Emerging markets (EM) tantalize investors with the prospects of higher returns; yet the key to these returns may be the value of the U.S. dollar. Currency movements impact all aspects of international investing, starting with the basic impact of adjusting gains for the change in currency value when determining total returns. However, changes in currency also impact areas like corporate earnings, the ability to repay debts, and the overall economic health of the country. These impacts are greater for EM investments, where currencies are more volatile and countries are more economically dependent on trade.

The value of EM currencies has depreciated significantly since mid-2011 for many reasons, including a reduction in capital flows into these countries. In turn, this has significantly reduced the return on EM investments to U.S. investors. The trend of EM currency devaluation appears to be turning; if the reversal continues, and if capital flows into EM countries resume, both debt and equity investments in these regions may be very attractive.

Following the money

Emerging market countries tend to be very dependent on capital flows to finance trade and budget deficits and to bolster investment. Money flows into EM countries for a number of reasons. Multinational companies, which set up manufacturing facilities to take advantage of cheaper labor and better access to EM consumers, are one source of investment. Investors focused on long-term growth purchase shares of companies to diversify their portfolios and seek another source of gains. Shorter-term investors often engage in the “carry trade,” borrowing money in low-yielding currencies—like the Japanese yen and U.S. dollar—to buy higher-yielding, but riskier fixed income assets from EM countries.

Capital flows into and out of EM countries are important for several reasons. Unlike richer countries, most EM countries don’t generally have enough internal savings to finance their growth (China is the major exception). Without external financing, they may not be able to build out infrastructure basic needs like transportation or power generation. More developed countries may need to import capital to build factories to produce goods necessary for both domestic consumption and exports. Yet, if a country has capital inflows too fast, it can result in an unwanted appreciation of its currency, making its exports more expensive than competitors. Like Goldilocks, EM countries need capital flows to be just right. Over time, the relationship between capital flows and currency can be tenuous; many factors influence currency. Yet, despite the conventional wisdom that “correlation does not prove causation,” we cannot help but remark that the current outflow from EM countries came just as their currencies were collectively declining.

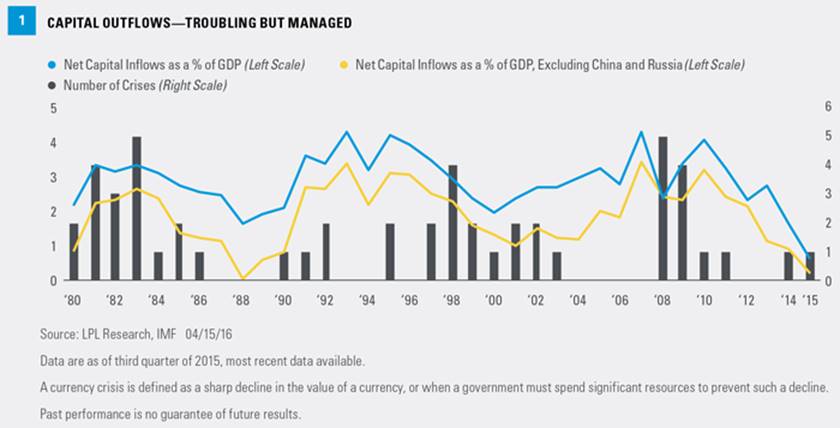

Since 2010, flows into EM countries have declined, recently turning negative [Figure 1]. Capital flows relative to gross domestic product (GDP) is the best way to measure this, as an outlier in a larger economy could otherwise distort the data. The International Monetary Fund (IMF) also examined the same data, separating out Russia (because of the sanctions imposed on it in 2014) and China (due to its large size and rapid growth), but there is very little difference between these two and the remaining countries.

Another important consideration is that capital outflows are often connected with a currency crisis. A currency crisis is defined as a sharp decline in the value of a currency, or when a government must spend significant resources to prevent such a decline. The most recent outflow from EM has not coincided with a currency crisis (or other financial crisis).

The inherent instability in EM is one reason investors limit their allocation to the asset class, regardless of how attractive the fundamentals may be. Like so many aspects of international economics, the relationship between cause and effect is often circular. Many economists suggest that the reason EM countries have been able to withstand sharp changes to capital flows is because their currencies are able to adjust to current conditions. Prior to the EM crisis of the late 1990s and early 2000s, many EM countries had currencies that were pegged to the U.S. dollar. Today, very few countries do. Even China has abandoned its dollar peg for a more globally diverse basket of currencies.

