In recent years, investors have become more comfortable with investing in emerging market equities, and for early adopters, these investments have paid off with higher returns than developed market equities have. Lately, the theme of frontier markets (those smaller, less-developed countries whose equity markets do not yet meet the stability, diversity or liquidity standards to be called “emerging”) is becoming popular, with many declaring these to be “the new emerging markets.”

However, despite the growing popularity of this asset class, two key aspects of the space are often overlooked. First is that the number of frontier market securities is extremely limited, as is the amount of market capitalization available. These things make a stand-alone allocation to frontier markets problematic, given the high transaction costs and management fees. Second, aside from being very small, the universe of assets has historically been very concentrated in a handful of countries. The recent migration of the United Arab Emirates and Qatar, two of the largest and best-performing countries, out of the frontier category and into the emerging market group further exacerbates this concentration issue. Their removal changes the frontier market asset class to such an extent that the class’s historical return patterns and liquidity characteristics may now give a misleading picture of future prospects.

Taken together, these issues argue against a stand-alone exposure. A better solution is to consider investing in an emerging markets strategy that includes a relatively static allocation to frontier markets. That would allow one to experience the benefits of investing in the developing nations of the world while avoiding many of the implementation issues.

Small And Concentrated

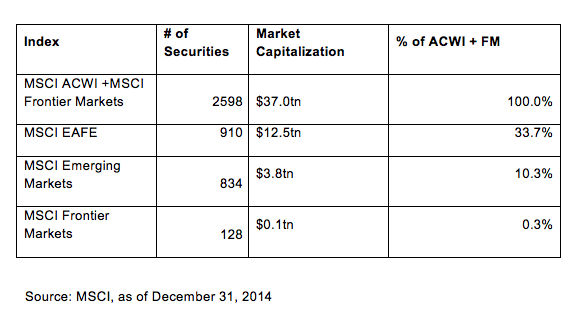

Because frontier markets are considered to be among the least-developed countries in the world, it is not surprising that the amount of assets available is a small fraction of what’s available in the emerging space. But even seasoned investors are shocked at how small the universe of frontier assets actually is. As Figure 1 shows, emerging markets make up more than 10% of the world’s equity markets, while frontier assets make up a shockingly low percentage of just 0.3%. This is only $100 billion of market capitalization, consisting of a mere 128 securities with a median market cap of $424 million. To put this in context, the Russell 2000 Small Cap Index consists of 1,975 U.S. securities with a total market cap of $1.8 trillion and a median market cap of $729 million (as of December 31, 2014).

Figure 1: Size of equity markets, as measured by MSCI Indexes

The small universe creates challenges for investors attempting to gain access. Transaction costs are high, especially in terms of the market impact on prices caused by managers’ buying and selling the positions. Management fees for both active and passive vehicles are also high, reflecting the economics of asset management in such capacity-constrained strategies. Because many vehicles have capacities well below $500 million, asset managers have to charge a premium management fee in order to make them profitable. And because the market is small, many open-ended frontier market funds maintain positions in the larger, more liquid emerging market countries in order to avoid these prohibitive transaction costs when dealing with daily fund flows. While all of these are defensible business practices, they add challenges for those investors wishing to get pure access to the frontier country assets.

Again, the investable universe of stocks here is massively concentrated in a handful of the largest countries. Figures 2 and 3 give the country breakdown of the MSCI Frontier Markets index as of December 31, 2013 and 2014. These demonstrate just how much of the index has historically been contained in the top five countries, something new investors in the asset class may not fully appreciate.

As the charts show, the two largest countries have represented over one-third of the index, and the largest five countries have made up roughly two-thirds. And this concentration has primarily been in economies heavily reliant on the export of crude oil for their economic growth (the UAE, Qatar and Kuwait are all Persian Gulf states, and Nigeria is the largest African exporter of crude oil). The oil factor amplifies the country concentration, removing some of the diversification benefit.