Health-Care Reform Taxes Alter Client Strategies

Two new levies on high-income individuals were cemented into the tax code when the U.S. Supreme Court upheld President Obama's healthcare-reform legislation, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act. Both taxes take effect in 2013 (assuming the legislation isn't overturned by Congress), and both apply to joint filers earning more than $250,000 and singles who make over $200,000.

At 0.9%, the Medicare Hospital Insurance Tax is the lighter one. It's assessed on earned income-chiefly wages and self-employment income-that tops the above-stated threshold. For example, a single client with a $300,000 salary will owe 0.9% on $100,000 ($300,000 earned income, minus the $200,000 threshold for single taxpayers).

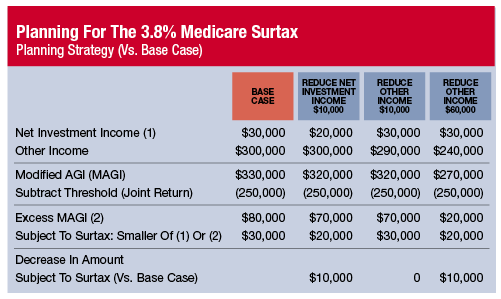

Larger and more vexatious is the Unearned Income Medicare Contribution Tax. Commonly called the investment income tax or the health-care surtax, it is 3.8% on the smaller of (1) net investment income or (2) the amount

by which the client's modified adjusted gross income (MAGI) exceeds the $250,000/$200,000 threshold. Thus if either (1) or (2) is zero, so is the surtax. Here, MAGI is the client's adjusted gross income plus his net foreign earned income exclusion.

Two broad approaches exist for reducing the surtax, although they aren't always equally efficient (as the accompanying chart demonstrates).

The first entails lowering net investment income, says Mark Luscombe, the principal tax analyst at CCH Inc., a business-information source in Riverwoods, Ill. He notes such income can include taxable interest, dividends (qualified or not), annuities, rents, capital gains, income from trading in financial instruments or commodities, gain on a second home or passive activity income.

To cut the client's surtax, Green Bay, Wis.-based CPA Robert Keebler suggests repositioning into assets that generate little or no currently taxable income. This includes tax-deferred non-qualified annuities, real estate (because depreciation deductions offset income from the property), oil and gas investments, master limited partnerships and cash-value life insurance, especially non-modified endowment contract (MEC) policies. Withdrawals from non-MECs begin with non-taxable basis recovery. Policy loans can also provide clients with non-taxable cash flow, Keebler says.

Attorney/CPA Leon LaBrecque advises stocking taxable accounts with municipal bonds because their interest isn't subject to the surtax. That increases the taxable equivalent yield on munis, says LaBrecque, CEO of LJPR LLC, a Troy, Mich., wealth-management firm.

The second planning lever calls for reducing taxable non-investment income such as wages, income from an active business activity, pension income and distributions from traditional individual retirement accounts. To do this, says Luscombe, workers and self-employed clients should consider increasing their qualified-plan contributions.

Roth IRAs can keep the surtax at bay, too. Whereas traditional IRA distributions count toward MAGI and thus can trigger the tax, Roth withdrawals don't because, as LaBrecque tells clients, "A Roth conversion today stops required distributions later."

There's plenty of surtax planning to do. But remember: client objectives always take precedence over nifty tax moves.

-Eric L. Reiner

RIA Firms To Expand Staff This Year

Nearly 40% of registered investment advisory firms say they plan to add additional staff within the next six months, according to the latest Advisor Index Survey released by TD Ameritrade Institutional.

RIAs surveyed reported an average annual revenue growth rate of 15% and indicated that 57% of new client assets continue to come from full-commission firms, up from 55% in 2011.

To maintain momentum, many RIAs say they're making the move to add staff to help sustain this growth. Nine in 10 advisors report that their total number of clients has increased or remained steady over the past year. Of those firms looking to hire, 25% said that they will look to hire a female advisor to attract and retain female investors.

Also of note: Nearly 80% of advisors have experienced no turnover in their offices in the past year.

