During the 30-year secular bull market for fixed income, advisors could construct a portfolio heavily weighted toward bonds and rest assured that the combined benefits of low risk, minimal volatility and a steady income stream would meet a client’s long-term retirement needs. In that falling-rate environment, bonds also enjoyed the added benefit of price appreciation. But in May, when interest rates began to rise—after years of anticipation--advisors knew they needed to revise their allocation formulas in short order.

The challenge for advisors now is to find a way to diversify their clients’ interest rate exposure without severely disrupting the portfolio’s income stream and risk/reward profile. Among the issues that advisors must confront is the fact that with interest rates at historic lows, bond yields no longer provide enough steady income. U.S. Treasury bond yields have fallen so precipitously that we believe they cannot even deliver returns that are expected to keep pace with inflation, let alone provide additional income.

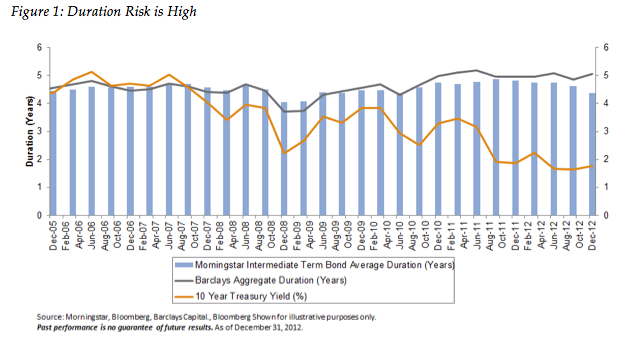

On top of that, as interest rates rise, investors carrying long- and intermediate-duration bonds are seeing the market value of those instruments drop. We are of the opinion that advisors need to take this maturity risk into account as they readjust the fixed-income portions of client portfolios to match current conditions.

Unfortunately, there is no “magic bullet” that is going to solve this interest rate exposure problem for advisors. But finding the right combination of asset classes and investment strategies could potentially meet specific client goals in ways that a portfolio of stocks and bonds alone cannot. There are a number of tools to consider, including high-yield bonds; floating-rate bank loans; emerging-market debt; dividend-paying equities, including REITs and MLPs; and alternative-bond and hedging strategies. We’ll look at each of these in turn.

High-Yield Bonds

High-yield bonds offer better returns than investment-grade corporate or government bonds, usually in the range of 150 to 300 basis points more at any given time. The caveat is that with the potential for greater returns comes more equity-like volatility. The current yield on the Barclays U.S. High Yield Index is 7.34 percent as of August 26, 2013, according to Bloomberg, but the downside is that high-yield credit is closely correlated to the relatively risky equity market. High-yield bonds can also provide an added benefit of capital appreciation for investors when a company’s performance improves enough to warrant a ratings upgrade or the overall economy performs well.

Floating-Rate Loans

If the main concern with longer maturity issues is staying out of the way of a yield curve shift when interest rates rise, then a convincing case can be made for adding floating-rate loans to a portfolio. These variable-rate bank loans charge interest based on LIBOR and reset every 60-90 days, which substantially reduces interest rate risk. Although the bank loan category qualifies as below investment-grade, there is actually less risk than may seem apparent because these loans are highly collateralized. The default rate on floating rate loans, according to S&P Capital IQ, is currently less than 2 percent; and if they do default, these are the most senior securities in the capital structure. Volatility in this sector has mostly been low. The current yield of the Barclays High Yield Loan Index is 4.81 percent as of August 26, 2013, according to Bloomberg.

Emerging-Market Debt

Emerging -market debt has become another compelling option for advisors looking for higher yields. Although historically this category has been considered a high credit risk, today many emerging market sovereign bonds may actually be much more attractive than those from developed markets, if for no other reason than that the emerging nations have cleaner balance sheets. Several European governments, for example, are hobbled by austerity measures and massive levels of debt. Advisors do need to remain cognizant of the specific country and currency risk associated with this sector, however, which is why buying a basket of emerging market debt is likely to be a better solution than purchasing debt from a single country.

Dividend-Paying Stocks

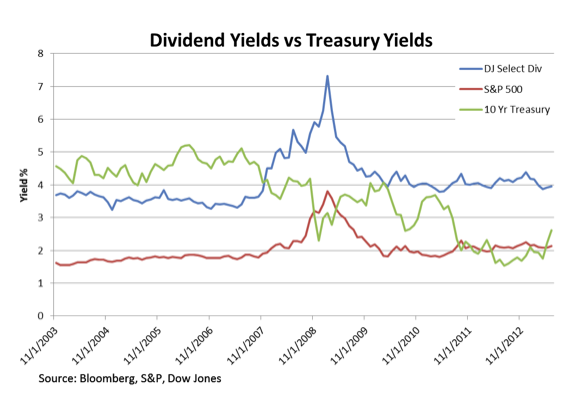

Over the last decade, dividend-paying stocks, in which category we include REITs and MLPs, have consistently outperformed the S&P 500, and over the last five and a half years the category dramatically outpaced the yield on 10-Yr. U.S. Treasuries. Today, many stocks offer higher dividend yields than bonds, which can help advisors increase their clients’ cash flow and upside potential while simultaneously lowering interest rate risk. The downside of high dividend stocks is their higher volatility. They are equities, after all.

Figure 2: The State Of Dividends

Unconstrained Bond Funds

These funds have become extremely popular during their relatively short existence, in large degree due to the number of tools available to their managers, such as the ability to go short. Unconstrained bond funds are not tied to any particular benchmark. These are go-anywhere portfolios that involve closely timed buying and selling strategies, and represent an area where the skill of an active manager can really come into play. They provide opportunity for realizing alpha, but also increase the due diligence requirements. These strategies can be extremely complex and most investors can truly benefit from professional guidance. Most funds have very short track records and investing in them requires significant confidence in the manager. These funds offer the promise of low, fixed income-like volatility while having lower correlations to traditional fixed-income products. The shorter durations when compared to core bond funds can also help reduce interest rate risk, an added benefit in a rising rate environment.

As stated earlier, there is no perfect replacement for fixed income in every portfolio. By tactically diversifying fixed-income positions and including one or more non-traditional strategies, investors can continue to benefit from the core functions of bonds while buffering interest rate risk.

Of course, each client is an individual. Scenario analysis using historical and Monte Carlo simulations can help advisors better define the potential outcome of a given diversification strategy in different environments. As with any portfolio construction, bond diversification strategies should be implemented with caution and proper diligence. This is an area where advisors can truly demonstrate the value of a well-thought-out financial plan and professional advice.

Tim Clift is chief investment strategist at Envestnet | PMC and is responsible for the development of investment strategies for client portfolios as well as the development of manager and fund strategist selection methods.

This material contains the current opinions of the author but not necessarily those of Envestnet | PMC and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. For investment professionals only. It is not intended for private investors.