As U.S. corporations begin to report their results for the recently completed first quarter of 2016, global growth will likely take center stage among investors. While comments from corporate managements on business conditions in Europe, Japan, China, and other emerging markets will be closely watched, those comments may be overshadowed. This week, the International Monetary Fund (IMF) will publish the spring edition of its World Economic Outlook publication. In addition, Christine Lagarde, the managing director of the IMF, will garner plenty of attention in the financial media, as she briefs investors on the publication and prepares for the IMF-World Bank spring meetings in Washington, DC. Although we don’t know what the IMF will forecast for global growth, if history is any guide, the global gross domestic product (GDP) forecasts for 2016 and 2017 should be lower than the forecasts made by the IMF last fall. Lagarde is also likely to remind policymakers (and investors) that central banks (via monetary policy) cannot boost global growth alone, and that fiscal policy is also required. Aside from a few countries, our view is that the call for more fiscal policy will go unheeded.

WHY GLOBAL GDP GROWTH MATTERS

The outlook for global growth matters to investors because it defines the ultimate pace of activity that creates value for countries, companies, and consumers.

As investors begin to digest the S&P 500 earnings reports for the first quarter of 2016 (15 S&P 500 companies will report first quarter results this week, with another 300 set to report in the final two weeks of April 2016), we provide an update on how consensus estimates for economic growth for 2016 and 2017 — in the United States and worldwide — have evolved over the past few years.

In recent years, markets have focused more on global GDP growth, whereas in the past, prospects for U.S. economic growth garnered the most attention from market participants. Why does global GDP growth matter? As we have noted in prior Weekly Economic Commentaries, financial markets — especially equity markets — focus intently on earnings. Broadly speaking, earnings growth is driven by “top-line” growth, or revenue growth, less the costs incurred earning that revenue, with labor accounting for more than two-thirds of total costs.

A good proxy for global revenue growth is global GDP growth plus inflation. Thus, the pace of growth in the global economy is a key driver of global earnings growth, and ultimately, the performance of global equity markets [Figure 1]. As we noted in the recent Weekly Market Commentary, “Q1 2016 Earnings Preview: No More Excuses,” the consensus of analysts expects that S&P 500 companies will post a 7% drop in earnings growth in the first quarter of 2016 versus the first quarter of 2015. The expected decline is primarily driven by the stronger U.S. dollar and the decline in oil prices; however, we expect more than a handful of firms may cite global growth concerns (mainly in emerging markets and especially in China) when discussing first quarter results and providing guidance for the second quarter of 2016 and beyond.

