Now, we are not taking sides. Manchester United is but one example of a massively successful global sports team. Training kits and shirts struck in the infamous red and white are as popular in Kuala Lumpur as they are in Riyadh. Fans around the world huddle in smoky bars, craning their necks over friends’ shoulders to catch a glimpse of the action.

Manchester United is also one of the few global sports brands under public ownership, precisely why we’ve chosen to inspect it closely. For the many who wonder about the business of sports, for those curious about just how profitable such a ubiquitous sports brand actually is, we have some answers.

Like other elite sports franchises (read: Real Madrid), Man U’s financials tell of the profound impact wrought by globalization and digitization. No longer are packed stadiums the driver of sports profits. Top performing sports teams capture massive gains from global sponsorship and broadcasting agreements, attract the best players from around the world, and reach fans everywhere on screens big and small. Few business models look as promising as those of great sports teams in the 21st century.

Money Machine

Manchester United runs a profitable enterprise that pulls in significant revenue. In 2014, the team generated £433 million in sales. Of those sales, the club booked almost 15% as operating profit (for a total of £61 million). By way of rough example, that means for every £60 you spend on a shirt, £9 comes in as profit.

The football club breaks its revenues into three primary streams: commercial, broadcasting, and matchday. Commercial revenues (44% of the total) are from sponsorship agreements, merchandising agreements, and team tours. Broadcasting revenue (31%) is the result of media rights the club owns to televise Premier (2/3 of broadcasting revenue) and Champions League matches (1/3 of broadcasting revenue).

Finally, the club earns matchday revenue (25%). Just as it sounds, this is the money made at the so-called Theatre of Dreams (Old Trafford Stadium’s sobriquet) on match days. Manchester United also gets a cut of “gate receipts” from other cup matches, even when it plays away from home.

