For investors of a broadly diversified fixed-income portfolio, bank loans continue to offer meaningful yield opportunities, particularly in the current low interest rate environment. The asset class can also potentially provide investors with a short-duration advantage and protection from rising interest rates due to their floating rate feature.

Since the peak of the financial crisis, the bank-loan market has benefited from substantial capital appreciation. While capital appreciation opportunities may be less compelling following a strong price recovery, fundamental improvements have returned the bank loan asset class to a source of stable income generation. Stronger corporate fundamentals, a precipitous decline in the default rate, improving market liquidity, and better loan structures have facilitated attractive opportunities.

Stronger Corporate Fundamentals

Bank

loans, also referred to as leveraged loans, tend to be issued by companies

rated below investment grade, which have more debt on their balance sheets. While

bank loans have a higher risk of default and are more volatile than investment-grade

bonds, corporate earnings results have benefited from modest economic growth, rational capital expenditure and hiring.

Structural balance sheet improvements have been implemented as earnings have improved. Debt ratios have declined, interest coverage has risen, and cash flows have strengthened. Additionally, first quarter 2011 earnings season has shown not only further improvements to credit fundamentals, but also to top-line growth of the companies.

Decline In Default Rate

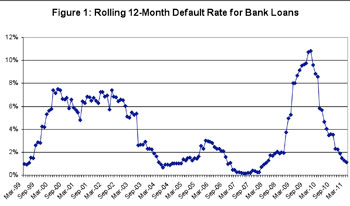

An

important indicator of the improvement in corporate health is the decline in the

default rate since the end of 2009. According to the S&P/LSTA Leveraged

Loan Index, the annualized default rate among loan issuers decreased to 1.11%

of the par amount outstanding in March 2011 from a peak level of 10.81% in

November 2009 (see figure 1).

In 2010, 20 leveraged loan issuers defaulted on a total of $9.4 billion of institutional loans within the S&P index versus 64 issuers that defaulted on over $60 billion during 2009, according to Standard & Poor's LCD. We expect the default rate to remain low in 2011.

The sharp improvement in the default rate is, in part, attributable to many of the weakest companies filing for bankruptcy. These companies have strengthened their balance sheets and reemerged stronger, resulting in a healthier average rate for the remaining issuers.

Issuers have been able to refinance existing debt, buying some time to repair their balance sheets and benefit from any economic improvements. For issuers that do default, recovery rates are above average. First-lien loan recovery rates averaged 71.2% in 2010 versus Moody's long-term average of 65.8%, according to J.P. Morgan's High Yield Default Monitor (April 1, 2011).

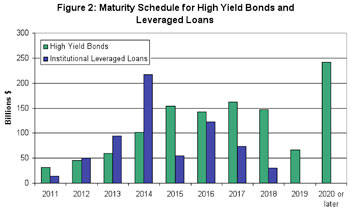

Going forward, a key concern for investors is the impending maturity wall: $312 billion of institutional leveraged loans are set to mature in 2013 and 2014, a figure representing 48% of all outstanding loans (see Figure 2).

But progress is being made. Bond-for-loan takeouts and amend-to-extend maturity initiatives, both of which enable issuers to extend near-term maturities and alleviate covenant restrictions, are being implemented and are helping to reduce the probability of default. In addition over the first quarter 2011, basic loan repayments accounted for the majority of reductions to the maturity wall, an indication that companies are addressing the situation outright.

Improving Market Liquidity

New

issuance activity in 2010 totaled $154.5 billion, easily surpassing 2009's

full-year volume of $38.3 billion. Rising supply is being met by

robust demand. Volumes for the first quarter continued at an elevated level

with $99.8 coming to the market. Demand has also remained strong this year with

a total of $13.8 inflows into bank loan funds reported, compared to 2010 inflows

of more than $12.3 billion and 2009's total of $3.4 billion, according to J.P. Morgan's High Yield Market Monitor (April 1, 2011).

Investors' search for yield has contributed to an active high yield bond market, with new supply easily absorbed. This demand has enabled high yield issuers to lower coupons. As a result, valuations of bank loans have become more compelling versus BB rated high yield bonds.

In a sign of a recovering market, there is also an increasing trend toward new issue activity originating from more traditional capital-raising activities. The main source of these activities has been merger and acquisition activity, which picked up in 2010 and has remained high. Although year-to-date, the majority of proceeds, by far, have been used to refinance existing debt, another positive for the fundamentals of the asset class.

Investors continue to benefit from the senior secured risk status of the loans. Issuing companies often are required to comply with maintenance covenants each quarter, which may include meeting certain financial ratios such as limits to dividends. Such measures allow investors some downside protection. While there has been a revival in the primary market, investors are insisting on a better set of covenants than in the pre-crisis years.

Another positive for bank loan investors is that many new issues offer a London interbank offered rate (Libor) floor. A Libor floor creates a lower limit on the floating rate coupon loans pay to investors, thereby providing better current income than comparable loans without Libor floors.

Protection From Rising Interest Rates

A

key difference between fixed-rate high-yield bonds and bank loans is the

floating interest rate structure of bank loan coupons, typically based on

three-month Libor. While an increase in interest rates can cause the price of a

fixed debt security to fall, the floating rate feature of bank loans means that

the coupon resets, typically every three months. This creates a low duration

profile and helps protect investors in the event of rising interest rates.

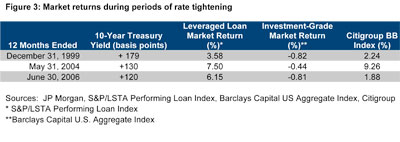

In previous Federal Reserve tightening cycles (June 1, 1999 to May 31, 2000 and June 1, 2004 to June 30, 2006), the leveraged loan asset class outperformed the U.S. Treasury, U.S. corporate investment-grade, and U.S. aggregate indices. During periods when the 10-year U.S. Treasury yield increased more than 100 basis points, leveraged loans outperformed the investment-grade corporate bond market and kept pace (if not outperformed) the high yield market (see Figure 3).

Bank loans may also be viewed as a more cautious way of getting high-yield exposure. They typically are secured by a lien against the borrower's assets as opposed to bonds, which are frequently unsecured obligations.

Justin Gerbereux and Paul Massaro are portfolio managers of the T. Rowe Price Institutional Floating Rate Funds.