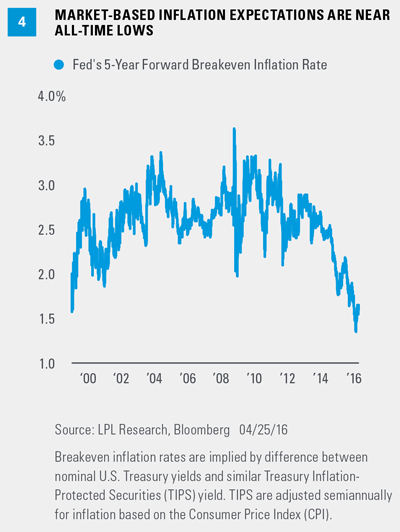

In her post-FOMC press conference in mid-March 2016, Fed Chair Yellen noted that “inflation expectations remain reasonably well anchored” and that “survey-based measures of longer-run inflation expectations are little changed, on balance, in recent months, although some remain near historically low levels. Market-based measures of inflation compensation also remain low.” The Fed tracks inflation expectations using both survey-based and market-based data. The University of Michigan’s survey of consumer expectations over the next 5 to 10 years has moved lower in recent months and is at the lower end of the 2.5–3.0% range it has been in for the past 18 years. Low inflation expectations beget low inflation, and the Fed doesn’t want to jeopardize this trend. Market-based inflation expectations (the difference between the yield on a 5-year Treasury note and a 5-year inflation-protected Treasury note, or TIP [Figure 4]) stands at 1.62% as of late last week, up from the 1.32% level—an all-time low—in mid-February 2016; but it is still below the 1.72% from mid-December 2015, when the Fed raised rates for the first time since 2006.

John Canally is chief economic strategist at LPL Financial.