Hiring and firing staff led the list of top human resources challenges advisors say they face today, while developing and training staff also ranked high. Compared with 2011, more advisors report increased spending on human capital efforts, including professional development (43%), staffing (40%), and salaries and bonuses (50%).

"Adding staff is a very important process for each advisor," said George Tamer, director, strategic relationships, TD Ameritrade Institutional. "The survey mirrors what we've been hearing from advisors, who say successfully cultivating new staff in an advisor's business can be a difficult task, but in the end, it is essential for growth."

The survey was conducted by St. Louis-based Maritz Inc. on behalf of TD Ameritrade Institutional, a division of TD Ameritrade Inc. Maritz interviewed 502 RIAs in a telephone survey from March 29 to April 9.

Hedge Funds Trail 'Old' 60-40 Formula

(Bloomberg News) Before they discovered hedge funds, pension funds and endowments typically held portfolios with 60% in equities and 40% in bonds. Many would be better off if they had stuck with the old formula.

Hedge funds have trailed both the Standard & Poor's 500 Index and a Vanguard index fund with the same 60/40 mix over the past five years, according to data compiled by Bloomberg. The balanced fund beat the main Bloomberg hedge-fund index in six of the last seven calendar years.

The hedge fund industry's underperformance has contributed to an estimated $4 trillion in unfunded liabilities at U.S. pensions and prompted investors such as the California Public Employees' Retirement System to question whether every manager is worth the standard fees of 2% of assets and 20% of profits.

Calpers isn't alone in that thought. David Swensen, the chief investment officer of Yale University's $19.4 billion endowment, said the fees charged by hedge funds are a drag on their returns. Swensen, speaking at a Bloomberg conference in January, said that hedge funds' fees "are a huge issue," and unmerited unless there is extraordinary performance.

While there is no evidence that hedge funds are falling out of favor, their scale is making it more difficult for the hedge-fund industry as a whole to produce better results than other asset classes, said Simon Lack, a former executive at New York-based JPMorgan Chase & Co. and author of the 2012 book The Hedge Fund Mirage.

"You have more money chasing fewer opportunities," he said.

The main Bloomberg hedge fund index, which is weighted by market capitalization and tracks 2,697 funds, fell 2.2% a year in the five years ended June 30. The Vanguard Balanced Index Fund, which has a 60/40 split of equities and bonds, gained 3.5% annually and the S&P 500 Index gained 0.2% a year.

The Vanguard fund had also beaten the HFRX Global Hedge Fund Index, a measure of hedge fund performance with a longer history, every year since 2003.

Investors still expect hedge funds to outperform in the long run as low bond yields and a slow-growing global economy limit the gains from stocks and bonds, said Don Steinbrugge, managing partner of Agecroft Partners LLC, a Richmond, Va.-based firm that advises hedge funds and investors. Hedge funds continue to make sense for investors because over time they have boosted returns and protected investors in difficult markets.

From the end of 2000 through 2002, when the S&P 500 index fell 17% annualized and the Vanguard Balanced Index Fund lost 6.3%, hedge funds returned 6.7% annually, according to data from Hedge Fund Research Inc.

Hedge funds also beat the balanced fund in 2008, the second quarter of 2010 and the third quarter of 2011, periods when stocks tumbled, Bloomberg data shows. Hedge funds lost 19% in 2008 compared with a decline of 37% for the S&P 500 index and 22% for the balanced fund.

Citigroup, in a June report, concluded that "lingering concerns" about recent hedge-fund performance would not stop institutional investors from putting more money into them. The industry could attract an additional $1 trillion by 2016, Citigroup predicted, as public and private pension funds need strong investment returns to meet their long-term obligations.

Golden Years?

"What a drag it is getting old," sang Mick Jagger in the opening line of the Rolling Stones' 1966 hit, "Mother's Little Helper," which was a commentary on barbiturate use by housewives. The line also seems to encapsulate a recent report from iShares arguing that an aging population in the developed world-and possibly in China, too-bodes ill for people's future economic growth prospects and equity market performance.

