By Christian Magoon

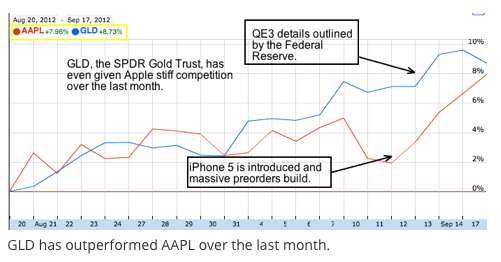

GLD, the SPDR Gold Trust, is the largest gold ETF on the planet and has been on a performance hot streak over the past month. GoldETFs.biz has been flooded with investors taking another look at gold due to QE3. GLD has had such a strong last four weeks that it has even outperformed the most popular stock on the planet, Apple (AAPL). Here's the month long annotated chart from the NASDAQ's interactive chart center.

The anticipation and fruition of QE3 has pushed gold prices up over 8.7% over the last four weeks. Conversely Apple stock rallied significantly in the last few days to gain 7.9% for the month after the announcement and subsequent avalanche of pre orders for the latest iPhone. Both investments are essentially in a sweet spot of late with sentiment about their future prospects on a significant upswing.

Gold Bullishness

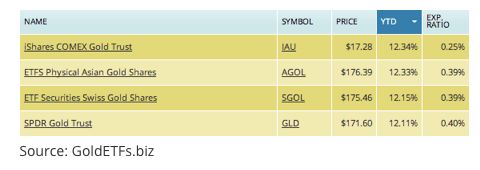

Gold is in demand and limited supply because precious metals like gold usually benefit when financial liquidity is increased by central banks. More liquidity generally devalues paper currency due to more supply being introduced. Thus gold benefits as it becomes worth more devalued paper currency (especially when the U.S. dollar loses value, as gold is primarily denominated in dollars). In addition the scarcity and rareness of gold begins to appeal to investors as a hedge against asset devaluation. Here's a performance snapshot of all gold ETF products which seek to track the price of physical gold.

Apple Rolling

Apple is riding its upcoming introduction of the iPhone 5, which has pre orders at double the rate of its previous version. Apple closed above $700 last week despite the S&P 500 finishing in negative territory.

GLD Over AAPL: Could It Happen Again?

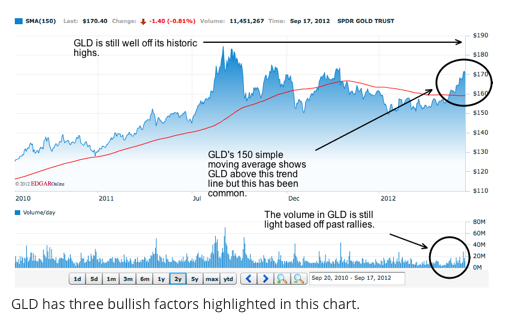

So could GLD outperform AAPL over the next four weeks? At face value it seems unlikely as Apple has been one of the best performing investments for several years. Over the longer term, Apple is tough to beat. But could QE3 give GLD a fighting chance? The answer is yes, as we have just witnessed a month long streak of QE3 inspired out performance. In addition, GLD has a few other factors going for it including being below all-time highs and having lighter share volume than witnessed in past rallies. Here's the annotated two year GLD performance chart.

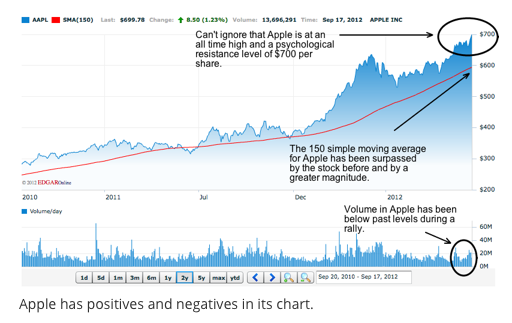

Apple also has positive factors going for it including its incredible momentum and historically light volume displayed in this current rally. However, one must note Apple is at all-time highs and is priced near a psychological resistance level around $700 per share. Here's the two year annotated Apple chart.

Going forward it is clear that the tide is changing in the marketplace due to QE3. It has initially given GLD a boost over Apple. To continue GLD's outperformance, less faith in the value of paper currency and a thirst for hard assets must increase. Apple, on the other hand, needs to have a bug-free iPhone 5 launch and then reload the pipeline with the next big thing. While both of these scenarios are simple, they are not easy. This is one battle that seems like it could remain close over the short term despite longer term trends.

Christian Magoon advises asset management firms on ETF-related issues as founder of Magoon Capital. He is publisher of ETF Web sites GoldETFs.biz and IndiaETFs.com.