Consequences of the UAE and Qatar Migration

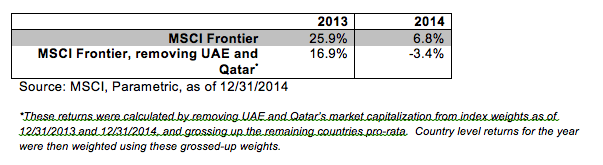

But that argument may not dissuade many investors, since it ignores frontier markets’ recent eye-popping index returns: 25.9% in 2013, followed by a respectable 6.8% in 2014. But do those returns reflect reality? As Figures 2 and 3 show, the UAE and Qatar graduated from the frontier markets and entered the emerging space in June 2014. Thus, one could argue that it would be better to look at the index returns with those countries removed. We did this in Figure 4.

These disparate and somewhat less impressive returns reveal that an accurate picture of the broader asset class is masked by the larger countries’ contributions.

Just as important is how the departure of those countries has affected the opportunity set: It eliminated one-third of the market capitalization available for investment. This is staggering. Both the UAE and Qatar were also known for their relatively liquid markets; the large trading volumes and low transaction costs made positions easy to enter and exit. That means any historical assessments of the liquidity and investability of frontier markets must now take into account the two countries’ removal.

Blending Emerging And Frontier

Given all these obstacles, we would argue that a better solution for many investors seeking frontier market exposure is to invest in an emerging market strategy that’s blended with frontier assets, and both markets should have material, relatively static, representation. Investors in both markets generally seek the same thing: to capture the potential growth opportunities in the less-developed economies of the world. The size distinction between frontier and emerging is, in many ways, less important when it comes to this thesis. When frontier markets are included in an emerging markets portfolio, many of the implementation problems are less pronounced. For example, transaction costs are not as burdensome, because the more liquid emerging market securities can be used to meet liquidity needs, leaving the core frontier assets untouched. And given the increased capacity of a blended strategy, the management fees are typically much lower than they would be if emerging and frontier market solutions were pursued separately. And the frontier markets’ concentration issue would be less concerning.

Moreover, in a blended strategy, it would matter less when countries like the UAE and Qatar switch categories; the historical performance would still be relevant. An additional benefit is that, given the low correlation between emerging and frontier countries, the addition of the latter to most emerging market portfolios can serve to lower the overall volatility of their strategies, while arguably having little impact on expected growth (if one accepts that the expected returns of emerging and frontier market country returns are roughly similar).

Because of these advantages, we argue that most investors interested in frontier markets will be better served by choosing a blend.