The ancient city of Petra in the Jordanian desert thrived and famously became an economic force in the Middle East because it figured out how to do one thing: capture water and manage its supply effectively. Not an easy feat in the first century B.C.

Petra is now a UNESCO World Heritage site. Its cisterns, pipes, pools, conduits and drains have fallen to ruin and rubble. The city is "petrified"-a stone symbol of both innovation and disrepair. As investments in its water supply system waned, so too did the commerce that fed off the oasis.

Today, the world is Petra. There is a dire need for water investments around the globe before we, too, fall to ruin. According to the San Francisco-based nonprofit organization Food & Water Watch, two-thirds of the world's population will suffer some sort of water shortage by 2025. According to the United States Environmental Protection Agency, $500 billion is needed to upgrade the water systems in the U.S., and trillions more dollars are needed to upgrade the systems of all the other countries.

Leaks, breaks and pollution are the results of poor water management systems. And with 14% of water leaking before it gets to its intended source-your home, crops or a business-it's no wonder that there is estimated to be a 40% world water shortfall by 2030.

Population and climate change are the two main factors affecting water supply, according to water experts. One needs look no further than Colorado, where wildfires roared recently, for evidence of drought. Or take Texas, the second-largest agriculture state in the country, and now one of the driest; livestock are being sold off or slaughtered, crops lie fallow. There isn't as much water as there used to be to grow or raise things.

To get a long-lens sense of the world water crisis, check out the water problems China and India are experiencing. They are scrambling to shore up water supplies in the face of the melting away of their biggest freshwater source: Himalayan glaciers. China holds 20% of the world's population, but just 7% of the world's water supply. Add to that India's population of 1.2 billion and water demand goes off the charts. India has just 4% of the world's water supply.

Water makes food. Water makes businesses run. Water is essential for proper health-care. And we need water for energy, too.

Peter Brabeck-Letmathe, the chairman of Nestle, the largest food maker in the world, has gone on record saying that wars will break out over water in the future. Businesses such as Nestle, Pepsi and Coca-Cola that rely on water for their viability are falling all over themselves to buy or control supply. Global Water Intelligence's annual market report has forecast that private-company spending on water supplies will grow in five years to $70 billion annually from $45 billion today.

In terms of health care, water-borne diseases kill about 2 million people every year; most of them are children less than 5 years of age.

And on top of all this there is the water-energy nexus to be concerned about. According to the Boston-based environmental coalition Ceres, the electric power sector alone in the U.S. accounts for 41% of freshwater withdrawals.

Given all this fire and ice, how can investors umbrella their capital? William Sarni, the director and practice leader of the enterprise water strategy group at Deloitte Consulting LLP and the author of Corporate Water Strategies and the forthcoming Water Tech-A Guide to Innovation and Business Opportunities (from the publisher Earthscan), says boosting the data and analytics segment of the water industry would bring great opportunities and positive change.

"As companies struggle to figure their own water use and how they can be more efficient, data and analysis become important," he says. "It's not glamorous, but there is high value and it's one of the building blocks."

Indeed, we often hear a lot about wastewater treatment, water management and water monitoring. But those are ineffective without accounting. Data and analytics facilitate accounting.

"Water utilities are still struggling with non-revenue water," Sarni says, talking about water lost to leaks or mismanagement.

Consumers also need efficiency tips-watering their lawns in the early morning hours, for example. You can waste as much as 30% of the water you use to evaporation by watering at midday. And regardless of what cooking instructions say, it takes only 1.5 quarts of water to cook a pound of pasta. (Most instructions require four to six quarts. In the U.S., we cook a billion pounds of pasta per year. That adds up to possible water savings equal to a billion gallons.)

Lost water can mean business opportunities, specifically in wireless technology-one of the great, unsung heroes of the sustainable water movement. Wireless monitors allow utilities to better track usage and spot leaks and inefficiencies, and several applications can shore up supplies. In certain municipalities, "meter readers" are housed inside vehicles. This means a utility representative can drive down streets collecting information without having to leave his or her vehicle, and data are then collected and analyzed immediately for aberrations. The information can be sent electronically to a customer alerting him of leakage. (Along with those conservation tips.)

Wireless technology also helps manage water usage inside the home. Small-screen displays can relay water use from meters on different outlets (the tap, the shower or an appliance), allowing users to better manage consumption.