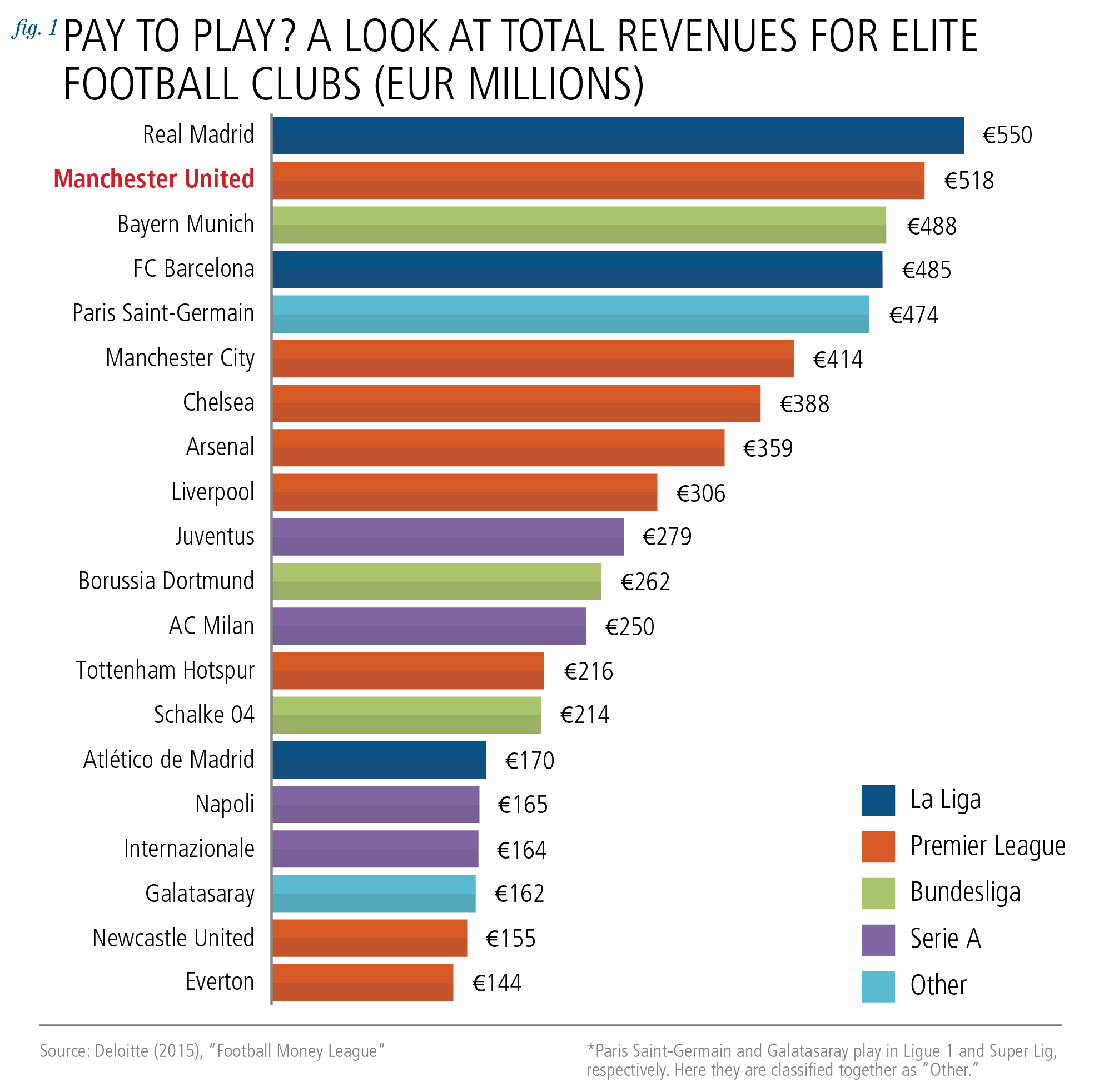

2014 was a rough year for Manchester United. They finished seventh in the Premier League. Remarkably, though, despite their less-than-stellar performance, the club was still the world’s second largest revenue generating football squad (see Figure 1). Consider that FC Barcelona claimed first place in its league twice in the last four years and still collected less revenue than Manchester United.

