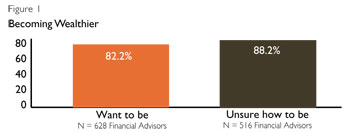

If the title of this column piqued your curiosity, then you are probably among the large majority of advisors that wants to be wealthier. Our experience with advisors-actually every group of individuals regardless of their profession-tells us that most people like the goal of getting rich, in theory. The stumbling block is their lack of knowledge about the behaviors, mindsets and actions that result in greater wealth. In a recent survey of more than 600 advisory professionals, about four out of five said they want to be wealthier. But nearly 90% admit they are uncertain about how to turn their desire into a reality (Figure 1). It's worth noting that other financial professionals such as insurance agents, accountants and attorneys exhibit similar characteristics.

Implementation Over Insight

Although the desire to get rich is virtually ubiquitous, it's a goal few people succeed in attaining. But our research tells us that failure is not due to a lack of technical competence. Most advisory professionals have the experience and expertise to do their jobs well. They also have at least a cursory understanding of how they can be more effective and efficient. Many of these skills are integral to the successes of the ultra-affluent and at the heart of Money Rules. As we've said repeatedly, the core behaviors of the super-rich are not secret. The bigger mystery is how to apply them in the context of your life and practice. The reason the financial elite hire us is not to educate them on the Money Rules but to help them use the rules on a systematic and consistent basis.

Money Rules For Advisors

In this column (and in our new book, The Family Office: Advising the Financial Elite) we've discussed Money Rules that translate into significant wealth, focusing specifically on how they are applied by billionaires and centimillionaires. In this edition of the column, we'll consider how advisory professionals can employ the Money Rules.

#1: Commit To Extreme Wealth. To get seriously rich, you have to want to get seriously rich and be willing to commit the necessary time and resources. A good way to start is by identifying your personal financial goals. How much do you want to be worth? How much money do you want to earn next year? Once you're comfortable with your ultimate goal (recognizing that this is often a moving target that inches upward as you achieve successes) you can focus on the milestones that will enable you to achieve your ultimate objectives.

When we ask people what they would do to become extremely wealthy, the usual answer is "anything." After we do some probing, however, we quickly discover that people are willing to do a lot less than "anything." A better way to think about these rules is to decide what you won't do. Each person has a moral code. Know when and where you draw the line.

#2: Engage In Enlightened Self-Interest. To get seriously rich, you have to remain focused on your goal and avoid getting derailed by distractions, such as the chance for group happiness or pleas for fairness, and poor decision-making. Burning others is not the objective. Obtaining the best strategic and financial outcome in every business situation is, and that requires a detailed knowledge of your business finances. In our experience, very few advisors have done the math (or do it when faced with a business opportunity) and rely instead on a "gut feel" when making decisions.

Using this logic, it's essential to know the ins and outs of your business model. Where are you making your money? Which methods of sourcing affluent clients are the most profitable? It's almost impossible to negotiate favorable working arrangements without a clear sense of your P&L statement (or something close). Without that information, you can fall into the trap of negotiating against yourself.

#3: Put Yourself In The Line Of Money. To get seriously rich, you have to concentrate your skills and talents in the endeavors that offer the highest returns. In the financial advisory business, for instance, working with the financial elite is typically a more lucrative path than servicing a mass-market clientele. How would increasing the average net worth of your clients impact your bottom line? What would it take to actively upgrade your clientele?

At the same time, you should consider ways to maximize the profitability of your wealthier clients. The most successful and reliable method has been the adoption of a wealth management approach enabling advisors to deliver a broader array of products and services. The next evolutionary trend is the migration of elite advisors to a multifamily office model.

#4: Pay Everyone Involved. To get seriously rich, you must cultivate the loyalty of your associates and business partners and reward them for the behaviors and actions that benefit you and your business. Assuming that people are adequately motivated by a desire to do the right thing or generate good will is a recipe for fiscal failure. Take, for instance, the centers of influence (such as trustees, estate attorneys and accountants) that can refer their wealthy clients to you. There are an abundance of exceptional advisors for them to choose from, so hoping they will direct business to you based on your technical proficiencies or reputation is fantasy. Professionals with the best clientele will seek advisory partnerships that meet three criteria: top-notch capabilities, a demonstrated ability to work with them without overstepping boundaries and a willingness and ability to compensate them.

Appropriate remuneration takes many forms. The most effective is monetary, but often this is not possible and will require that you develop an understanding of your partners' business models to decide adequate compensation.