There are also industrial needs for wireless water monitoring. In remote areas, pipelines can be equipped with signals that alert authorities when leaks occur. The company TaKaDu, for example, has developed software to target leaks in a water-supply network. Water loss, it notes, accounts for as much as 30% of the world's water production. The company's technology can identify leaks hundreds of miles away using sensors. It can also sometimes identify leaks before they happen by monitoring flow rates and anomalies.

Still, even if the world captured all the freshwater it's losing from leaks and mismanagement, that still wouldn't be enough to fill the gap in supply. We need to figure out ways to use our wastewater.

That's why membrane technology is all the rage. Membranes are essentially filters, and they're key to water reuse and recycling. But membrane technology is expensive. In China, it is still as much as three times more expensive than traditional treatment technologies (chemicals and less-high-tech filters). "As the need for high-quality water treatment increases, specifically for potable or high-quality industrial use or reuse, low-pressure membrane technology could develop a [big] market potential," posits the McKinsey & Co. report Charting Our Water Future. The thinking is that when costs come down, the market will be waiting.

Sarni says anything involving membrane technology in general has strong growth potential. But nanotechnology and low-energy treatment technology, especially for the shale gas industry, are particularly promising areas.

The trick to investing in any of these areas, of course, is finding the right opportunity and the best way in.

Tamin Pechet, chief executive of the Banyan Water company and chairman of Imagine H2O, a nonprofit, says the public investment landscape offers many ways to invest in the water industry, from utilities to exchange-traded funds to pooled funds to multinational corporations. However, he says there are few "pure plays."

For example, to gain exposure to up-and-coming water technology via investments in tech companies, people "have to do the digging themselves and go to conferences and network or use incubators such as Imagine H20." Those opportunities would be relegated to private equity investors. For publicly traded stock, Pechet says people could build their own ETFs-if they put in the time to screen companies and do the due diligence themselves.

What Pechet suggests would be a lot of work for the nonprofessional investor. Hence, financial advisors can play a critical role in vetting and creating a portfolio of water and water-related companies that facilitate water efficiency.

Fidelity Investments has figured this out, and the fund firm has launched a strategy called "thinking big" that explicates the need for water investments, among other world-changing ideas.

"Because global water consumption is expected to increase by 40% over the next 20 years, water shortages may get more acute and widespread, spurring more reliance on desalination technologies, water reuse and conservation," says Fidelity on its microsite, "The World's Water." "The results could have massive economic, ecological and geopolitical consequences, creating investing opportunities in places you may never have considered."

The point is to give investors and professionals ideas about where to invest in the future and for the future.

Bennett Freeman, senior vice president of sustainability research and policy at Calvert Investments, says his firm makes this easier by offering the Global Water Fund. The fund holds 30% of its assets in water utilities, 40% in infrastructure companies and 30% in water technologies, according to its report. Some 65% to 70% of the fund's positions (averaging about 100 stocks) are "pure plays," meaning the companies derive more than 50% of their revenue from water-related activities. The fund largely invests in small- and mid-cap stocks, since large-cap exposure spills outside pure plays.

"We began to realize a half dozen years ago that there was a freshwater crisis around the world," Freeman says. "We started looking at the whole range of water infrastructure and technology issues even in the most advanced OECD [Organisation for Economic Co-operation and Development] countries. And there is an extreme congregation of environmental challenges and investment opportunities."

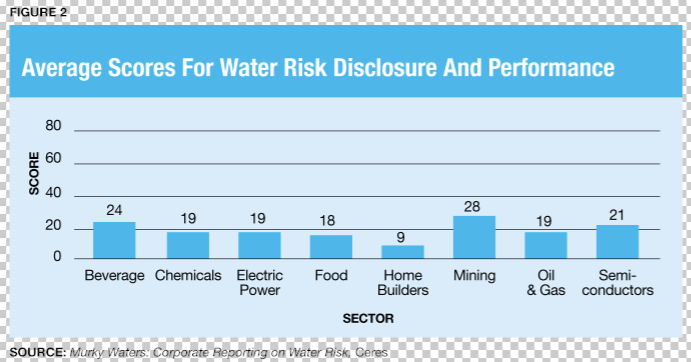

Via its Global Water Fund investments, Calvert not only wants to address water issues but also bring them to light. The firm, Freeman says, regularly engages in shareholder resolutions to effect further positive change and "make a commitment to advocacy with companies and their water-risk disclosures."

To be sure, there are other funds and vehicles that invest in a similar manner. But it will take far more funds and dollars. With the right amount of investment attention, capital flows can make the water flow blue again.