 most serious incidents among the 23 that FINRA requires brokers to disclose. That compares to 9 percent of brokers industry-wide who have at least one of those 12 FINRA flags on their record.

In total, the 48 firms oversee about 4,600 brokers and billions of dollars in investor funds. For a graphic with the complete list of firms and statistics on each, see here.

FINRA officials acknowledged in interviews with Reuters that the longstanding hiring practices at certain firms are a threat to investors. But they also argued that they can do little to stop firms from hiring high concentrations of potentially problematic brokers because doing so is not illegal.

That leaves investors like Haus vulnerable to a small group of brokerages that regularly hire advisors with blemishes on their backgrounds that would make them unemployable at most firms, former regulators and industry experts said.

The dozen FINRA flags examined by Reuters include regulatory sanctions for misconduct, employment terminations after allegations of misconduct and payments by firms to settle customer complaints. They also include brokers’ personal financial troubles, such as bankruptcies or liens for nonpayment of debts.