The currency tells the story

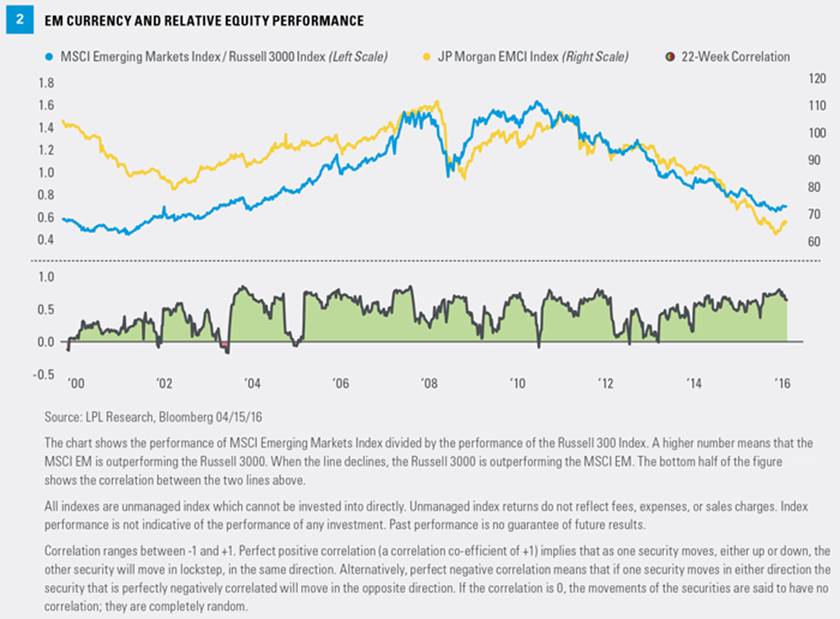

If a picture is worth a thousand words, Figure 2 is a novel. The top half of the chart shows the performance of the JP Morgan Emerging Market Currency Index, and also the performance of the MSCI Emerging Markets Index relative to the Russell 3000 Index. They rise and fall together fairly consistently. The bottom piece of the chart shows the rolling correlation between the two, which, on average, is 0.44—a noteworthy correlation. A closer look at the bottom half of Figure 2 reveals additional insights into the relationship of the data. Notice that the pattern is somewhat saw-toothed, with periods of high correlation, over 0.7, and periods where the correlation is nonexistent, near 0. However, the relationship is almost never negative, and when it is negative, it is only modestly so for a brief period of time. This suggests that while EM equities may not always outperform when their currencies are strong, historically it is rare that they outperform when their currencies are declining.

What caused the multiyear decline in EM currencies, and what may be causing their recent rebound? This is a complex problem, but there are some points of agreement. It is hard to ignore the impact of reduced capital flows into, and eventual capital flows out of, EM countries generally. Many EM countries are experiencing an economic slowdown, making their currencies less attractive and less in demand around the world. This may be especially true for commodity-oriented countries that have been hurt by the price decline in their primary source of trade. Fear of instability across EM countries is another contributing factor to currency declines.

By definition, currencies are priced on a relative basis, usually against the U.S. dollar. Recently, the dollar has been strong against all currencies, in both developed and emerging markets. Support for the dollar has come from many sources, including the belief that the Federal Reserve (Fed) would begin to raise interest rates in 2015 and that there would be as many as four rate hikes in 2016. As the Fed delayed the start of its rate hike campaign until December 2015, and as predictions for the number of further increases has declined, the dollar has reversed course against most EM currencies. Figure 2 suggests that should the recent trend of EM currency strength continue, it could last for an extended period.

What’s the play: EM stocks or bonds?

Investors looking for a rebound in EM currencies may reasonably ask, should we use stocks or bonds as the vehicle? For reasons we stated in last week’s Weekly Market Commentary, “Emerging Market Earnings: Is the Tide Turning?” EM equities appear reasonably valued, and even cheap relative to developed market equities, provided earnings come in close to expectations. Stronger currencies relative to the dollar are generally not considered a positive for earnings. However, EM companies operate around the world, and increasingly with each other; strength against the dollar should only be one consideration.

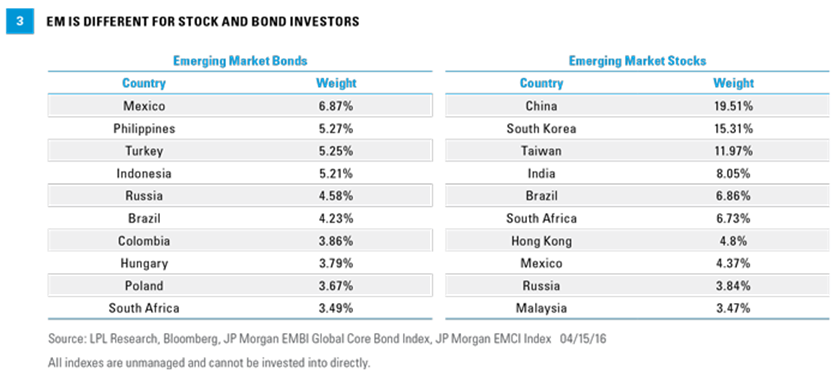

The term “emerging markets” is repeated often, but it means different things depending on context. EM equities are issued by companies, many of which were state owned and then privatized. Most EM debt issues, on the other hand, are sovereign debt, meaning the bonds are issued by the government. Therefore, the universe of available stocks and bonds are very different from each other in terms of country of issue, which impacts the degree of currency, liquidity, and other risks. Just because both are labeled as “emerging markets” does not mean they are the same asset class. Figure 3 shows the top 10 countries in both the primary EM debt and EM equity indexes.

Conclusion

Though many factors impact investor returns on EM investments, capital flows and, by extension, currency movements are two important elements in the performance of these asset classes. There are early signs of strength for EM currencies, and therefore, in EM stock and bond markets, though the composition of these markets is very different from each other. By their nature, these markets have a higher risk profile, but have the potential to positively impact portfolios should the most recent trends continue.

John Canally is chief economic strategist for LPL Financial.