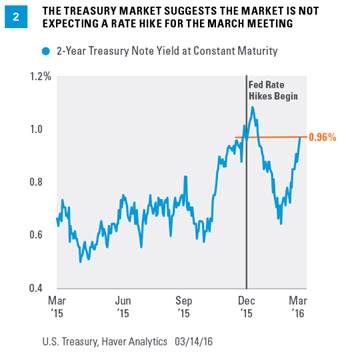

As the second of eight Federal Open Market Committee (FOMC) meetings of 2016 approaches later this week, the market and the Federal Reserve (Fed) remain deeply divided over the timing and pace of Fed rate hikes. The FOMC’s latest forecast of its own actions (December 2015) puts the fed funds rate at 1.375% by the end of 2016. As of March 14, 2016, the market (according to fed funds futures) puts the fed funds rate 0.50–0.75% lower than the Fed’s forecast, at around 0.67% by the end of 2016 [Figure 1], essentially pricing in just one more 25 basis point (0.25%) rate hike this year. How that gap closes—between what the market thinks the Fed will do and what the Fed is implying it will do—against the backdrop of what the Fed actually does, will be a key source of distraction for markets in 2016. Our view is that by the end of 2016, the fed funds rate will be pushed into the 0.75–1.0% range.

WHAT IS THE SCHEDULE OF EVENTS FOR THE FED THIS WEEK?

The Fed holds its second FOMC meeting of 2016 this Tuesday and Wednesday, March 15–16, 2016. The meeting will be followed by an FOMC statement at 2:00 p.m. ET on Wednesday March 16, along with the FOMC’s latest economic forecasts for gross domestic product (GDP), the unemployment rate, inflation, and fed funds projections for year-end 2016, 2017, 2018, and beyond (aka the “dot plots”). Following the release, at 2:30 p.m. ET, Fed Chair Janet Yellen will hold her first post-FOMC press conference of 2016.

HAS THE “MARKET” PRICED IN A RATE HIKE AT THIS WEEK’S MEETING?

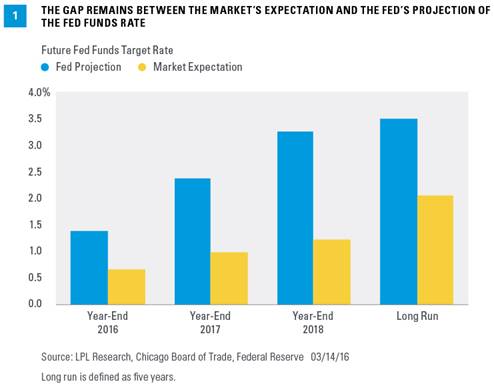

In short, no. As of Monday, March 14, the fed funds futures market has priced in just a 4% chance of a 25 basis point rate hike at this week’s meeting. Yields on the short end (as measured by the yield on the 2-year Treasury note) of the Treasury market—another good proxy for what the market is pricing in—have moved higher in the past month, from 0.65% in mid-February 2016 to 0.96% as of March 14. Taken out of context, that 0.30% increase in rates might indicate that the market expects a Fed rate hike at this week’s meeting. However, the volatile start to the year in financial markets drove the 2-year yield from 1.10% at year-end 2015 to as low as 0.65% in mid-February 2016; thus, at 0.96%, the 2-year yield is at the same level as just after the Fed hiked rates in mid-December 2015 [Figure 2].

WHY DO THE “DOT PLOTS” MATTER?

As noted earlier, the FOMC’s latest (December 2015) forecast of its own actions puts the fed funds rate at 1.375% by the end of 2016. As of March 14, the market (according to fed funds futures) puts the fed funds rate 0.50–0.75% lower at around 0.67% by the end of 2016. How this discrepancy resolves itself is crucial. Most market participants expect the FOMC to lower its year-end 2016, 2017, and 2018 fed funds target by at least 25 basis points (0.25%); this would mean that after this week’s meeting, the Fed would be looking for three 25 basis point rate hikes this year, not four. The market is split as to whether the FOMC will lower its forecast for the fed funds rate in the “long run” by 25 basis points to 3.0%. If the FOMC meets the market’s expectations and lowers the dot plots, this will help to close, but not completely eliminate, the gap between the market’s expectation and the Fed’s projection. We still think the Fed will maintain its insistence that any future rate hikes are “data dependent” and that every FOMC meeting in 2016 is a “live meeting.”