Stock Valuations: On Watch

Stock market valuation is a poor market-timing indicator. There is no statistical relationship between what investors are willing to pay today for earnings over the past year, as measured by the price-to-earnings ratio (PE), and how stocks perform over the following year. However, the PE is a good indicator of long-term stock returns and can help tell us when the market has become fully valued and may be more vulnerable to deterioration in the economic cycle, which is why we have included it as one of our Five Forecasters. A higher PE implies a more optimistic earnings outlook, which introduces more risk of disappointment if that growth outlook does not materialize.

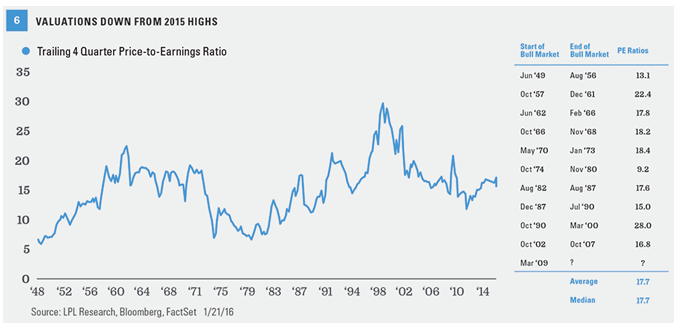

The stock market’s recent decline has brought the S&P 500 trailing price-to-earnings ratio (PE) down to 16. But the 2015 highs near 18, reached in May and sustained through much of the summer, were in the range where stocks have traded historically when bull markets have ended [Figure 6]. The good news is we are now below the post-1980 average of 16.4, and nowhere even remotely close to the record highs at the peak of the internet bubble in 2000, providing some potential for PE expansion should the growth outlook improve from here. But we are still above the longer-term average of 15.3 going back to 1950. At this point we would characterize valuations as flashing a warning signal because of the PE levels reached in 2015, and, assuming no recession or bear market in 2016, would look for a return to the previous range before this signal becomes more worrisome.

Conclusion

The Five Forecasters continue to signal economic growth and the continuation of the bull market, not a recession or bear market. The yield curve and Index of Leading Economic Indicators are sending clear positive signals. Meanwhile, the signals from the indicators that have flashed some warning signs, i.e., stock valuations, the ISM Manufacturing Index, and market breadth, are more mixed and consistent with a mid-cycle correction rather than recession. So although volatility may remain high, we expect the latest stock market correction may stop short of a bear market. We continue to watch these and other indicators to inform our tactical asset allocation views.

Burt White is chief investment officer for LPL Financial.