Source: LPL Research, Haver Analytics 02/22/16

The performance data presented represents past performance and is no guarantee of future results.

The U.S. is the world’s largest economy, and as a result, most global trade is denominated in dollars; in turn, this makes the U.S. dollar the world’s “reserve currency.” Central banks and governments of most nations outside the United States hold reserves in dollars, although the rise of China’s economy and the sheer size of the Eurozone’s economy has eroded the dollar’s “reserve currency” status in recent years. Still, the dollar is still viewed as a “safe haven” currency, as are U.S. Treasury notes and bonds, which, of course, are denominated in dollars. In times of global economic and political uncertainty, the dollar typically rises in value, as investors must use dollars to purchase Treasuries, and those commodities viewed as traditional safe havens.

Although our “twin deficits” and the Fed’s actions to stimulate the economy have put downward pressure on the dollar over time, the dollar’s status as the world’s reserve currency, and the position of the U.S. as the world’s largest economy and largest exporter, with its diversified and dynamic economy and labor force, suggest that any sudden, sharp movements in the value of the dollar either up or down are unlikely. On balance, the dollar is impacted by many factors in the short, medium, and long term. Interest rate differentials; monetary, fiscal, and regulatory policy divergences; movements in budget and trade deficits; changes in economic growth prospects; and even inflation and inflation expectations all influence the value of the dollar.

HEADWIND ABATING

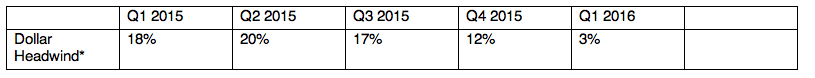

Since mid-2014, just as many market participants were gearing up for a collapse in the dollar, a stronger dollar emerged. This has been a headwind for U.S. exports, commodity prices, and corporate revenue and earnings, and played a large role in Fed policy via the tighter monetary conditions caused by the stronger dollar. That headwind, which was running between 12– 20% during 2015 [Figure 4], has subsided substantially: In the first seven weeks of 2016, the dollar is up just 3% from the first quarter of 2015.

Figure 4, The Dollar Headwind, Impacting U.S. Exports, Commodity Prices, and Corporate Revenue/Earnings, Has Abated

Source: LPL Research, Bloomberg 02/22/16

*Year-over-year % change in the U.S. dollar versus the currencies of the Eurozone, Japan, the U.K., Canada, Sweden, and Switzerland.

The performance data presented represents past performance and is no guarantee of future results.

If the dollar stabilizes at current levels—which is consistent with our view—by the end of 2016, the dollar headwind would disappear altogether, and could turn into a small tailwind for U.S. exports, commodity prices, and corporate revenue and earnings. In the longer term, however, we continue to believe the dollar will slowly depreciate over time—continuing the trend that has been in place since the early 1970s, but at a pace that will not undermine the nation’s health or its role as a global economic power.

John Canally is chief economic strategist for LPL Financial.