GROWTH ESTIMATES ARE ALMOST ALWAYS REVISED LOWER

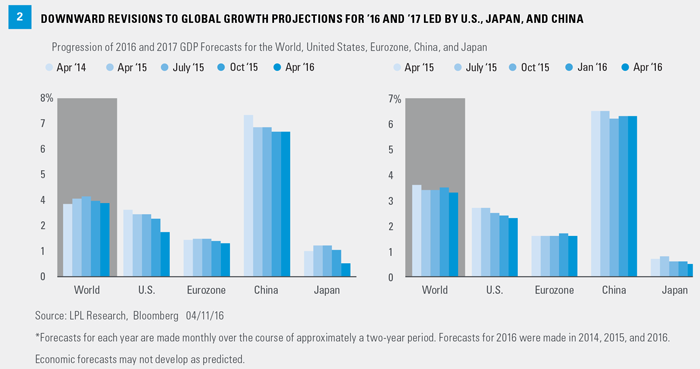

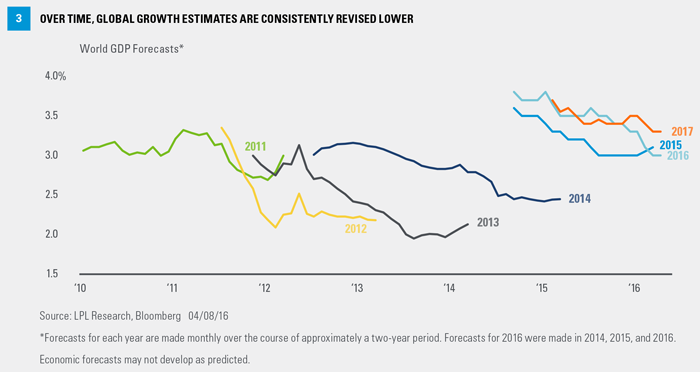

Figure 2 details the progression of the consensus GDP forecasts for 2016 and 2017 for the world, the U.S., China, the Eurozone, and Japan over the past several years. Figure 3 presents the changes over the past six years in the Bloomberg consensus estimate for global GDP for each year from 2011 through 2017, as an extension of the “world” bar. In short, the widespread and frequent reports in the media — most often cited by bearish investors — that “global growth has been revised downward” are technically correct, but miss the point that global growth estimates are almost always revised lower. That pattern could be reinforced this week when the IMF releases its World Economic Outlook. Despite this pattern of revising GDP growth estimates lower, the global economy has been in recovery since 2009, and global equity prices — as measured by the total return on the MSCI World Index — are up 151% since March 2009, and have posted gains in five of the seven calendars years from 2009 through 2015. Year to date through April 8, 2016, the MSCI World Equity Index is down 1.8%.

The latest (mid-April 2016) Bloomberg-tracked economists’ consensus forecast for 2016 global GDP growth stands at 3%, well below the 3.3% expected six months ago in October 2015 and the 3.5% growth expected in April 2015. In mid-2014, when Bloomberg first began tracking consensus estimates for global GDP growth for 2016, the consensus expected 3.8% world GDP growth. The downward revisions to 2016 global growth estimates are nothing new [Figure 3].

Consensus estimates for global growth in 2017, which stand at 3.3% as of April 2016, have also been moving lower over the past six months (the 2017 estimate stood at 3.4% in October 2015) and since the start of 2015 (3.7%) when 2017 estimates were first compiled by Bloomberg. Here again, this should neither surprise nor concern global investors, as global growth estimates are almost always revised lower over time. Indeed, as Figure 3 points out, consensus estimates for global GDP growth have been consistently revised lower since at least 2010.

SEVERAL FACTORS ARE CONTRIBUTING TO REGIONAL DIFFERENCES IN GROWTH ESTIMATES

The U.S., China, the Eurozone, and Japan account for nearly two-thirds of global economic activity. So while there have been some upward revisions to consensus GDP growth estimates for 2016 and 2017 in places like Turkey, India, and Poland, major downward revisions to 2016 and 2017 growth estimates in Russia, Brazil, and Indonesia were offsets to overall global growth estimates. On balance, growth in the U.S., China, the Eurozone, and Japan matters most.

U.S.: tracking to above-consensus 3.0%+ growth. Estimates for U.S. GDP growth for 2016 stand at 2% here in mid-April 2016, while the consensus estimate for 2017 is at 2.3%. Both the 2016 and 2017 estimates have dropped versus the estimates made six months ago and a year ago. We continue to expect 2.5–3.0% GDP in 2016.*

China: still struggling with transition to consumer economy. The consensus expects China to report 6.5% GDP growth in 2016 and 6.3% in 2017; much like global growth estimates, the consensus estimates for Chinese economic growth have been moving lower for years. Although China’s economy has been slowing since 2010, the recent pace of the slowdown has captured the market’s attention as fears of a “hard landing” (real GDP growth around 2%) persist. Chinese authorities have continued to struggle to implement the correct mix of monetary, fiscal, currency, and regulatory policy to help guide China’s economy from an export-led manufacturing economy to a more domestically oriented consumer economy.

The consensus expects a 6.7% year-over-year reading for China’s first quarter 2016 GDP (which is due out later this week).

Eurozone: steady but slow. The Eurozone’s GDP growth prospects for 2015 and 2016 were revised higher over the course of 2015, and have stabilized here in 2016. Actions by the European Central Bank (ECB) to enact quantitative easing (QE) in early 2015, followed by an expansion of QE here in early 2016, have helped to heal Europe’s fractured banking system; however, the current threat of the U.K. leaving the European Union has added to the economic uncertainty. Currently, the consensus expects 1.5% GDP growth in the Eurozone in 2016, accelerating to 1.6% in 2017. The estimates for 2016 and 2017 are little changed from where they were six months ago and in early 2015.

Japan: 2016 prospects fading. Of all the major global economies, Japan has seen its growth prospects for 2016 marked down the most over the past year. A year ago, in April 2015, the consensus expected 1.2% GDP growth in 2016. Today, the consensus stands at just 0.6%, as the Japanese economy has not responded as well as expected to several rounds of stimulus from the Bank of Japan. In addition, deteriorating demographics and large public debt levels are expected to continue weighing on Japanese growth in the coming years and decades.

*Our forecast for GDP growth of between 2.5–3% is based on the historical mid-cycle growth rate of the last 50 years. Economic growth is affected by changes to inputs such as: business and consumer spending, housing, net exports, capital investments, and government spending.

John Canally is chief economic strategist for LPL Financial.