Health-Care Reform Taxes Alter Client Strategies

Two new levies on high-income individuals were cemented into the tax code when the U.S. Supreme Court upheld President Obama's healthcare-reform legislation, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act. Both taxes take effect in 2013 (assuming the legislation isn't overturned by Congress), and both apply to joint filers earning more than $250,000 and singles who make over $200,000.

At 0.9%, the Medicare Hospital Insurance Tax is the lighter one. It's assessed on earned income-chiefly wages and self-employment income-that tops the above-stated threshold. For example, a single client with a $300,000 salary will owe 0.9% on $100,000 ($300,000 earned income, minus the $200,000 threshold for single taxpayers).

Larger and more vexatious is the Unearned Income Medicare Contribution Tax. Commonly called the investment income tax or the health-care surtax, it is 3.8% on the smaller of (1) net investment income or (2) the amount

by which the client's modified adjusted gross income (MAGI) exceeds the $250,000/$200,000 threshold. Thus if either (1) or (2) is zero, so is the surtax. Here, MAGI is the client's adjusted gross income plus his net foreign earned income exclusion.

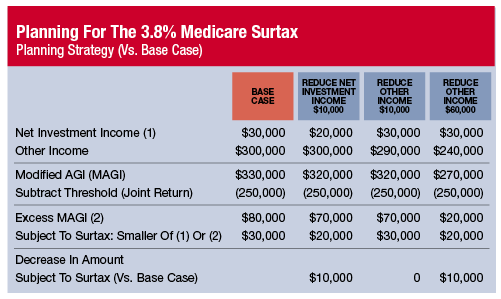

Two broad approaches exist for reducing the surtax, although they aren't always equally efficient (as the accompanying chart demonstrates).

The first entails lowering net investment income, says Mark Luscombe, the principal tax analyst at CCH Inc., a business-information source in Riverwoods, Ill. He notes such income can include taxable interest, dividends (qualified or not), annuities, rents, capital gains, income from trading in financial instruments or commodities, gain on a second home or passive activity income.

To cut the client's surtax, Green Bay, Wis.-based CPA Robert Keebler suggests repositioning into assets that generate little or no currently taxable income. This includes tax-deferred non-qualified annuities, real estate (because depreciation deductions offset income from the property), oil and gas investments, master limited partnerships and cash-value life insurance, especially non-modified endowment contract (MEC) policies. Withdrawals from non-MECs begin with non-taxable basis recovery. Policy loans can also provide clients with non-taxable cash flow, Keebler says.

Attorney/CPA Leon LaBrecque advises stocking taxable accounts with municipal bonds because their interest isn't subject to the surtax. That increases the taxable equivalent yield on munis, says LaBrecque, CEO of LJPR LLC, a Troy, Mich., wealth-management firm.

The second planning lever calls for reducing taxable non-investment income such as wages, income from an active business activity, pension income and distributions from traditional individual retirement accounts. To do this, says Luscombe, workers and self-employed clients should consider increasing their qualified-plan contributions.

Roth IRAs can keep the surtax at bay, too. Whereas traditional IRA distributions count toward MAGI and thus can trigger the tax, Roth withdrawals don't because, as LaBrecque tells clients, "A Roth conversion today stops required distributions later."

There's plenty of surtax planning to do. But remember: client objectives always take precedence over nifty tax moves.

-Eric L. Reiner

RIA Firms To Expand Staff This Year

Nearly 40% of registered investment advisory firms say they plan to add additional staff within the next six months, according to the latest Advisor Index Survey released by TD Ameritrade Institutional.

RIAs surveyed reported an average annual revenue growth rate of 15% and indicated that 57% of new client assets continue to come from full-commission firms, up from 55% in 2011.