KEY TAKEAWAYS

• The Fed holds its sixth of eight FOMC meetings of 2016 this Tuesday and Wednesday, September 20–21, 2016.

• With a rate hike unlikely, the Fed may begin to prepare the markets for a hike in December.

• Fed Chair Yellen’s third post-FOMC meeting press conference of 2016 provides an opportunity for the Fed to add color to its views of the economy, inflation, and financial market volatility, and to dodge questions about politics

As the sixth of eight Federal Open Market Committee (FOMC) meetings of 2016 approaches later this week, the market and the Federal Reserve (Fed) again remain deeply divided over the timing and pace of Fed rate hikes. In addition, the FOMC itself seems more divided, with many on the committee ready to raise rates now, while others urge patience.

WHAT IS THE SCHEDULE OF EVENTS FOR THE FED THIS WEEK?

The FOMC meeting this Tuesday and Wednesday, September 20–21, will be followed by an FOMC statement at 2:00 p.m. ET on Wednesday, along with the FOMC’s latest economic forecasts for gross domestic product (GDP), the unemployment rate, inflation, and fed funds projections (aka the “dot plots”) for year-end 2016, 2017, 2018, and for the first time, 2019, as well as the “long run.” At 2:30 p.m. ET, Fed Chair Janet Yellen will hold her third post-FOMC press conference of 2016, which is her first public appearance since her speech at Jackson Hole, Wyoming in late August 2016.

HAS THE MARKET PRICED IN A RATE HIKE AT THIS WEEK’S MEETING?

In short, no. As of Monday morning, September 19, the fed funds futures market has priced in just a 20% chance of a 25 basis point (0.25%) rate hike at this week’s meeting. Another good proxy for what the market is pricing in is the yield on the 2-year Treasury note, the Treasury note most sensitive to the Fed’s actions. The 2-year note yield has moved from 0.55% in late July 2016—in the aftermath of the late June Brexit vote and a weak June 2016 employment report (released in early July 2016)—to just under 0.80% here in mid-September 2016. At just 0.80%, the 2-year yield is below where it was (1.0%) when the Fed hiked rates in mid-December 2015 [Figure 1].

HOW LARGE IS THE DISCONNECT BETWEEN THE FED AND THE MARKET ON RATES?

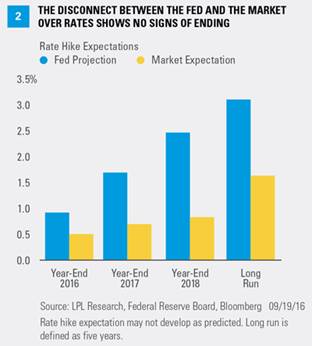

The FOMC’s latest forecast (June 2016) puts the fed funds rate at 0.875% by the end of 2016. The Fed will provide a new set of dot plots this week. As of September 19, the market (according to fed funds futures) puts the fed funds rate at around 0.50% by the end of 2016 [Figure 2], not fully pricing in even one 25 basis point (0.25%) rate hike this year. The latest dot plots (released in June 2016) had put the fed funds rate at 1.625% at the end of 2017, while the market says it will be less than half of that, at around 0.70%. The Fed’s June 2016 dot plots put the fed funds rate in the long term at 3.0%, down from 3.5%. As noted in Figure 3, the FOMC’s view of the long run fed funds rate has moved substantially lower over the past four years, as both economic growth and inflation have come in below their forecasts. The debate over the proper level for the “neutral” fed funds rate—among FOMC participants, and between the market and the Fed—is likely to persist well beyond this week’s meeting. On balance, we believe the FOMC will continue to lower its “dot plot,” forecasts for 2017, 2018, and perhaps even the “long run” to soften the blow of a rate hike later this year, but not by much.

How that gap closes—between what the market thinks the Fed will do and what the Fed is implying it will do—against the backdrop of what the Fed actually does will continue to be a key source of distraction for markets in 2016.

DOES THE FED CHANGE MONETARY POLICY IN AN ELECTION YEAR?

It often has and may do it again, despite misconceptions the Fed stands down before major elections. Although the Fed often pauses in the month or so prior to the November election, the Fed has changed policy (either raised or lowered rates or stopped or started quantitative easing [QE]) in every election year since at least 1968. We do not expect anything different in 2016, if conditions in the economy and labor force warrant a move. If the data called for a move at this week’s meeting, the Fed would likely act. However, the Fed would likely not raise rates at the November 2 FOMC meeting, which is less than a week ahead of Election Day on November 8. The final FOMC meeting of 2016 is on December 13–14, and our view is that the Fed considers that a “live” meeting; the fed funds futures market agrees, currently pricing in about a 55% chance of a hike at the December 2016 FOMC meeting.

WILL GLOBAL ECONOMIC AND FINANCIAL CONDITIONS GET A MENTION THIS WEEK?

Until Fed Chair Yellen’s speech in late August 2016 at Jackson Hole, a mention of “global economic and financial conditions” made it into every FOMC statement and was part of every one of her major speeches. However, Yellen left this phrase out of her Jackson Hole speech, leading some market observers to speculate that this was a precursor to a Fed hike as soon as this meeting. While financial stress has ebbed from where it was at the start of 2016 [Figure 4], financial conditions have tightened in the past few weeks and remain tighter than they were prior to the Fed’s first rate hike in this cycle in mid-December 2015. We expect the FOMC statement and Yellen’s prepared remarks may omit the reference to global economic and financial conditions, but Yellen is likely to be asked about the topic during the press conference.

WILL THE FOMC HINT AT A DECEMBER RATE HIKE?

We continue to expect that Yellen and the FOMC will stress that future rate hikes are dependent on the economy, labor market, and inflation tracking toward the FOMC’s forecasts. Looking back, in its October 2015 statement the FOMC did acknowledge it was determining “whether it will be appropriate to raise the target rate” at its next meeting. And in fact, the Fed did raise rates at its next meeting in December.

The inclusion of this type of language in this week’s statement would signal to the markets that the Fed is leaning toward raising rates at the December meeting. However, in our view, any such move would be heavily dependent on the U.S. data released between now and mid-December, and on global financial market stresses caused by the U.S. dollar, China’s bad debt problem, the ongoing negotiations around Brexit, a major terrorist event, or even the U.S. election, remaining relatively muted. We continue to expect that the Fed will raise rates in December 2016.

John J. Canally, Jr., CFA, is the chief economic strategist at LPL Financial.