The report, Not So Golden Years: How an Aging Society Can Impact the Markets, makes the case that countries with unfavorable demographics (i.e., too many aging folks and not enough young people to replace them) will experience shrinking labor forces, less economic growth and, ultimately, lower equity multiples.

In addition, older investors have less need for stocks, which crimps demand for equities and also contributes to lower multiples. The implications of that are twofold. For starters, while equity multiples in the developed world look reasonably priced and cheap relative to bonds, constrained growth could mean multiples don't revert to their historical averages. In addition, slower growth in the developed world could mean that the historical premium developed nations have enjoyed over emerging markets (roughly 35%) might contract over time.

The upshot: Investors seeking to mitigate the negative effects of aging populations should steer clear of Europe and Japan-particularly the latter, which the report warns is a place investors "should avoid at all costs."

The U.S. is in better demographic shape thanks to its healthy immigration rates, though the report cautions the country faces serious economic risk from burgeoning entitlement programs that could eventually sop up all other government spending.

As for China as an investment option, iShares appears to be agnostic-it merely points out that the country is more demographically challenged than its emerging market brethren, largely because of its long-standing one-child policy.

For folks looking to ride the demographic wave, the report says investors should consider equities in Brazil, Mexico, India, Indonesia and the Philippines.

Philanthropy Hangs In There

Despite tough economic times, charitable giving hasn't fallen off a cliff, according to the Giving USA: 2012 Annual Report on Philanthrophy.

The report paints a mixed picture, though: Giving by individuals rose an estimated 3.9% in 2011 to $217.79 billion and bequests rose 12.2% to $24.41 billion. Foundation donations, meanwhile, increased just 1.8% to $41.67 billion and corporate donations held steady at $14.55 billion.

According to the Giving USA report, total charitable giving grew by an average of 2.6% in the past 40 years, adjusted for inflation, in the two-year period after each recession. By comparison, giving grew by an average rate of only 1.1% for 2010 and 2011.

Individuals accounted for the vast majority of estimated gifts in 2011-73% of total giving. When giving by bequests and family foundations are added, the total share of giving by American households increases to 88%.

However, individual giving as a percentage of people's disposable personal income remained flat at 1.9% in 2011, the same as in 2009 and 2010.

Corporate contributions were basically the same as revised 2010 figures. Corporate pretax profits-traditionally a key factor in corporate donation levels-grew a modest 4.2% in 2011 compared with 25% in 2010.

The study showed a marked increase in giving to donor-advised funds (DAFs), which supports the findings of the National Philanthropic Trust's (NPT) annual Donor-Advised Fund Report that reviews the DAF marketplace.

Eileen Heisman, CEO of Jenkintown, Pa.-based NPT, which hosted the event where the Giving USA report was released, said the 2012 report demonstrates that charity is still a high priority for many U.S. households.

Banking On Business The principals at Firstrust

Financial Resources (FFR) in Philadelphia say their business model is an unusual one. The wealth management firm operates independently but is a wholly owned subsidiary of Firstrust Bank, a Philadelphia-area community bank started in 1934 and in its third generation of family ownership. The bulk of FFR's clients have no affiliation with the bank.

FFR provides wealth management, financial services, retirement planning, life insurance and other products to the bank's customers, as well as to their own clients. "There may be other wealth management firms that have some similar structure to what we have, but I think our model is unique and no one else has done it as successfully as we have in partnering with a community bank," says David Fleisher, FFR's president.

Large national banks usually have their own wealth management department. Smaller banks generally don't have the heft to create their own investment division, so they frequently refer customers to large, third-party companies. In the case of Firstrust, the bank's customers who need wealth management or investing services use Firstrust Financial Resources.

Only about one-third of FFR's clients come from the bank, though. The rest come from clients developed independently of the bank. Fleisher says the arrangement helps the bank develop long-term relationships with its customers.

"They [Firstrust Bank] have a conservative attitude towards people's money and that fit with our philosophy, which is one of the reasons we partnered with them," Fleisher adds.

Fleisher and his two partners, Andrew McIlhenny and Adam Sherman, are no strangers to working with banks. The trio started together at a large financial planning firm, but after the Gramm-Leach-Bliley Act passed in 1999 (which allowed banks to provide investment services), they smelled an opportunity.

