During the 30-year secular bull market for fixed income, advisors could construct a portfolio heavily weighted toward bonds and rest assured that the combined benefits of low risk, minimal volatility and a steady income stream would meet a client’s long-term retirement needs. In that falling-rate environment, bonds also enjoyed the added benefit of price appreciation. But in May, when interest rates began to rise—after years of anticipation--advisors knew they needed to revise their allocation formulas in short order.

The challenge for advisors now is to find a way to diversify their clients’ interest rate exposure without severely disrupting the portfolio’s income stream and risk/reward profile. Among the issues that advisors must confront is the fact that with interest rates at historic lows, bond yields no longer provide enough steady income. U.S. Treasury bond yields have fallen so precipitously that we believe they cannot even deliver returns that are expected to keep pace with inflation, let alone provide additional income.

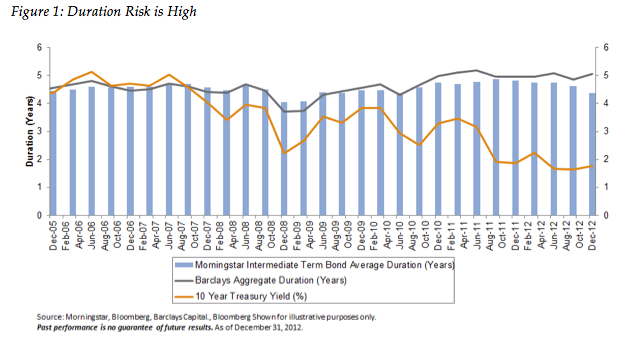

On top of that, as interest rates rise, investors carrying long- and intermediate-duration bonds are seeing the market value of those instruments drop. We are of the opinion that advisors need to take this maturity risk into account as they readjust the fixed-income portions of client portfolios to match current conditions.

Unfortunately, there is no “magic bullet” that is going to solve this interest rate exposure problem for advisors. But finding the right combination of asset classes and investment strategies could potentially meet specific client goals in ways that a portfolio of stocks and bonds alone cannot. There are a number of tools to consider, including high-yield bonds; floating-rate bank loans; emerging-market debt; dividend-paying equities, including REITs and MLPs; and alternative-bond and hedging strategies. We’ll look at each of these in turn.

High-Yield Bonds

High-yield bonds offer better returns than investment-grade corporate or government bonds, usually in the range of 150 to 300 basis points more at any given time. The caveat is that with the potential for greater returns comes more equity-like volatility. The current yield on the Barclays U.S. High Yield Index is 7.34 percent as of August 26, 2013, according to Bloomberg, but the downside is that high-yield credit is closely correlated to the relatively risky equity market. High-yield bonds can also provide an added benefit of capital appreciation for investors when a company’s performance improves enough to warrant a ratings upgrade or the overall economy performs well.

Five Bond Diversification Strategies

September 6, 2013

« Previous Article

| Next Article »

Login in order to post a comment