The businesses of Trust and Estate (T&E) lawyers are under considerable financial strain. There are a number of factors making the estate planning business for attorneys increasingly problematic:

More cost-sensitive wealthy clients.

Relatively fewer wealthy clients.

Increased competition from other attorneys as well as other types of professionals.

The increasing sensitivity of the wealthy to cost and their ways of dealing with it is one of the most vexing problems for T&E lawyers. Wealthy clients have, more than ever, been able to push down T&E attorney fees. By and large, the attorneys are at a loss over what to do about it. Here is an approach that can mitigate or even eliminate this problem.

Wealthy Clients

The financial downturn and the fact that the wealthy consider estate planning fees negotiable have resulted in wealthy clients paying less-or sometimes nothing-for T&E lawyer services.

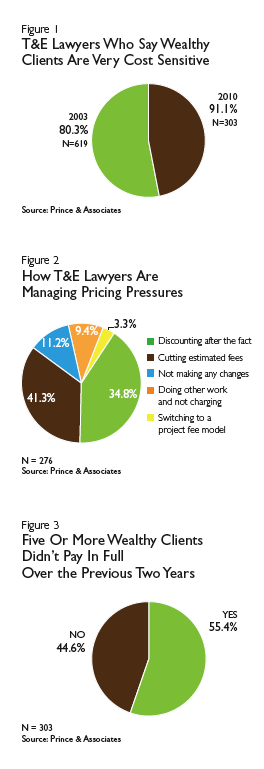

In a survey of 619 T&E lawyers in 2003, 80% said their wealthy clients are very cost sensitive. The situation has since worsened. In a 2010 study of 303 T&E attorneys conducted by Prince & Associates, that percentage rose to 90% (Figure 1).

T&E lawyers are dealing with this issue in a number of ways (Figure 2). The majority of attorneys discount their services after the fact. The way this generally plays out is that the wealthy client complains about costs, so the attorney lowers the bill. This actually works against the attorneys' own interests, conveying the message that they're overcharging and that clients are justified in questioning the fees.

About a third are lowering their fees by cutting their estimates for the services. About 10% are doing additional non-paid legal work for the wealthy clients. A few attorneys are switching to project fees as opposed to hourly rates. About 11% are holding the line on their fees. However, while the attorneys might be adamant about being paid what they're charging, that doesn't mean it is going to happen.

The 2010 survey of T&E lawyers found that for about half of them, five or more wealthy clients didn't pay in full over the previous two years (Figure 3). This is strong evidence that a solid percentage of the wealthy consider the cost of estate planning services to be adjustable after they've been delivered. When this happens, what do attorneys tend to do? They usually write it off, hoping to get as much of their fee as possible.

Delivering Value

Once upon a time, T&E lawyers commanded greater respect from the wealthy as well as other professionals. That's less likely to be the case today. With so many non-legal professionals-from accountants to insurance agents to financial advisors-willing to provide estate planning services much more cheaply than attorneys (as they earn their living with other services and/or products), the value and cost of estate planning provided by T&E attorneys is often called into question.

Along the same lines, the idea that the T&E lawyer is making a meaningful difference for the wealthy client is also being questioned. When the supposed "difference" is matched up against the cost, the wealthy tend to not see value.

For T&E lawyers to be paid in accordance with what they do and what they bill, they must communicate the value of their deliverables. Attorneys are mistaken if they think it's the wealthy client's responsibility to recognize the value they're receiving. The onus of responsibility falls squarely on the shoulders of the attorneys.

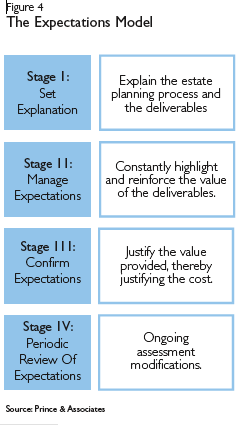

Figure 4 shows a four-stage model for communicating value. Stage I: Set Expectations. The T&E lawyers, in the very first client meeting and all subsequent meetings until the engagement letter is signed, explain the estate planning process as well as the nature of the deliverables and how they'll be developed and provided.

Stage II: Manage Expectations. Wealthy clients are involved throughout the estate planning process. Wealthy clients are consistently shown the nature of the work the attorneys are doing to validate the expertise and effort they're getting.

Stage III: Confirm Expectations. Attorneys justify the value they've provided-and thereby the cost-at the conclusion of the estate planning process.

Stage IV: Periodic Review of Expectations. Here, the T&E lawyers continue to evaluate and respond to the changing needs of clients as well as the changing legal environment.

More than a few T&E lawyers are uncomfortable with this approach and resistant to adopting it. Nevertheless, T&E lawyers who use this model say their wealthy clients are less likely to question fees. Why? Because the wealthy clients have a much better understanding of what they're getting and, more importantly, appreciate that T&E attorney services are indeed valuable.

More Ways To Excel

For the most part, T&E lawyers have to adjust to a dramatically changing professional environment to be financially successful. The Expectations Model is one of a number of best practices they need to consider adopting.

Transitioning a portion of their practices away from hourly billing to project fees should also be seriously considered. It appears that, when this transition is done intelligently, attorneys generate greater profits per wealthy client.

What's important to note is that even in today's competitive and difficult environment for estate planning services, T&E lawyers can excel.

David M. Ross is a managing director of the Fraenkel Group at Neuberger Berman LLC, a registered investment advisor and broker-dealer. Mr. Ross can be reached at [email protected].

Russ Alan Prince is Editor-at-Large of Private Wealth magazine.