“Global citizenship” is becoming an increasingly popular tool for the world’s ultra wealthy. There are many different reasons why an ultra-high-net-worth (UHNW) individual—for the purposes of this study, those with $30 million or more in assets—might seek a second citizenship, including but not limited to greater stability and security, tax efficiency, ease of travel, higher standard of living, increased options for children’s education and investment opportunities.

Location still remains an important factor for UHNW individuals, but on a country level rather than a street level. For many ultra-wealthy people purchasing homes abroad, the passport is becoming as important as the neighborhood, according to Wealth-X and Sotheby’s UNHW Luxury Real Estate Report: Homes As Opportunity Gateways report.

For UHNW individuals seeking citizenship or visa status in a foreign country, buying a home is often the best route. An increasing number of nations offer citizenship through investment programs that give people residency in return for a significant investment in the country.

The centerpiece of many of these programs is property investment. Financial requirements range widely—from a $200,000 minimum real estate investment in Dominica to a $700,000 minimum in Spain and Cyprus. In return, investors gain residency or citizenship status after a multi-year waiting period.

Such programs are divided into immigrant investor programs (IIPs) and citizenship by investment programs (CIPs). IIPs require a residence permit as a condition for receiving citizenship, while CIPs do not.

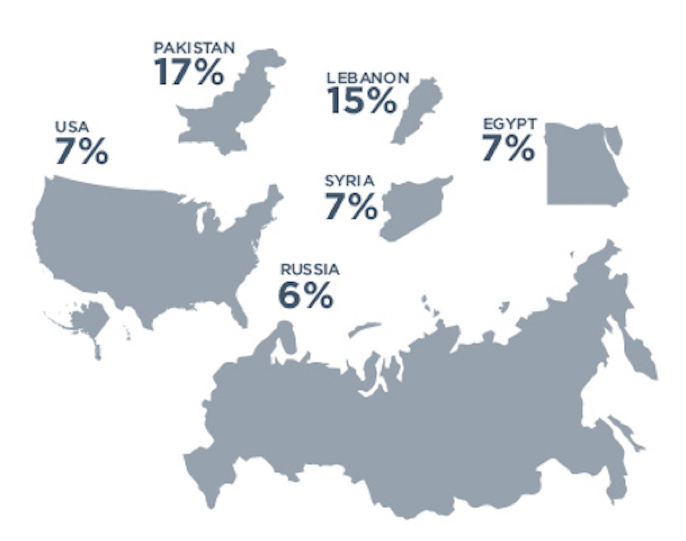

Interest in such programs comes from individuals in a wide range of nations, but much of it arises from the Middle East (See Figure 1).

Figure 1: Countries With The Highest Percentage Of UHNW Citizens With Second Citizenships

Slightly less than 60 percent of all UHNW second citizenship applicants come from countries in the Middle East. One possible explanation for this is that 40 percent of UHNW wealth in the Middle East belongs to billionaires—among the highest percentages in the world. Billionaires are five times more likely to apply for a second citizenship, as they have more to gain from obtaining one and the costs of obtaining it are also lower as a proportion of their wealth.

UHNW individuals wishing to move or change their citizenship most commonly come from countries that do not have high asset security. Lebanon, Syria and Egypt, for example, have all experienced unrest in the last few years, and are places where rich people are likely to want to resettle.

However, not all UHNW individuals seeking second citizenship are coming from unstable countries. The U.S., for example, is the fifth most significant country in terms of the number of UHNW individuals applying for other citizenships. There are three factors that would help explain why the U.S. ranks high in this category:

• The United States has by far the largest UHNW population, so even a small percentage of citizens moving elsewhere will generate relatively high totals. For example, UHNW individuals from Syria are 300 times more likely to apply for a second citizenship than those from the US.

• There is greater transparency in the U.S., which issues a monthly, public list of those who have given up their citizenship. This makes it impossible for Americans to renounce their U.S. citizenship “under the radar.”

• The global taxation system can make it very expensive for UHNW individuals to maintain their U.S. citizenship, especially if they are living in a lower taxed jurisdiction such as Switzerland, Dubai or Singapore. The annual savings in capital gains tax alone for an average UHNW individual could reach almost $1 million (assuming an average UHNW individual receives 5 percent of his or her net worth in income a year, and 90 percent of this is subject to a capital gains tax rate of 15 percent).

Russia is also near the top of the list in terms of people renouncing their citizenship, with London a popular destination. Much like in the Middle East, billionaires in Russia have a disproportionate share of the country’s UHNW wealth, controlling 55 percent of the total.

As of 2015, over 20 nations offered citizenship by investment programs and as Figure 2 shows, most nations offering citizenship by investment programs are located in Europe and the Caribbean.

Figure 2: Where The World’s UHNW Population Has Applied For Second Citizenships

In addition, a number of nations offer programs where residency or citizenship can be gained via investment in local business interests. Especially in nations where these programs are paired with attractive tax regimes, buying a home can be part of an attractive wealth preservation plan.

Joyce Chen is editor at Wealth-X (www.wealthx.com), which provides marketing, strategy and compliance solutions for financial clients in the high-net-worth market.