As the fourth of eight Federal Open Market Committee (FOMC) meetings of 2016 approaches later this week, the market and the Federal Reserve (Fed) again remain deeply divided over the timing and pace of Fed rate hikes. The FOMC’s latest forecast (March 2016) puts the fed funds rate at 0.875% by the end of 2016. As of June 13, 2016, the market (according to fed funds futures) puts the fed funds rate at around 0.50% by the end of 2016 [Figure 1], not fully pricing in even one 25 basis point (0.25%) rate hike this year. How that gap closes—between what the market thinks the Fed will do and what the Fed is implying it will do—against the backdrop of what the Fed actually does will continue to be a key source of distraction for markets in 2016. Our view is that by the end of 2016, the fed funds rate will be pushed into the 0.75–1.0% range, from 0.375% currently.

WHAT IS THE SCHEDULE OF EVENTS FOR THE FED THIS WEEK?

The FOMC meeting this Tuesday and Wednesday, June 14–15, will be followed by an FOMC statement at 2:00 p.m. ET on Wednesday, June 15, along with the FOMC’s latest economic forecasts for gross domestic product (GDP), the unemployment rate, inflation, and fed funds projections for year-end 2016, 2017, 2018, and beyond (aka the “dot plots”). Following the release, at 2:30 p.m. ET, Fed Chair Janet Yellen will hold her second post-FOMC press conference of 2016.

HAS THE MARKET PRICED IN A RATE HIKE AT THIS WEEK’S MEETING?

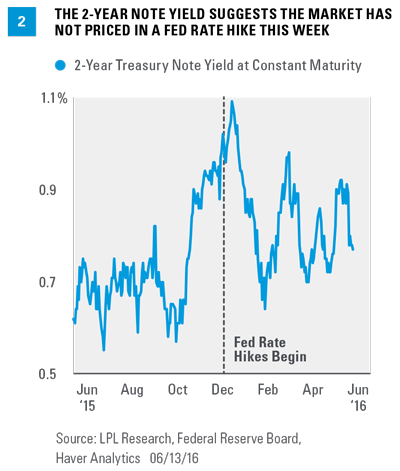

In short, no. As of Monday, June 13, the fed funds futures market has priced in 0% chance of a 25 basis point (0.25%) rate hike at this week’s meeting. Another good proxy for what the market is pricing in is the yield on the 2-year Treasury note, the Treasury note most sensitive to the Fed’s actions. The 2-year note yield has moved from just over 0.90% in late May 2016 to just over 0.70% here in mid-June. Most of that decline came in the wake of the much weaker than expected May employment report, released on June 3. In addition, we point out that at just 0.72%, the 2-year yield is below where it was (1.0%) when the Fed hiked rates in mid-December 2015 [Figure 2].

DOES THE FED CHANGE MONETARY POLICY IN AN ELECTION YEAR?

It often has and probably will again, despite misconceptions the Fed stands down before major elections. Although the Fed often pauses in the month or so prior to the November election, the Fed has changed policy (either raised or lowered rates or stopped or started quantitative easing [QE]) in every election year since at least 1968. We do not expect anything different in 2016, if conditions in the economy and labor force warrant a move. The Fed would likely not raise rates at the November 2 FOMC meeting, less than a week ahead of Election Day on November 8, 2016; but it may act at either the September or December meeting, if history is any guide.

WILL NEXT WEEK’S BREXIT VOTE IMPACT THE FED?

While financial stress has ebbed from where it was at the start of 2016 [Figure 3], and is now finally back in-line with where it was prior to the Fed’s rate hike on December 16, 2015, the looming Brexit vote in the U.K. is a potential source of heightened global financial market volatility. (For more on the Brexit, see today’s Weekly Market Commentary.) If the data on the U.S. economy and inflation had been unambiguously pointing to a rate hike at this week’s meeting, Fed policymakers may have had a dilemma on their hands. But the soft May employment report (among other data points) removed the immediate need for a hike, allowing Fed policymakers to defer any decision on rates until late July, after the June 23 vote.

Fed Chair Yellen is likely to be asked whether or not the Brexit vote was a factor in the Fed’s deliberations at her press conference, and the FOMC statement itself is likely to note that the FOMC is continuing to monitor “global economic and financial developments,” as it noted in its first three statements this year.

WHAT ABOUT THE DOT PLOTS?

We, along with most market participants, expect the FOMC to continue to show two more rate hikes this year in the “dot plot” portion of the Summary of Economic Projections that will be released alongside the FOMC statement this week. In our view, the collective decision by the FOMC in March 2016 to reduce the number of expected rate hikes this year from four to two has been instrumental in addressing many of the global imbalances that disrupted financial markets in the first six weeks of 2016. Although much of the focus may be on the “dot plots” for 2016, the market’s attention will likely soon turn to the expected path of rates in 2017. Currently, the dot plots show four 25 basis point (0.25%) rate hikes in 2017, on top of the two in 2016, leaving the fed funds rate near 2.0%. This disconnect is likely to become more troublesome for markets as 2016 progresses.

WILL THE FOMC HINT AT A JULY RATE HIKE?

We continue to expect that Fed Chair Yellen and the FOMC will stress that future rate hikes are dependent on the economy, labor market, and inflation tracking toward the FOMC’s forecasts. Looking back, the FOMC used the language, “In determining whether it will be appropriate to raise the target rate at its next meeting…” in its October 2015 statement. In fact the Fed did raise rates at its next meeting in December.

The inclusion of this type of language in this week’s statement would signal to the markets that the Fed is leaning toward raising rates at the July 26–27, 2016 FOMC meeting. However, in our view, any such move would be heavily dependent on the U.S. data released between now and late July, and on global financial market stresses remaining relatively low. We continue to expect that the Fed will raise rates two more times this year, and if the U.S. economy—as measured by growth in real GDP—runs closer to 3% than 2% in the second half of 2016, a third rate hike in 2016 is not out of the question.

John Canally is chief economic strategist for LPL Financial.