All anyone wants to talk to me about these days is frontier markets.

I was lucky enough to organize a breakfast at the recently completed Inside ETFs conference with Nouriel Roubini and 10 of the biggest ETF strategists in the world. I invited the group to the table for an hour of freewheeling discussion, figuring the questions would center on the Fed, the ECB and China. Maybe Japan.

Instead, we started with West Africa and spent 45 minutes discussing frontier markets. Everyone wanted to know if we had crossed over the threshold whereby frontier markets had become a real investment opportunity. Professor Roubini’s answer was a definitive “Yes, but…”

Yes, but the best investments were probably in private equity.

Yes, but you had to deal with liquidity issues.

Yes, but political risk was a very real issue.

Yes, but … yes.

ETF investors seem to agree. Investors plowed $330 million in new money into frontier market ETFs in 2013. Amazingly, flows accelerated in January: Despite major pullbacks in global equity markets – and mass redemptions in most equity ETFs -- investors sunk $72 million in net new money into frontier market ETFs for the month.

Is it smart money? Let’s investigate.

Don’t Judge A Frontier Markets ETF By Its Name

The first thing to know about Frontier Market investing is that you can’t take things at face value. Consider this chart, which compares the two most popular “frontier markets ETFs.”

That’s not an error. The blue line – the one that is up 15 percent over the past year – is the $515 million iShares MSCI Frontier Markets ETF (FM). The red line – which is down 28 percent over the past year – is the $76 million Guggenheim Frontier Markets ETF (FRN).

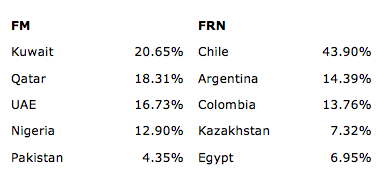

How could the two broad-based frontier markets ETFs have such spectacularly different returns? The answer is simple: FRN is a frontier markets ETF in name only. Consider their top five country positions:

Chile, of course, is an emerging market, according to MSCI, the dominant global indexer. So are Colombia, Egypt and a good number of other countries that FRN holds. And Chile – among other commodity-exporting countries – has been absolutely clobbered over the past year, which goes a long way towards explaining FRN’s terrible performance.

And what explains FM’s strong move?

Mostly a few Gulf coast countries that are classified as frontier markets ... for now (more on this important point later).

As it turns out, frontier markets are not especially well correlated to one another. Of the 32 countries that MSCI classifies as emerging markets, the spread in performance over the past year is 102 percent: up 75 percent for the United Arab Emirates and down 27 percent for Ukraine.

The vast majority of FM’s strong performance owes itself to just one region – the Gulf – and particularly to just two countries: the UAE and Qatar, both of which had spectacular years. Excluding Gulf Coast countries, frontier markets were up just 3.83% over the past year. That’s still better than emerging markets, which are down 12 percent, but it’s not great.

The funny thing is that Gulf countries aren’t exactly what most people think of when they think of frontier markets. The United Arab Emirates is one of the richest places in the world. It’s GDP per capita is over $48,000; it is ranked as the 14th best place in the world to do business by the World Bank; inflation is contained; and its debt is rated AA2 by Standard & Poor’s. It counts as frontier --- for now --- because its markets are not easily accessed by foreign investors.

What About Africa?

Africa (excluding South Africa) better fits most people’s vision of frontier markets. Many countries in the region have staggering natural resources and underdeveloped economies begging for infrastructure improvements. The population skews young and is growing rapidly. GDP growth can be spectacular: Nine of the 20 fastest-growing economies in the world are in Africa, and a half-dozen countries have delivered consistent GDP growth exceeding 5 percent for the past 10 years.

The story more recently has been mixed. A handful of African nations have delivered spectacular returns both last year and on a trailing 5-year basis. Ghana, Kenya and Mauritius have all been performing very well recently. It’s worth noting that Professor Roubini called out Ghana and Kenya as potential areas of interest at our breakfast.

But the African story is mixed. For every Ghana posting 61 percent returns last year, there is a Morocco falling 8 percent or a Nigeria going flat.

Can You Really Buy The Growth You Want?

Which brings us to the final point: I don’t think most investors know what they are buying when they buy frontier market ETFs. FM is clearly better than FRN – despite the name - but my gut tells me that people are hoodwinked a bit by FM as well. My guess is most people are trying to buy into under-developed economies with enormous potential … places like Ghana and Kenya … when in reality, they’re mostly buying into Gulf countries. It’s better to be lucky than good, but people should recognize luck when they see it.

Importantly, FM – and the index it tracks – will change dramatically in May, when the MSCI plans to reclassify the UAE and Qatar as emerging markets. Together, they make up 35 percent of FM’s portfolio and almost all of its strong returns in recent months.

The new portfolio will be more frontier-y. It will be closer to what investors want. The question is: Will that be a good thing or not?