For most advisors, enhancing existing client relationships is the highest priority. Developing new client relationships is the second. Interestingly, the best way to achieve the second is to excel at the first. Below are five simple things to do in 2014 to help deepen your existing client relationships.

1. Move the conversation. For the majority of clients, there is more to the relationship than performance. Having a personal relationship – not just a business relationship – is valuable. Moving the conversation toward helping clients achieve their financial goals strengthens the relationship.

This year, as you meet with clients, add both short-term financial goals and long-term financial goals to your agenda. In my experience, it is normal for advisors to talk with clients about their long-term financial goals, but too few advisors speak with clients about their annual financial goals.

I ask clients, particularly younger clients, if they have written financial goals for the year. Having goals is important, and writing them down is helpful. Studies show that written goals are more likely to be achieved than non-written goals. Also, sharing your goal with someone else further increases the chance of attainment. So encouraging your clients to share their goals with you helps them achieve their goals.

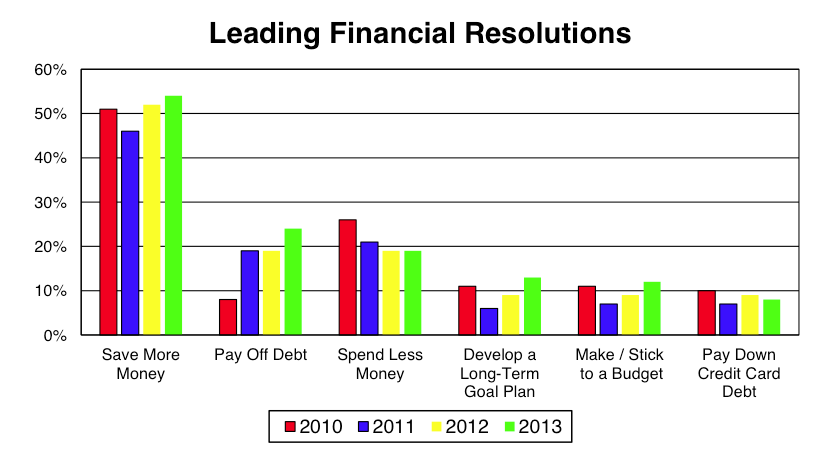

Two of the more common annual financial goals people make are to save more and spend less (see graph). There is another way you can directly help them achieve these goals – by providing a friendly reminder at the most opportune time.

2. Keep it simple. We routinely remind workers of the two easiest and least painful ways to increase savings and reduce debt. We tell workers to:

- Save the raise, and

- Bank the bonus.

More specifically, we encourage people to save half of every raise and bonus. This is painless because it increases their savings without reducing their current standard of living. Because they have not yet seen the extra income, they should not miss the extra income. This is most beneficial earlier in one’s career. For example, let’s assume that Mary, a recent business communications graduate in a sales role, has a starting salary of $50,000 a year and is not currently saving. If she started by saving half of her next raise, by the time she doubled her salary (to $100,000), she would be saving 25% (or $25,000 a year).

A few of the questions we ask working clients are:

- Does your company make annual pay raises? If so, when?

- How frequently does the company pay a bonus? Annually, quarterly?

- Are you in line for a promotion? When might you envision this?

3. Maximize timing. For many workers, there are a few times each year that present the optimal opportunity to save more or reduce debt. Find out these key dates. At Acropolis, we like to schedule a meeting with the client a couple of weeks before the event and have a discussion about how much of it will go to savings. It is a friendly reminder, and clients appreciate it.

As a side note, we also keep an eye out for other one-off events that may happen through the year, such as, a large tax refund, an inheritance, the sale of a piece of property, etc.

4. Shift shorter. Some clients have long-term financial goals and lack shorter-term year-to-year goals. Short-term goals increase the likelihood of attaining long-term goals. When we meet with someone who has no short-term goals, we help them think through where they may want to start. A sample of some of the goals we recommend include:

- Saving for retirement

- Paying off debt

- Spending less money

- Calculating their net worth

- Making (or sticking to) a budget

- Building an emergency fund

- Having a frank financial discussion with their children

- Diversifying their investments

- Minimizing investment costs

- Consolidating debt

- Checking insurance coverage

- Updating estate planning documents

We help clients with all of these. For example, we have clients bring their children in to get some basic personal finance education.

5. Be SMART. Management gurus talk about goals being SMART (Specific, Measurable, Assignable, Realistic and Time-bound.) Making goals specific and measureable help to make them achievable.

Remember to keep it simple. It is better to have one goal that the client accomplishes than to have three that they do not.

We want to empower clients to be financially responsible. We have found that this enhances the client relationship and provides us something tangible besides performance to talk about with clients. We have also found that this often gives the client something they can talk about at cocktail parties. For example, how Acropolis is helping their children get the personal finance education that they did not get in school.

Michael Lissner is a partner with Acropolis Investment Management LLC, a St. Louis-based, fee-only wealth management firm, serving individual investors and 401(k) plan sponsors. Acropolis specializes in retirement planning and currently has over $1 billion in AUM. For more information, visit www.acrinv.com.