Investors first embraced American small cap stocks in the late 1970s, when small companies became recognized for their potential to grow rapidly as a result of being more nimble and able to adapt to change more quickly than larger competitors. Since their first great boom, U.S. small caps have proven to be one of the most successful asset classes, especially for talented active managers.

While U.S. small cap, international large cap, and even emerging markets have all attracted significant assets over the years, small cap stocks in developed non-U.S. markets remain largely uncharted territory. We believe there are a number of reasons that investors should consider an allocation to international small cap stocks:

• The breadth of the international small cap equity universe provides significant opportunities

• Inefficiency of international small cap market offers alpha potential for active managers

• International small cap offers diversification to mainstream equity classes

• International small cap investors are less impacted by currency fluctuations than other international Investors

Reason 1: The Breadth and Depth of the International Small Cap Market Provides Opportunity

Beyond the breadth of the opportunity justifying its consideration for inclusion in investors’ portfolios, the vast number of companies highlights the potential advantages of active management over indexing. With so many companies to choose from, and dispersion existing between the best and worst performers in this area, stock selection can have a significant impact on returns for active managers able to capture the best opportunities and avoid the worst. With only approximately 5% of the market capitalization of international developed mid and small cap stocks being actively managed , there is considerable opportunity for those active managers to differentiate themselves. And the opportunity has been increasing, with 89% of the roughly 19,400 IPOs that have occurred globally since 2000 taking place outside of the U.S.

Second, as with many U.S. large cap companies, international large cap companies are generally global in nature (58.3% of their revenue is earned from foreign markets as of February 29, 2016) , reducing the diversifying impact of allocating to U.S. and international large caps. However, the more localized focus of EAFE small cap companies provides a more pure exposure to international investing than that of their large cap brethren, thereby increasing the diversifying effect of adding this asset class to a portfolio.

Many investors utilize various asset classes to add diversifying influences to their portfolios. As the table below in Exhibit C illustrates, international small caps have proven more effective at diversifying exposures to domestic large caps than have U.S. small caps or even international large caps.

Reason 4: International Small Cap Investors are less Impacted by Currency Fluctuations than other International Investors

The key point here is that U.S. investors in international small caps are far less exposed to the impact on company performance from currency fluctuations than are U.S. investors in international large cap companies due to the significant inter-continental export activities of these larger companies versus smaller ones.

Higher Risk and Potentially Greater Rewards from International Small Caps

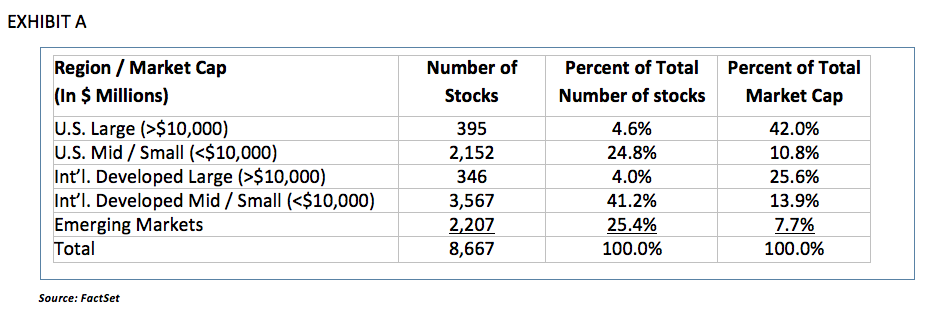

From a size standpoint, we believe the non-U.S. small cap equity market is large enough to warrant interest by U.S. investors. As the table in Exhibit A below illustrates, small/mid cap investment opportunities globally represent 66% of the investable universe, compared to 8.6% for large caps. And while international small and mid-sized companies constitute 41% of that investable universe, these companies provide more than 91% of the equity investment opportunities in developed international markets (i.e. 3,567 = 91% of (3,567 +346))

Reason 2: There is Significant Potential to Capture Inefficiencies in International Small Caps

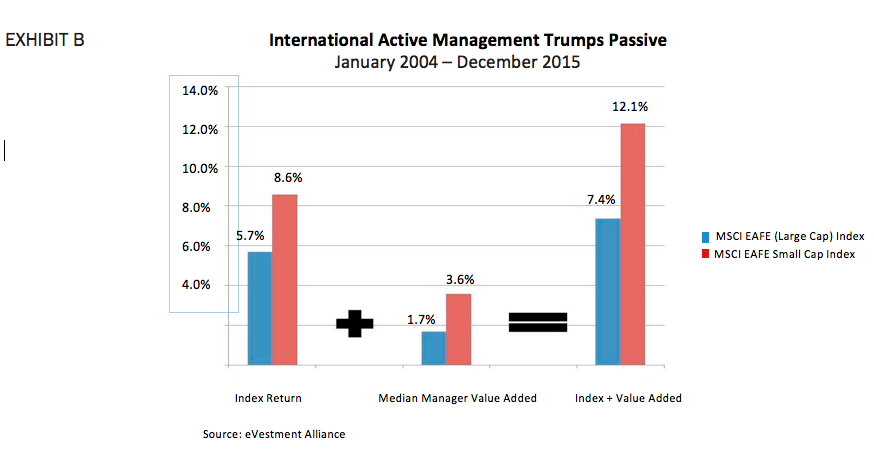

Those active managers who do operate in the international small cap arena have demonstrated a penchant for capturing inefficiencies and generating excess return compared to passive indexes. Exhibit B below shows the performance of the MSCI EAFE Large and Small cap Indexes, as well as the median value added over the indexes by active managers. Given the greater number of international small cap stocks compared to international large caps, we’re not surprised to see similar information inefficiencies that have been noted between active and passive management also showing up between small caps and large caps. The breadth of the investment universe and the limited number of active managers work in tandem to provide fertile ground for investors seeking additional diversification sources and alpha generating opportunities.

Reason 3: International Small Caps Provide Diversification to Both International Large Cap Stocks and Domestic Small Cap Stocks

International small cap investing can offer diversification to international large cap equity allocations in two key ways. First, since many large cap allocations are dominated by a small percentage of stocks relative to the entire investable universe (see Exhibit A), the broader universe of investment opportunities in international small cap provides a natural diversifier.

Many pundits have spoken of the benefits and challenges for investors from currency fluctuations in countries with significant export activity, which can lead some investors to try and capture gains by timing the markets. This approach seems more rooted in trading than investing from our perspective, so we offer an alternative view of currencies for discerning international investors. Large European corporations that earn a significant percentage of their revenue from exports could be harmed by a weakening U.S. dollar. But smaller European companies offer a purer play, by comparison, earning only 12% of their revenues from exports to the U.S., with 67% of their revenue coming from sales within Europe as of April 2016. For them, a weakening or strengthening dollar has little impact on their bottom lines and valuations. This is not to say that currency poses no risks, as U.S. investors would still feel the impact of repatriating those non-dollar assets into the U.S. as dollars, but this risk exists for all U.S. investors investing overseas.

As with almost any investment, potentially greater rewards can come with greater risks. In the case of international small cap equities, this increased risk shows up as slightly higher standard deviation than that of their large cap counterparts according to a review of rolling ten-year periods (stepped one year apart) - Exhibit D below shows how standard deviation (read volatility) differs between EAFE large caps and EAFE small caps.