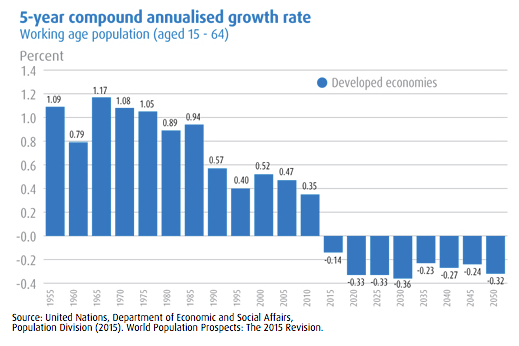

The countries at the far right of the chart have a real problem — the “oldies” (over 65) will be almost as numerous as the workers by 2050. The red dot shows the situation in 2000 and highlights the rapid deterioration in all countries over the period. And the working-age population? This is defined by the UN as all people aged between 16 and 64. In the developed world this segment of the population, on average, is now starting to shrink. This will deduct around 0.3% annualised from GDP growth over the next 35 years. In the previous 35 years it added an average of 0.4% annualised to developed world GDP growth. The combination of the two means a comparative (negative) growth differential of 0.7% annualised in the next several decades.

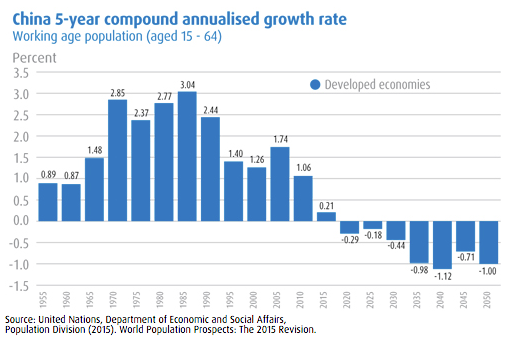

The boom country of the past twenty years, China, is about to experience a very dramatic change in fortunes due to its one-child per family policy — a policy that the government is only now getting around to amending — but it is very much a case of too little too late. Even if all the fetters are removed there is no indication that there will be a birth-boom in China. The potential working-age population starts to shrink about now providing a stark contrast to the growth of the past 50 years. A glance at the chart is sufficient to indicate that the comparative negative growth differential is going to be considerably more than 1% annualised.

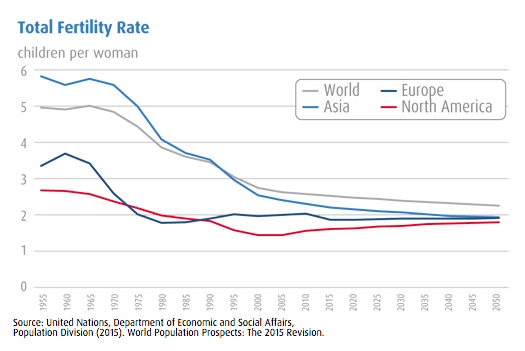

The fertility rate (children per woman) needs to be 2.1 for a population to maintain itself. Anything lower and shrinkage occurs. In all of the world’s regions the fall in the fertility rate has been nothing short of dramatic. Europe is in the most parlous position with the fertility rate now comfortably below replacement level.

So the picture that emerges is very clear — a rapidly ageing global population with steadily fewer workers (relative to the retirees) to maintain overall living standards. From an investment perspective behavioural economics now becomes a very important study. A legion of retirees behaves quite differently than an equivalent legion of younger workers. Retirees need income and security, spend a significant amount on healthcare, tend to be downsizing housing rather than upsizing, will not be seeking mortgages, are unlikely to be patronizing shops selling the latest fashions and will be liable to spend some of the kid’s inheritance on the odd cruise (the fastest growing holiday segment).