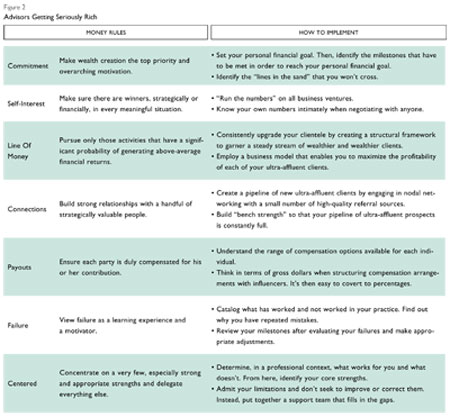

#4: Pay Everyone Involved. To get seriously rich, you must cultivate the loyalty of your associates and business partners and reward them for the behaviors and actions that benefit you and your business. Assuming that people are adequately motivated by a desire to do the right thing or generate good will is a recipe for fiscal failure. Take, for instance, the centers of influence (such as trustees, estate attorneys and accountants) that can refer their wealthy clients to you. There are an abundance of exceptional advisors for them to choose from, so hoping they will direct business to you based on your technical proficiencies or reputation is fantasy. Professionals with the best clientele will seek advisory partnerships that meet three criteria: top-notch capabilities, a demonstrated ability to work with them without overstepping boundaries and a willingness and ability to compensate them.

Appropriate remuneration takes many forms. The most effective is monetary, but often this is not possible and will require that you develop an understanding of your partners' business models to decide adequate compensation.

#5: Connect For Profit And Results. To get seriously rich, you need a network comprising a few powerful and highly targeted professionals, each of whom has his own array of professional relationships. Most advisors approach networking as a social activity rather than a business activity, which results in dozens of superficial contacts that have little to no ability to advance an advisor's personal or professional agendas.

Empirical research has shown that up to five key relationships, when leveraged correctly, can have a compound effect on your income. Conversely, more than five relationships can dilute the effectiveness of each relationship and detract from your overall effectiveness and profitability. Part of the process, however, does entail cultivating bench strength in the form of influencers who can replace the original five, if necessary, and who can provide periodic business referrals.

#6: Use Failure To Improve And Refocus. To get seriously rich, you must fail, analyze your failures and do everything possible to prevent repeated mistakes. We find that most financial advisors are troubled by their failures and work to distance themselves from them before they can learn valuable lessons that can be applied to future endeavors.

In our consulting engagements with the ultra-affluent, we always work with them to identify what approaches have or have not been successful. By doing something similar and cataloging the various initiatives and activities that have delivered results, as well as those that have come up short, you can identify patterns. The key is to break the patterns associated with underperformance and failure.

#7: Stay Highly Centered. To get seriously rich, you have to know what you do exceptionally well and then align your business in a way that allows you to leverage your talents to maximum effect. Most advisors are part of organizations that want them to become well-rounded, so they are instructed to strengthen their weaknesses rather than exploit their strengths. This results in a professional being capable of handling a multitude of situations but excelling at virtually nothing.

At the same time, many advisors envision themselves as the CEO of their practice and operate as generalists, further blunting their few advantages.

Without exception, our research with the financial elite (including people with disparate sources of wealth, such as family-owned businesses, the entertainment industry and hedge funds) has shown that being centered always results in significantly more personal wealth. Therefore, you should identify and validate the true skills you bring to your advisory practice, assemble a support team that complements your strengths and delegate the areas and responsibilities where you are not as capable.