This announcement has a number of broader implications beyond GE’s own company and stock price. It may be an indication of what large multinational companies must do at this point in the market cycle to show earnings growth. It also highlights the end of the boom in leverage creation and the benefits of being a global infrastructure specialist.

The corporate earnings growth rate for stocks in the S&P 500 Index (GE is one of them) has declined dramatically during the last year. One year ago, the estimate for 2015 S&P 500 Index earnings was $137.36 while today it stands at $118.37. This is a 14 percent decline in expectations. Weaker corporate earnings are likely a function of much lower energy company earnings stemming from a decline in oil prices, slower economic growth, a stronger U.S. dollar and perhaps less room to engineer earnings.

When GE made its announcement last week, the stock’s initial reaction was to rally over 9 percent. Investors in the company’s shares were acknowledging that the reduction in risk by eliminating much of GE Capital as well as the return of capital in the form of dividends was welcome. They were also acknowledging that the share buyback would make it easier for GE to reach its earnings growth rate over time.

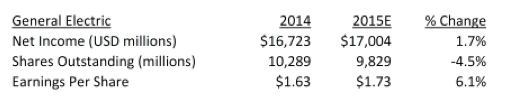

A share buyback does two things. It reduces the supply of a company’s stock by taking shares out of the market, and it makes the divisor for earnings per share smaller. This makes it easier to make a growth rate hurdle. Here is how the math works.

Assume that Company A has 1,000 shares of stock outstanding and will earn $100 this year. Their earnings per share equal $100 divided by 1,000 shares or $0.10 per share. If they buy back 100 shares, reducing their outstanding stock by 10%, then their earnings per share rises by 11.11%. In our example, they will divide their $100 of earnings by 900 shares outstanding which equal $0.11. In other words, the stock buy-back increases earnings per share even though the actual amount of earnings remains the same. (See example below.)

In 2014, GE earned $16.7 billion in net income for earnings per share of $1.63 with shares outstanding of 10.3 billion. In 2015, GE is estimated to make $17.0 billion in net income an increase of 1.8 percent over last year. However, the shares outstanding will be reduced by about 5 percent to approximately 9.8 billion shares, which will boost earnings per share to $1.73 for an increase of 6 percent over 2014.

In GE’s case, it can use the sale of its financing arm to purchase much of the stock. Many companies are using the debt market and the low level of interest rates to finance such purchases. The low cost of leverage makes this exercise very attractive for large multinational companies at a time when revenue growth is tough to come by and earnings growth is even tougher.

Leverage Last Thursday, General Electric announced that it was selling a $26 billion real estate portfolio and substantially reducing the size of its financing arm, GE Capital. The only portion of the business being retained will be that which sustains GE’s manufacturing businesses. In addition, the company announced a $50 billion stock buyback and another $40 billion in dividends paid out through 2018.

Last Thursday, General Electric announced that it was selling a $26 billion real estate portfolio and substantially reducing the size of its financing arm, GE Capital. The only portion of the business being retained will be that which sustains GE’s manufacturing businesses. In addition, the company announced a $50 billion stock buyback and another $40 billion in dividends paid out through 2018.

Financial Engineering

Good Things To Life

April 20, 2015

« Previous Article

| Next Article »

Login in order to post a comment