"We had enough foresight to see that big financial institutions had the resources to provide their own financial planning services, but community banks could not do that," Sherman says. "A community bank is the financial resource center for the middle market and the mass affluent. Being able to provide wealth management services helps differentiate a community bank from its competition."

They started their own firm and partnered with Progress Bank in the Philadelphia region. Their firm, Progress Financial Resources LLC, was a subsidiary of the bank.

With Progress Bank, the firm provided exclusive financial services, wealth management and life insurance for any of the bank's customers who wanted to work through the bank for their financial planning needs.

Progress Bank was bought by Fleet Bank in 2003, but Fleisher, Sherman and McIlhenny didn't want to be absorbed by a larger bank. Instead, they formed an independent financial planning firm that operated under the Progress Financial Resources name.

The trio went through their own evaluation process and decided to reconnect with a community bank that wanted to be able to compete with the larger banks by providing financial planning services. They settled on Firstrust Bank in 2006.

"Firstrust Bank fit with our goal of community involvement and building a sustainable business while helping clients achieve their long-term goals," Fleisher says.

FFR now has 50 employees, including 20 bankers who are also licensed as financial advisors, and has $680 million in assets under management, which is not part of Firstrust Bank's $2.4 billion in assets. It has a downtown headquarters in Philadelphia, as well as offices in 20 bank branches. It has grown by 30% in the past two years. The firm provides the same types of services for the bank's customers that it provides for its own clients.

FFR specializes in high-net-worth owners of closely held businesses, as well as professionals. It is beginning to expand into the not-for-profit area for employee benefits and retirement plans. It works on both a fee and commission basis.

In addition, the partners also are focusing on women as investors and families with special needs, partially through educational workshops.

Last year, FFR decided to affiliate with MetLife as its broker-dealer. Fleisher says MetLife is a leader

with female investors and families with special needs.

MetLife, with the guidance and experience of working with FFR, will be able to use the business model established between FFR and Firstrust Bank to transfer that same working relationship to other MetLife-affiliated firms in other areas of the country, Fleisher says. He adds that similar working relationships could then be established between financial firms and community banks in their geographic footprint.

-Karen DeMasters

Finra Reports $84 Million Loss

What a difference a year makes.

Finra reported a $84 million loss in 2011 that officials attributed to reduced regulatory fee revenues and transaction volumes from which Finra collects fees, as well as a more conservative investment policy that shrunk its portfolio. That's a big comedown from the prior year when the agency earned $54.6 million.

The loss by Finra, which oversees nearly 4,400 brokerages and 630,000 brokers, was its first since an estimated $700 million shortfall during the 2008 financial market meltdown, which reflected a huge decline in its investment portfolio.

Ketchum said the agency had changed its investment portfolio dramatically in 2009 to avoid large losses, shifting to what it said was a conservative investing strategy. Finra finished 2011 with a 2% return on a portfolio that was about $1.5 billion at year-end. A large chunk of the portfolio was invested in cash and bonds, with just 14% in equities.

Finra last year recorded net revenue of $880.1 million, a 3.6% increase over revenue of $849.9 million in 2010. However, its operating expenses rose 5.7% to $994.9 million versus $940.9 million in 2010.

In the agency's financial report, Ketchum says Finra has made severe cost cuts to pare its 2012 budget by $36 million from last year. The belt-tightening efforts are expected to generate an estimated $60 million in savings by the end of 2013. In addition, Ketchum outlined plans to trim costs by making strategic investments in Finra's businesses, such as bringing in-house some data center operations and cross-market surveillance capabilities.

To bolster its coffers, Finra has sought approval to raise fees for its brokerage firm members in light of its "robust regulatory responsibilities, but static funding levels."

The SEC has approved Finra's request for a 25% increase in equities trading fees. The increase, which became effective July 1, is earmarked to provide proper funding of Finra's regulatory oversight, despite a continued decline in trading volume at brokerages. The SEC also approved higher fees for new membership applications, review of corporate finance filings and other activities.