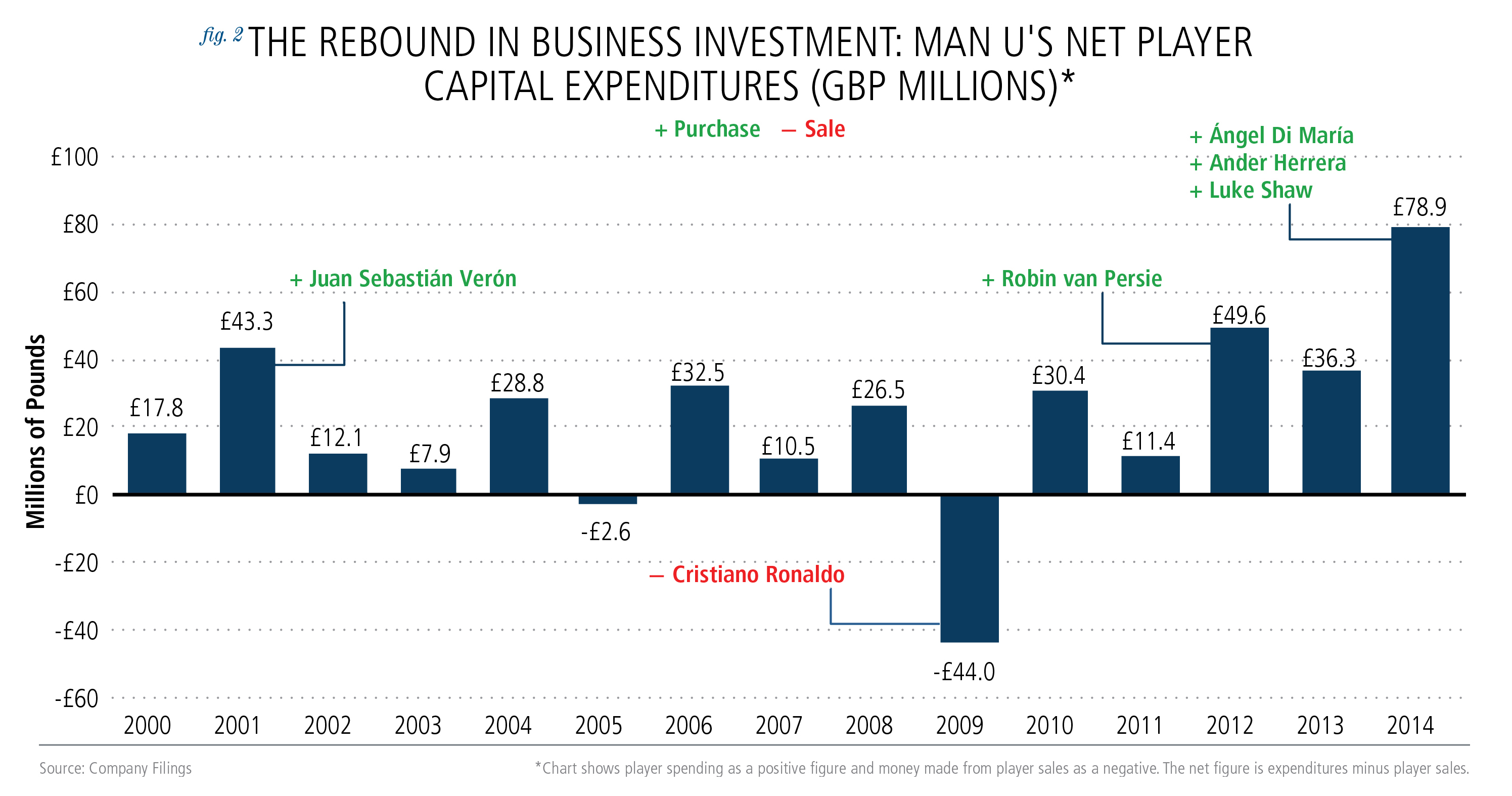

What about those player expenses? Employee benefit expenses were fully 50% of total revenues, costing the club £215 million in 2014. New joiners (Ángel Di María, Ander Herrera, and Luke Shaw) brought player costs up 19% in 2014 (see Figure 2). Not only does the club have to pay salaries to these prized players, it also must pay transfer fees—the cost of buying a player out of his prior contract. Transfer fees owed by Manchester United to other teams total just shy of £120 million as of December 2014. Talk about wage growth! The TV buzzes on in the living room. Pre-match pundits detail starting line-ups. You press open the microwave and gingerly remove a bag of popcorn. Beer foam bubbles out of a hand-chilling bottle. Dashing to the sofa, you are just in time to witness the first touches. Rooney kicks off. The Manchester United match is underway.

The TV buzzes on in the living room. Pre-match pundits detail starting line-ups. You press open the microwave and gingerly remove a bag of popcorn. Beer foam bubbles out of a hand-chilling bottle. Dashing to the sofa, you are just in time to witness the first touches. Rooney kicks off. The Manchester United match is underway.

Football And Finance: What Manchester United Teaches Us About The Global Economy And The Business Of Sports

August 21, 2015

« Previous Article

| Next Article »

Login in order to post a comment

Comments

-

You are correct and see what happened to messi and his dad. That's the product if sports is mixed with money. They become oligarchs that manipulates the money of people through entertainment. Another thing is Pau Pogba's return to the Premiere League for manchester united. They let go of a player just to buy him almost quadruple the amount. Insane!

-

You are correct and see what happened to messi and his dad. That's the product if sports is mixed with money. They become oligarchs that manipulates the money of people through entertainment. Another thing is Pau Pogba's return to the Premiere League for manchester united. They let go of a player just to buy him almost quadruple the amount. Insane!