#5: Connect For Profit And Results. To get seriously rich, you need a network comprising a few powerful and highly targeted professionals, each of whom has his own array of professional relationships. Most advisors approach networking as a social activity rather than a business activity, which results in dozens of superficial contacts that have little to no ability to advance an advisor's personal or professional agendas.

Empirical research has shown that up to five key relationships, when leveraged correctly, can have a compound effect on your income. Conversely, more than five relationships can dilute the effectiveness of each relationship and detract from your overall effectiveness and profitability. Part of the process, however, does entail cultivating bench strength in the form of influencers who can replace the original five, if necessary, and who can provide periodic business referrals.

#6: Use Failure To Improve And Refocus. To get seriously rich, you must fail, analyze your failures and do everything possible to prevent repeated mistakes. We find that most financial advisors are troubled by their failures and work to distance themselves from them before they can learn valuable lessons that can be applied to future endeavors.

In our consulting engagements with the ultra-affluent, we always work with them to identify what approaches have or have not been successful. By doing something similar and cataloging the various initiatives and activities that have delivered results, as well as those that have come up short, you can identify patterns. The key is to break the patterns associated with underperformance and failure.

#7: Stay Highly Centered. To get seriously rich, you have to know what you do exceptionally well and then align your business in a way that allows you to leverage your talents to maximum effect. Most advisors are part of organizations that want them to become well-rounded, so they are instructed to strengthen their weaknesses rather than exploit their strengths. This results in a professional being capable of handling a multitude of situations but excelling at virtually nothing.

At the same time, many advisors envision themselves as the CEO of their practice and operate as generalists, further blunting their few advantages.

Without exception, our research with the financial elite (including people with disparate sources of wealth, such as family-owned businesses, the entertainment industry and hedge funds) has shown that being centered always results in significantly more personal wealth. Therefore, you should identify and validate the true skills you bring to your advisory practice, assemble a support team that complements your strengths and delegate the areas and responsibilities where you are not as capable.

Making It Happen

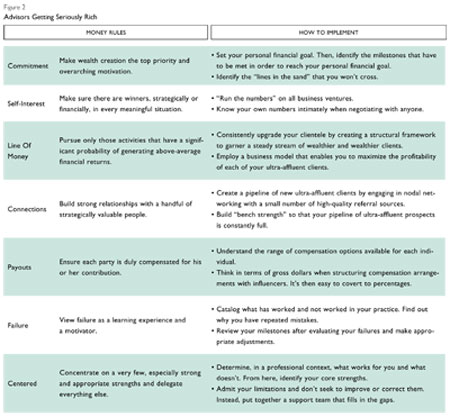

Figure 2 includes examples of how the financial elite follow the Money Rules and some ideas for how advisors can employ them to boost their income and net worth. Each rule has multiple implications and, depending on the information you gather and the business decisions you make, can lead to a broad array of possible actions. Down the road, there are numerous other ways that interested advisors can translate the Money Rules into concrete actions that result in greater wealth.

Finding Balance

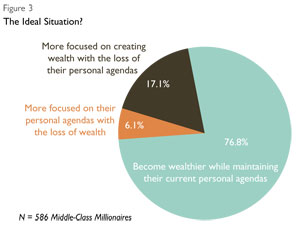

As any billionaire or multimillionaire will attest, getting exceptionally wealthy always comes with sacrifices: exhaustion, long work hours, missing the first steps or words of a child, canceled vacations and divorce. And given the extreme psychological and physical changes often required to reach the realm of the financial elite, those that do understand the quid pro quo are often reluctant. It's important to realize, however, that this is not a binary situation. It's possible to increase your wealth without sacrificing your personal agenda. And, not surprisingly, this is what the large majority of people want. In a survey of individuals with between $1 million and $10 million in net worth, more than three-quarters of them said the ideal situation would be garnering more wealth while maintaining the current allocation of time and effort they put toward their personal affairs (Figure 3). Another 6% were willing to sacrifice wealth in exchange for more personal time.

By working to strike that balance, you might end up with tens of millions instead of hundreds of millions-an acceptable outcome for many people-yet you will have been able to establish a comfortable balance between amassing a personal fortune and your personal preferences and self-determined obligations.

Whether you want to become incrementally wealthier or join the ranks of the super-rich, the actions you need to take are the same. It's just a matter of degree. The non-negotiable element is follow-through. Pondering, talking, planning and daydreaming will not deliver results. You must be process oriented, highly systematic and persistent. It's been proved throughout the ages that by embracing the Money Rules you can get seriously rich. When you do, we recommend you get yourself a private jet to go with your private foundation.